Notification No. 01/2021 – Customs (N.T.)

Table of Contents

Notification No. 01/2021 – Customs (N.T.)

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

New Delhi, the 04th January 2021

NOTIFICATION

No. 01/2021 – Customs (N.T.)

G.S.R.___ (E). – In exercise of the powers conferred by section 157 read with subsection (1) of section 28H, sub-section (1) of section 28KA and sub-section (1) of section 28M of the Customs Act, 1962 (52 of 1962) and in supersession of the Authority for Advance Rulings (Customs, Central Excise, and Service Tax) Procedure Regulations, 2005, in so far as they relate to the matters pertaining to the Customs Act, 1962 (52 of 1962), except as respects things done or omitted to be done before such supersession, the Board hereby makes the following regulations, namely:-

1. Short title and commencement

(1) These regulations may be called the Customs Authority for Advance Rulings Regulations, 2021.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. Definitions

In these regulations, unless the context otherwise requires, –

(a) “Act” means the Customs Act, 1962 (52 of 1962);

(b) “authorized representative”, –

(i) in relation to an applicant means an authorized representative as defined in sub-section (2) of section 146A of the Act;

(ii) in relation to a Principal Commissioner or Commissioner, means a person –

(A) authorized in writing by the Principal Commissioner or Commissioner to act as an authorized representative; or

(B) appointed by the Central Government as authorized representative or authorized by the Central Board of Indirect Taxes and Customs to appear, plead and act for the Principal Commissioner or Commissioner in any proceeding before the Authority;

(c) “petition” means any petition of interlocutory, incidental or ancillary nature or representation filed in a pending or disposed of application;

(d) “Principal Commissioner or Commissioner”, in respect of an application, means-

(i) the Principal Commissioner or Commissioner of Customs, specified in the application; or

(ii) the Principal Commissioner or Commissioner of Customs designated by the Board in respect of the application;

(e) “Secretary” means an officer, not below the rank of Assistant Commissioner of Customs or Assistant Commissioner of Central Tax designated as Secretary by the Board;

(f) “section” means section of the Act;

(g) words and expressions used in these regulations and not defined but defined in the Act shall have same meanings respectively assigned to them in the Act.

Related Topic:

Notification No. 02/2021–Customs (N.T.)

3. Language of Authority

(1) The language of the Authority shall be Hindi or English.

(2) Where any document is in a language other than Hindi or English, a Hindi or English translation thereof duly attested shall be filed along with the original document.

Related Topic:

Notification No. 35 /2021-Customs (N.T.)

4. Powers of Authority

(1) The Authority shall have the power to hear and determine all applications and petitions.

(2) The Authority may, if any difficulty arises in giving effect to its order or advance ruling, either suo motu or on a petition made by the applicant or the Principal Commissioner or Commissioner, within a period of one month of noticing the difficulty, by appropriate order remove such difficulty, and pass such other order as it considers just and necessary in the circumstances of the case.

(3) The Authority may reopen the hearing of any case, before pronouncement of its order or advance ruling, for sufficient cause.

(4) The Authority may, in an appropriate case, direct –

(i) examination of any records and submission of report;

(ii) conduct of any technical, scientific or market enquiry of any goods or services and submission of a report and may also call for reports from experts and order such further investigation as may be necessary for effectual disposal of the application.

Related Topic:

Important changes as per Notification No. 94/2020-CT dated 22-12-2020 Applicable from 1 January 2021

Read & Download the full Notification in pdf:

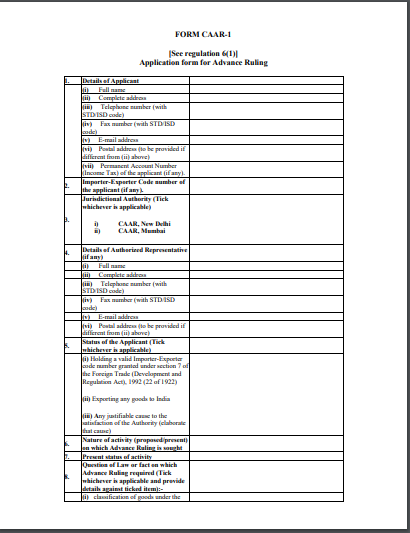

Download the CAAR FORM in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.