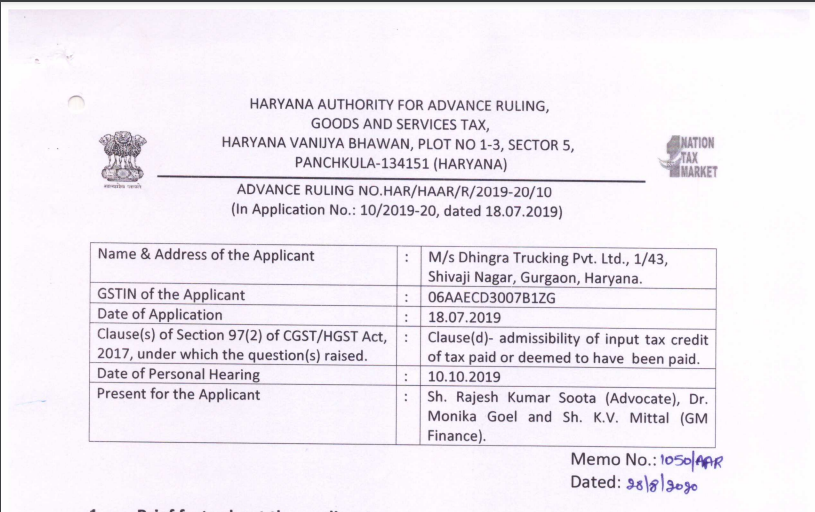

Haryana AAR in the case of M/s Dhingra Trucking Pvt. Ltd.

Case Covered:

M/s Dhingra Trucking Pvt. Ltd.

Facts of the Case:

The applicant has entered into an agreement with a company engaged in the business of manufacturing, sales and marketing of two-wheelers of various models and is desirous of leasing the said warehouse (logistics facility space) for storage of the lessee’s two-wheelers. Under the proposed arrangement, in order to provide the leasing of logistics facility space services, the applicant has undertaken as under:

a) that the premises is capable of being used as logistics facility space/ commercial use under all applicable laws and that all necessary approval(s) have been obtained from all regulatory/governmental authorities.

b) That full electricity backup would be provided for the premises at all times for which the applicant shall install a generator with the required load capacity. The applicant shall also be responsible for the upkeep and maintenance of the generator (including the fuel) so that no hindrance is caused to Lessee for the use of the premises.

c) That the premises inclusive of service lift and other elcetrical equipment shall be maintained by the Applicant at its own cost, in good condition including cleaning and housekeeping. That for the purpose of maintenance and use, the Applicant shall deploy sufficient number of manpower at the premises all times so that no hindrance is caused to Lessee while using the premises.

d) That the applicant shall provide to the lessee the loading and unloading ramps for the vehicles as per standards of lease.

Ruling:

- The applicant is not eligible to input tax credit in respect of inputs/capital goods used or intended to be used for creation of covered logistics facility space (warehouse) to be rented out for storage purposes.

- Since no credit of input tax in repsect of input goods or services consumed and used in the construction of covered logistic facility space is available, there arises no possibility of utilization of the same.

Read & Download the full Ruling in Pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.