Notification No. 60/2018 – Customs

Notification No. 60/2018 – Customs

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification No. 60/2018 – Customs

New Delhi, the 11th September 2018

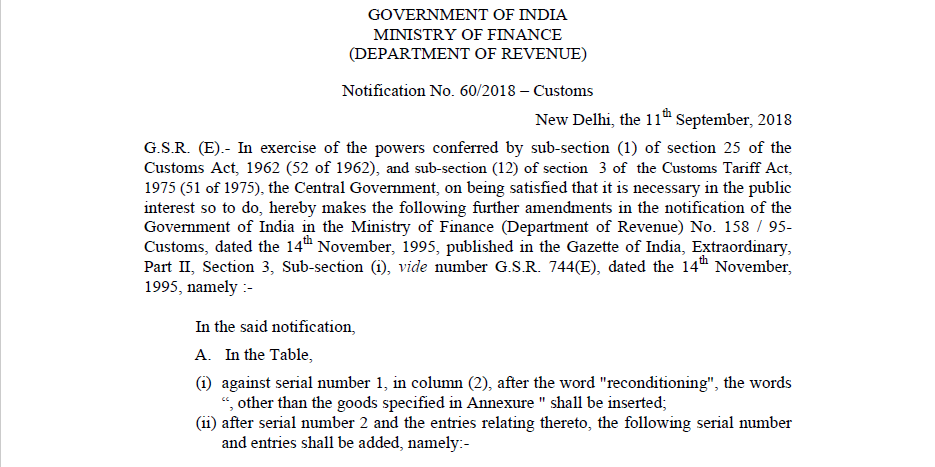

G.S.R. (E).- In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act, 1962 (52 of 1962), and sub-section (12) of section 3 of the Customs Tariff Act, 1975 (51 of 1975), the Central Government, on being satisfied that it is necessary in the public interest so to do, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue) No. 158 / 95- Customs, dated the 14th November, 1995, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 744(E), dated the 14th November, 1995, namely :-

In the said notification,

A. In the Table,

(i) against serial number 1, in column (2), after the word “reconditioning”, the words “, other than the goods specified in Annexure ” shall be inserted;

(ii) after serial number 2 and the entries relating thereto, the following serial number and entries shall be added, namely:-

| (1) | (2) | (3) |

| “3 | Goods as specified in Annexure, manufactured in India and reimported into India for repairs or for reconditioning |

1. Such re-importation takes place within 7 years from the date of exportation; Provided that such re-importation takes place within 10 years from the date of exportation in case of Nepal and Bhutan. 2. Goods are re-exported within one year of the date of reimportation; 3. The Assistant/Deputy Commissioner of Customs is satisfied as regards identity of the goods; 4. The importers at the time of importation execute a bond undertaking to – (a) export the goods after repairs or reconditioning within the period as stipulated; (b) pay, on demand, in the event of his failure to comply with any of the aforesaid conditions, an amount equal to the difference between the duty levied at the time of re-import and the duty leviable on such goods at the time of importation but for the exemption contained herein”. |

Related Topic:

SECTIONWISE ANALYSIS – CUSTOMS AMENDMENTS

Download the full Notification No. 60/2018 – Customs by clicking the below image:

Source: CBIC, Customs Notification.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.