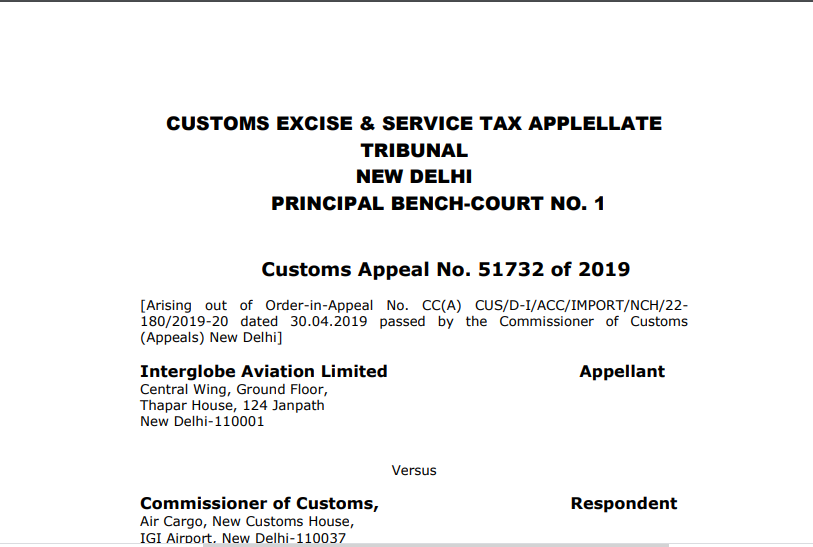

CESTAT in the case of Interglobe Aviation Limited Versus Commissioner of Customs

Case Covered:

Interglobe Aviation Limited

Versus

Commissioner of Customs

Facts of the Case:

The Appeals seek the quashing of the 346 orders passed by the Commissioner of Customs (Appeals) that uphold the orders of assessment of Bills of Entry, as a result of which all the appeals have been dismissed by the Commissioner (Appeals).

The records indicate that the Commissioner (Appeals) had passed the following six main orders while deciding the 349 Appeals that had been filed :

(i) The order dated April 30, 2019, upholding the orders of assessment of 159 Bills of Entry. This order, therefore, has led to the filing of 159 appeals before the Tribunal.

(ii) The order dated September 28, 2018, upholding the order of assessment of 39 Bills of Entry. This has resulted in the filing of 39 appeals before the Tribunal.

(iii) The order dated August 31, 2018, upholding the order of assessment of 96 Bills of Entry. Accordingly, 96 appeals have been filed before the Tribunal.

(iv) The order dated April 30, 2019, upholding the order of assessment of 9 Bills of Entry. Accordingly, 9 appeals have been filed before the Tribunal.

(v) The order dated April 30, 2019, upholding the order of assessment of 9 Bills of Entry. Accordingly, 9 appeals have been filed before the Tribunal.

(vi) The order dated February 20, 2019, upholding the orders of assessment of 37 Bills of Entry. Accordingly, 37 appeals have been filed before the Tribunal.

Observations:

The inevitable conclusion that follows from the aforesaid discussion is that the absence of mention of integrated tax and compensation cess in column (3) under serial no. 2 of the Exemption Notification would mean that only the basic customs duty on the fair cost of repair charges, freight, and insurance charges are payable and integrated tax and compensation cess are wholly exempted.

Order:

It would, therefore, not be necessary to examine the contention of learned Authorised Representatives of the Department that in case of any ambiguity in an Exemption Notification, the benefit should go to the Revenue. It would also not be necessary to examine the remaining contentions advanced by the learned Counsel for the Appellant that the activity of repairs is “supply of service” or that the said activity would not fall under the category of „import of service‟ under the Integrated Tax Act since the necessary ingredients mentioned therein have not been fulfilled.

Thus, for all the reasons stated above, it is not possible to sustain the impugned orders upholding the assessments made on the 346 Bills of Entry. The 346 orders passed by the Commissioner (Appeals) are, accordingly, set aside and it is held that the Appellant is entitled to exemption from payment of integrated tax under the Exemption Notification on re-import of repaired parts/aircraft into India. All the 346 Appeals are, therefore, allowed.

Read & Download the full Order in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.