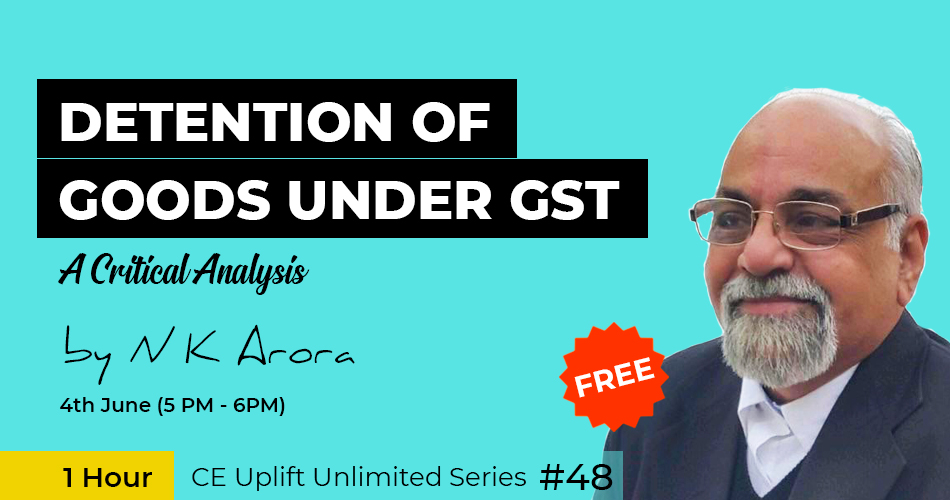

In this session, the detention of goods under GST will be discussed by Adv. NK Arora and CA Shafaly Girdharwal. Detention of vehicles is a common practice. It was there in the Excise and VAT also. It generates revenue for the government. But the provisions for detention in GST have many loopholes. That's the reason for the huge litigation in detention cases. We have many court cases since the inception of GST for wrong detention. Some of the major issues are:

- Whether the order of detention u/s 129 is an appealable order. A discussion is required in light of relevant case laws.

- If it is no appealable then is it a violation of article 14 and 19(1)(g)

- Jurisdictional issues

-the interplay of sections 129 and 130 of the CGST Act. Both of these have non-obstante clause.

He is a practicing Advocate since May 1976 having qualification B.Sc. LL. B., LL.M. (in Constitution) and pursuing Ph. D. on GST on Search, Seizure & Arrest. He has more than 43 years of experience in Direct & Indirect Taxation and specializes in all aspects of Income Tax, Goods & Service Tax (GST), Service Tax, Excise, Value Added Tax (VAT) / Central Sales Tax Act (CST) & Negotiable Instrument Act. He is member of Supreme Court Bar Association, Nainital High Court Bar Association and argued many cases to interpretate provisions of law. He has Given lectures on GST to professionals and stake holders.

This webinar was nice. We got more knowledge and lot of information.

This topic is very good point. All point details explain. All document require to in case file uplode