Analysis of 20% limit on ITC availment

Govt Proposal to fix 20% margin money for ITC availment violates Article 14 & 19(1)(g) of COI?

ITC being an indefeasible right, Govt cannot impose any unreasonable condition for its availment. If done, same may ultra vires the Constitution. Reference may be drawn from the Gujarat HC ruling, where on deciding the validity of Rule 8(3A) of the excise rules, HC held that –

“This extreme hardship is not the only element of unreasonableness of this provision. It essentially prevents an assessee from availing cenvat credit of the duty already paid and thereby suspends, if not withdraws, his right to take credit of the duty already paid to the Government. It is true that such a provision is made because of peculiar circumstances the assessee lands himself in. However, when such provision makes no distinction between a willful defaulter and the rest, we must view its reasonableness in the background of an ordinary assessee who would be hit and targeted by such a provision.

The restriction being irrational and arbitrary and therefore, violative of Article 14. It prevents him from availing credit of duty already paid by him. It also is a serious affront to his right to carry on his trade or business guaranteed under Article 19(1)(g) of the Constitution and hence, the same must fail.”

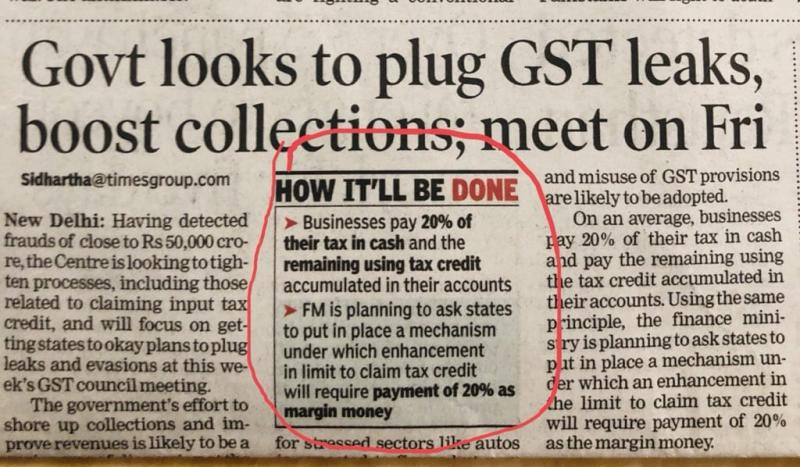

Amendment in CGST Act is may restrict the ITC availment without payment by supplier at 20%. CGST amendment Act 2018 inserted section 43A in CGST Act. Thus we need to be careful while conducting business in future.

If you already have a premium membership, Sign In.