Notification No. 75/2020-Customs (N.T.)

Table of Contents

- Notification No. 75/2020-Customs (N.T.)

- 1. Short title and commencement. –

- 2. Definitions. –

- 4. Eligibility for application for operating under these regulations. –

- 5. Grant of permission. –

- 6. The validity of permission. –

- 7. Appointment of warehouse keeper. –

- 8. Facilities, equipment, and personnel. –

- 9. Strong-room. –

- 10. Conditions for the transport of goods. –

- 11. Receipt of goods from customs station. –

- 12. Receipt of goods from another warehouse. –

- 13. Receipt of domestically procured goods. –

- 14. Transfer of goods from a warehouse. –

- 15. Removal of resultant goods for home consumption. –

- 16. Removal of resultant goods for export. –

- 17. Conditions for due arrival of goods. –

- 18. Maintenance of records in relation to warehoused goods. –

- 19. Audit. –

- 20. Penalty. –

- 21. Power to exempt. –

- Read The Notification:

Notification No. 75/2020-Customs (N.T.)

G.S.R. (E). –In exercise of the powers conferred by section 157, read with sections 58A, 65 and 143AA of the Customs Act, 1962 (52 of 1962), the Central Board of Indirect Taxes and Customs hereby makes the following regulations, namely: –

1. Short title and commencement. –

(1) These regulations may be called the Manufacture and Other Operations in Special Warehouse Regulations, 2020.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. Definitions. –

(1) In these regulations, unless the context otherwise requires, –

(a) “Act” means the Customs Act, 1962 (52 of 1962);

(b) “bond officer” means an officer of customs in charge of a warehouse;

(c) “Controller of Certifying Authorities” means the authority appointed under sub-section (1) of section 17 of the Information Technology Act, 2000 (21 of 2000);

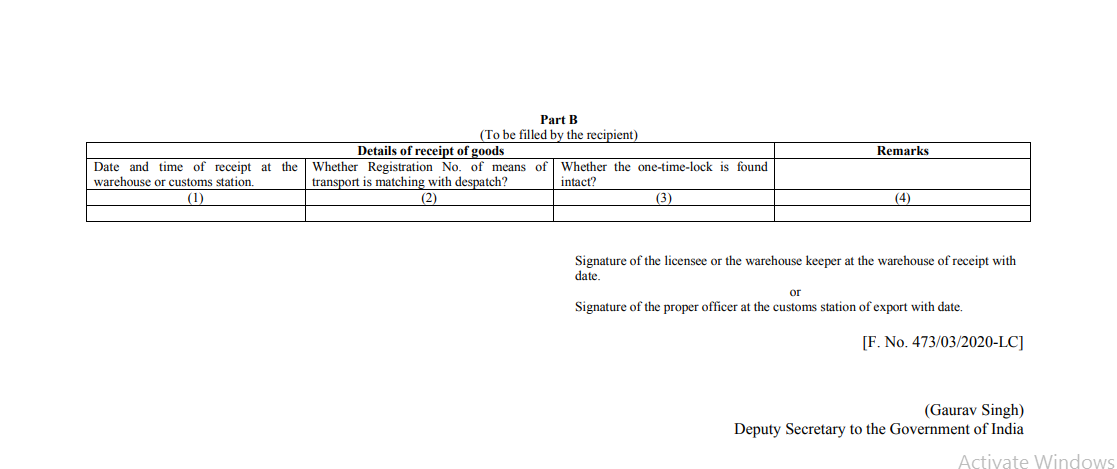

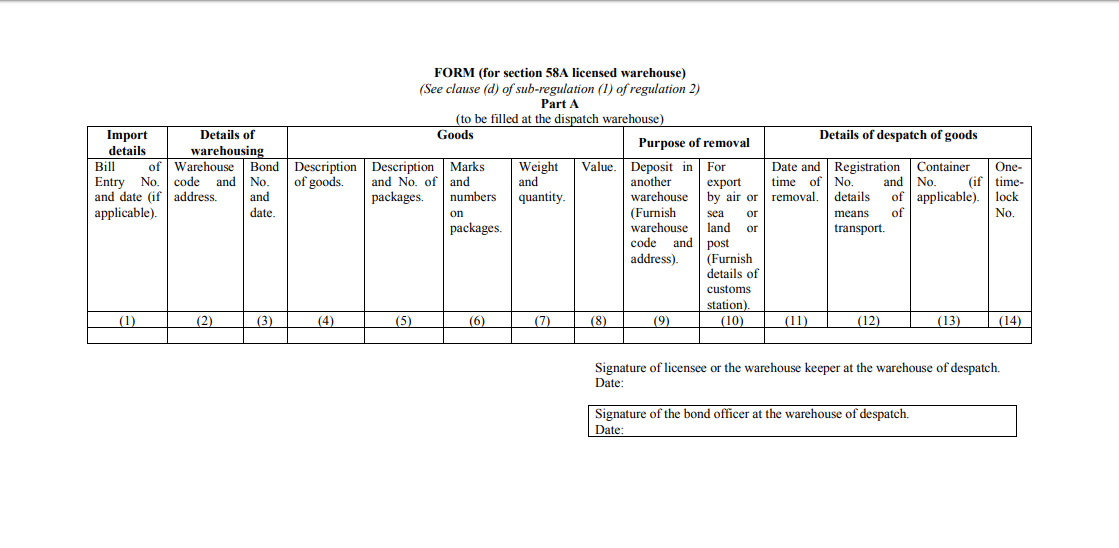

(d) “Form” means the form appended to these regulations;

(e) “section” means the section of the Act.

Related Topic:

Custom Bonding Warehousing and Provisional and Final Assessment in Custom

(2) The words and expressions used herein and not defined in these regulations but defined in the Act shall have the same meanings respectively as assigned to them in the Act.

3. Application. –

These regulations shall apply to, –

(i) the units that operate under section 65 of the Act, or

(ii) the units applying for permission to operate under section 65 of the Act,

in a special warehouse licensed under section 58A of the Act.

4. Eligibility for application for operating under these regulations. –

Related Topic:

Notification No. 81/2020-Customs (N.T.)

(1) The following persons shall be eligible to apply for operating under these regulations, –

(i) a person who applies for a license under section 58A of the Act for warehousing of goods listed at clause (1) of notification 66/2016-Customs (NT) (hereinafter referred to as the specified goods), along with permission for undertaking manufacturing or other operations in the warehouse under section 65 of the Act; or

(ii) a person who has been granted a license under section 58A of the Act for warehousing of the specified goods, in accordance with Special Warehouse Licensing Regulations 2016.

(2) An application under these regulations shall be made to the Principal Commissioner of Customs or the Commissioner of Customs, as the case may be, along with an undertaking to,-

(i) maintain accounts of receipt and removal of goods in digital form in such format as may be specified and furnish the same to the bond officer on a monthly basis digitally;

(ii) provide facilities, equipment, and personnel as required in these regulations;

(iii) execute a bond in such format as may be specified;

(iv) submit security in such manner and with such amount as may be specified;

(v) inform the input-output norms, for raw materials and the final products and to inform the revised input-output norms in case of change therein;

(vi) pay for the services of supervision of the warehouse by officers of customs on cost recovery basis or overtime basis, as may be determined by the Principal Commissioner of Customs or the Commissioner of Customs as the case may be; and

(vii) comply with such other terms and conditions as may be specified by the Principal Commissioner of Customs or the Commissioner of Customs, as the case may be.

5. Grant of permission. –

The Principal Commissioner of Customs or the Commissioner of Customs, as the case may be, upon due verification of the application made under sub-regulation (2) of regulation 4, and after satisfying that all requirements of regulation 4 and the Special Warehouse Licensing Regulations, 2016, have been fulfilled, may grant permission to operate under the provisions of these regulations, along with a license under section 58A of the Act where required, subject to such conditions as deemed necessary.

6. The validity of permission. –

The permission granted under regulation 5 shall remain valid unless it is cancelled or surrendered or the license issued under section 58A is cancelled or surrendered, in terms of the provisions of the Act or the rules and regulations made thereunder.

7. Appointment of warehouse keeper. –

(1) A person who has been granted permission under regulation 5 shall appoint a warehouse keeper who has sufficient experience in warehousing operations and customs procedures to discharge functions on his behalf.

(2) The warehouse keeper shall obtain a digital signature from authorities licensed by the Controller of Certifying Authorities for filing electronic documents required under the Act or rules or regulations made thereunder.

8. Facilities, equipment, and personnel. –

A person who has been granted permission under regulation 5 shall provide at the warehouse, –

(i) signage that prominently indicates that the site or building is a customs bonded warehouse;

(ii) a computerized system for accounting of receipt, storage, operations and removal of goods;

(iii) doors, windows and other building components of sturdy construction;

(iv) a separate strong-room for keeping the specified warehoused goods;

(v) facility for locking the warehouse and the strong-room by the bond officer;

(vi) sufficient office space for bond officer;

(vii) adequate personnel, equipment and space for the examination of goods by officers of customs; and

(viii) such other facilities, equipment, and personnel as are sufficient to control access to the warehouse, provide secure storage of the goods in it, and ensure compliance to these regulations by officers of customs.

9. Strong-room. –

(1) Except for the dutiable specified goods, no other goods shall be stored in the strong-room.

(2) The bond officer shall cause the strong-room to be locked and no person shall enter the strong-room or deposit goods therein or remove goods therefrom, except in the presence of the bond officer.

(3) The warehouse keeper shall, as and when required by the bond officer and at least once in six-months, conduct physical stock-taking of the goods stored in the strong-room in presence of the bond officer, and demonstrate that-

(i) the physical stock of specified goods in the strong room tallies with the stock on record; and

(ii) the specified goods cleared from the strong-room are either lying as work-in-progress or have been utilized in the permitted manufacturing or other operations or have been exported as such or have been cleared as such in the domestic market.

(4) The warehouse keeper and the bond officer shall sign a summary of stock-taking, prepared in duplicate, and keep one copy each for their records.

(5) Where a discrepancy is noticed during a stock-taking conducted under these regulations, the bond officer shall take appropriate action under the Act.

10. Conditions for the transport of goods. –

(1) Where the goods are transported from the customs station of import to a warehouse or from one warehouse to another warehouse or from the warehouse to a customs station for export, the load compartment of the means of transport shall be securely sealed with a one-time-lock:

Provided that the Principal Commissioner of Customs or Commissioner of Customs, as the case may be, may having regard to the nature of goods or manner of transport, permit transport of such goods without affixing the one-time-lock.

(2) Where the goods to be warehoused are removed, from the customs station of import to a warehouse, the one-time-lock as per sub-regulation (1) shall be affixed by the proper officer of customs.

(3) Where the warehoused goods are removed from the warehouse to another warehouse, the one-time-lock as per sub-regulation (1) shall be affixed by the licensee, in presence of the bond officer.

(4) Where the warehoused goods are removed, from the warehouse to a customs station for export, the one-time-lock as per sub-regulation (1) shall be affixed by the licensee, in presence of the bond officer.

11. Receipt of goods from customs station. –

(1) A licensee shall not receive any goods or permit unloading of any goods at the warehouse except in the presence of the bond officer.

(2) Upon the bond officer permitting the deposit of the goods received from a customs station, the licensee shall, –

(i) verify the one-time-lock affixed by the proper officer at the customs station on the load compartment of the means of transport carrying the goods to the warehouse;

(ii) inform the bond officer immediately if the one-time-lock is not found intact, and refuse the unloading of the goods;

(iii) allow unloading, provided the one-time-lock is found intact, and verify the quantity of goods received by reconciling with the bill of entry for warehousing;

(iv) report any discrepancy in the quantity of goods immediately to the bond officer;

(v) endorse the bill of entry for warehousing with the quantity of goods received and retain a copy thereof;

(vi) acknowledge the receipt of the goods by endorsing the transportation document presented by the carrier of the goods and retain a copy thereof;

(vii) take into record the goods received; and

(viii) where the goods are dutiable specified goods, deposit the goods received in the strongroom.

(3) Upon taking into the record the goods received in the warehouse, the licensee shall cause to be delivered an acknowledgment to the proper officer referred to in sub-section (1) of section 60 of the Act and to the bond officer regarding the receipt of the goods in the warehouse.

12. Receipt of goods from another warehouse. –

(1) A licensee shall not receive any goods or permit unloading of any goods at the warehouse except in the presence of the bond officer.

(2) Upon the bond officer permitting the deposit of the goods received from another warehouse, the licensee shall, –

(i) verify the one-time-lock affixed on the load compartment of the means of transport carrying the goods to the warehouse;

(ii) inform the bond officer immediately if the one-time-lock is not found intact and refuse the unloading of the goods;

(iii) allow unloading, provided the one-time-lock is found intact, and verify the quantity of goods received by reconciling with, –

(a) in case of goods received from a unit operating under section 65 of the Act, the Form appended to these regulations;

(b) in case of goods received from a warehouse not operating under section 65 of the Act, the Form as prescribed under the Warehoused Goods (Removal) Regulations, 2016.

(iv) report any discrepancy in the quantity of the goods immediately to the bond officer;

(v) endorse the Form for transfer of goods from a warehouse with quantity received and retain a copy thereof;

(vi) acknowledge the receipt of the goods by endorsing the transportation document presented by the carrier of the goods and retain a copy thereof;

(vii) take into record the goods received; and

(viii) where the goods are specified goods, deposit the goods received in the strong-room.

(3) The licensee upon taking into the record the goods received in the warehouse shall cause to be delivered, copies of the retained documents to the bond officer, and to the warehouse keeper of the warehouse from where the goods have been received.

13. Receipt of domestically procured goods. –

(1) A licensee shall not receive any goods or permit unloading of any goods at the warehouse except in the presence of the bond officer.

(2) Upon the bond officer permitting receipt and deposit of the domestically procured goods, the licensee shall take into record the goods received.

14. Transfer of goods from a warehouse. –

(1) A licensee shall not allow the transfer of warehoused goods to another warehouse or to a customs station for export without the permission of the bond officer on the form for transfer of goods from a warehouse.

(2) Upon the bond officer permitting the removal of the goods from the warehouse, the licensee shall, in the presence of the bond officer, –

(i) allow removal of the goods and their loading onto the means of transport;

(ii) affix a one-time-lock to the means of transport;

(iii) endorse the number of the one-time-lock on the form and retain a copy thereof;

(iv) endorse the number of the one-time-lock on the transport document and retain a copy thereof;

(v) take into record the removal of the goods; and

(vi) hand-over copy of the retained documents to the bond officer.

15. Removal of resultant goods for home consumption. –

(1) A licensee may remove the resultant goods from the warehouse for home consumption:

Provided that a bill of entry for home consumption has been filed in respect of the warehoused goods contained in so much of the resultant goods and the import duty, interest, fines, and penalties payable, if any, in respect of such goods have been paid:

Provided further that the goods shall not be removed except in the presence of the bond officer.

(2) The licensee shall retain a copy of the bill of entry filed and take into record the goods removed.

16. Removal of resultant goods for export. –

(1) A licensee shall remove the resultant goods from the warehouse for export, upon, –

(i) filing a shipping bill or a bill of export, as the case may be; and

(ii) affixing a one-time-lock to the load compartment of the means of transport in which such goods are removed from the warehouse:

Provided that the licensee shall cause the goods to be loaded onto a means of transport and affix a one-time-lock to the means of transport in the presence of the bond officer.

(2) The licensee shall take into record the goods removed.

17. Conditions for due arrival of goods. –

The licensee of the goods shall produce, –

(i) to the proper officer within one month of the order issued under sub-section (1) of section 60 of the Act, an acknowledgment that the goods have been deposited in the warehouse;

(ii) to the bond officer in charge of the warehouse, within one month from the date of removal of the goods from the warehouse an acknowledgment issued by the licensee of the warehouse to which the goods have been removed, stating that the goods have arrived at that place;

(iii) to the bond officer in charge of the warehouse, within one month from the date of removal of the goods from the warehouse an acknowledgment issued by the proper officer at the customs station of export, stating that the goods have arrived at that place;

failing which, the owner of such goods shall pay the full amount of duty chargeable on account of such goods together with interest, fines, and penalties payable under sub-section (1) of section 72.

18. Maintenance of records in relation to warehoused goods. –

(1) A licensee shall, –

(i) maintain detailed records of the receipt, handling, storing, and removal of any goods into or from the warehouse, as the case may be, and produce the same to the bond officer, as and when required;

(ii) keep a record of each activity, operation or action taken in relation to the warehoused goods;

(iii) keep a record of drawl of samples from the warehoused goods under the Act or under any other law for the time being in force; and

(iv) keep copies of the bills of entry, transport documents, forms for transfer of goods from a warehouse, shipping bills or bills of the export or any other documents evidencing the receipt or removal of goods into or from the warehouse and copies of the bonds executed under section 59 of the Act.

(2) All activities prescribed in these regulations need to be recorded immediately and the data prescribed in the Form shall also be stored electronically. Such electronic, as well as manual records, should be kept updated, accurate, and complete and shall be available at the warehouse at all times and accessible to the bond officer or any other authorized officer for verification.

(3) The software for maintenance of electronic records must incorporate the feature of an audit trail which means a secure, computer-generated, time-stamped electronic record that allows for the reconstruction of the course of events relating to the creation, modification or deletion of an electronic record and includes actions at the record or system level, such as, attempts to access the system or delete or modify a record.

(4) The records and accounts required to be maintained under sub-regulation (1) shall be kept updated and accurate and preserved for a minimum period of five years from the date of removal of goods from the warehouse and shall be made available for inspection by the bond officer or any other officer authorized under the Act.

(5) A licensee shall also preserve updated digital copies of the records specified under sub-regulation (1) at a place other than the warehouse to prevent loss of records due to natural calamities, fire, theft, skillful pilferage, or computer malfunction.

(6) A licensee shall file with the bond officer a monthly return of the receipt, storage, operations, and removal of the goods in the warehouse, within ten days after the close of the month to which such return relates.

19. Audit. –

The proper officer may conduct an audit of a unit operating under section 65 of the Act in accordance with the provisions of the Act and the Rules made thereunder.

20. Penalty. –

If a person contravenes any of the provisions of these regulations, or abets such contravention or fails to comply with any of the provisions of these regulations, he shall be liable to a penalty in accordance with the provisions of the Act.

21. Power to exempt. –

The Board, having regard to the nature of the goods, their manner of transport or storage, may exempt a class of goods from any of the provisions of these regulations.

Read The Notification:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.