One important CBIC clarification that has recently come is the deduction of The claim bonus (NCB) from the value of supply for the purpose of GST levy.

It’s pertinent to note that NCB is a benefit the r […]

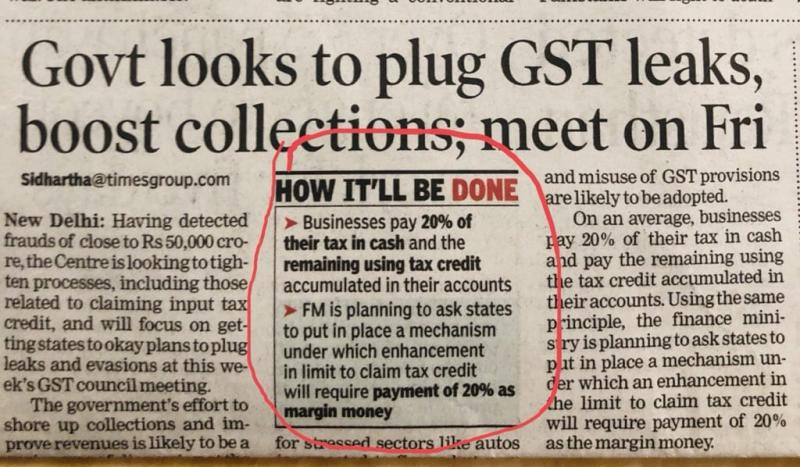

Govt Proposal to fix 20% margin money for ITC availment violates Article 14 & 19(1)(g) of COI?

ITC being an indefeasible right, Govt cannot impose any unreasonable condition for its availment. If done, same may […]

For the purpose of sec 22, “aggregate turnover (AT)” shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals.

Hence, the definition of ‘AT […]

Vikash Agarwal

@vikash-agarwal

Not recently activeVikash Agarwal

OOPS!

No Packages Added by Vikash Agarwal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewVikash Agarwal wrote a new post, ’Discount’, a reduction or a revision in sales price? 1 year, 2 months ago

One important CBIC clarification that has recently come is the deduction of The claim bonus (NCB) from the value of supply for the purpose of GST levy.

It’s pertinent to note that NCB is a benefit the r […]

Vikash Agarwal wrote a new post, Analysis of 20% limit on ITC availment 4 years, 7 months ago

Govt Proposal to fix 20% margin money for ITC availment violates Article 14 & 19(1)(g) of COI?

ITC being an indefeasible right, Govt cannot impose any unreasonable condition for its availment. If done, same may […]

Vikash Agarwal wrote a new post, Turnover limit for GST regn need not be measured at PAN level 4 years, 7 months ago

For the purpose of sec 22, “aggregate turnover (AT)” shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals.

Hence, the definition of ‘AT […]