ITC can be claimed on invoices. HC dropped the notice

Table of Contents

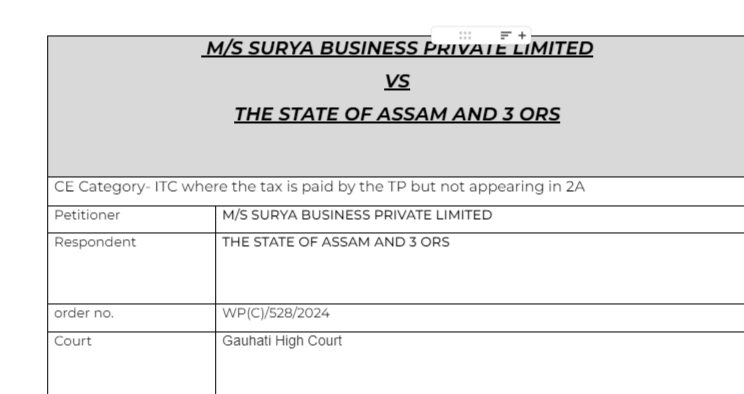

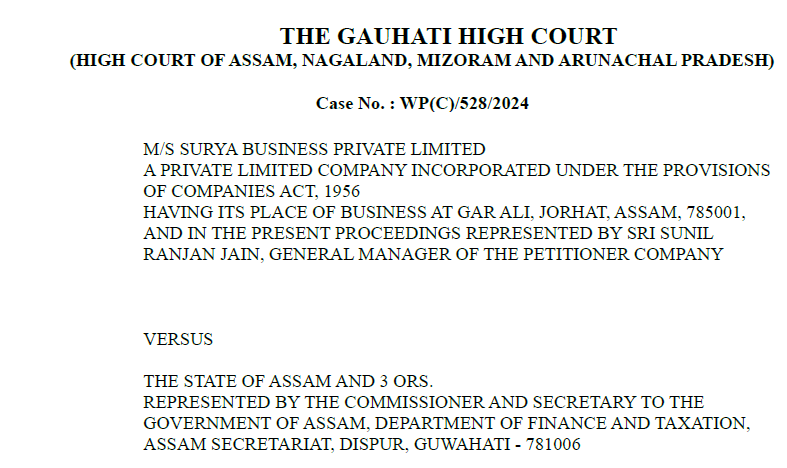

Details of the case

In the case of M/s Surya Business Private limited Vs the State of Assam, it was held that tax paid by the TP but was not appearing in 2A shall not be disallowed.

M/s Surya Business Private limited Vs the State of Assam GST judgment for ITC not appearing in GSTR 2A.

Citations

Suncraft Energy Private Limited and another vs. The Assistant Commissioner

Union of India vs. Bharti Airtel Limited and others

Pleading

To stay the SCN issued for recovery of ITC

Facts

The petitioner in this writ petition has challenged a Show Cause Notice dated 11.01.2024 issued under Section 73[1] r/w Section 50 of the Assam GST Act, 2017, whereby the petitioner was called up to show cause within 30 [thirty] days from the date of receipt of Show Cause Notice as to why an amount of Rs. 27,25,503/- [SGST Rs. 11,26,329.00, CGST Rs. 11,26,329.00 and IGST Rs. 4,72,845.00] should not be recovered from the petitioner being the Input Tax Credit [ITC] excess claimed for the period : 2018-2019 plus interest and penalty. The petitioner has assailed the Show Cause Notice on the ground that the petitioner had availed ITC on valid tax invoices raised by the supplier and had also made payment of taxes to the supplier.

Reliance has been held in the decision of the Hon’ble Supreme Court of India in Union of India vs. Bharti Airtel Limited and others, decided on 28.10.2021, as well as a decision of the Hon’ble Calcutta High Court in the case of Suncraft The petitioner in this writ petition has challenged a Show Cause Notice dated 11.01.2024 issued under Section 73[1] r/w Section 50 of the Assam GST Act, 2017, whereby the petitioner was called up to show cause within 30 [thirty] days from the date of receipt of Show Cause Notice as to why an amount of Rs. 27,25,503/- [SGST Rs. 11,26,329.00, CGST Rs. 11,26,329.00 and IGST Rs. 4,72,845.00] should not be recovered from the petitioner being the Input Tax Credit [ITC] excess claimed for the period : 2018-2019 plus interest and penalty.

The petitioner has assailed the Show Cause Notice on the ground that the petitioner had availed ITC on valid tax invoices raised by the supplier and had also made payment of taxes to the supplier. Reliance has been held in the decision of the Hon’ble Supreme Court of India in Union of India vs. Bharti Airtel Limited and others, decided on 28.10.2021, as well as a decision of the Hon’ble Calcutta High Court in the case of Suncraft. Energy Private Limited and another vs. The Assistant Commissioner, State Tax, Ballygunge Charge and others [Page 112 – 117].

Observation

Having regard to the submissions of the learned counsel for the petitioner, it is observed that the respondents shall not act upon the impugned Show Cause Notice dated 11.01.2024 till the next date of listing.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.