Order Now $14,550 (2)

-

4 Logo Drafts, Icon based, modern

312 Sold

-

30 Minutes Call with me

12 Sold

-

Monthly Fee

21 Sold

-

1 year shared hosting

ConsultEase.com Interviewed.

Read Interview-

Manoj Agarwal wrote a new post, GSTsathi Updates: Key Changes in E-WayBill Rules 7 years, 4 months ago

Today, CBEC has issued Notification No. 03/2018-Central Tax dated 23-01-2018 substituting new Rule 138 w.e.f. 01-02-2018. The main changes in E-WayBill Rules are as below:

1. The new rule has now given me […] -

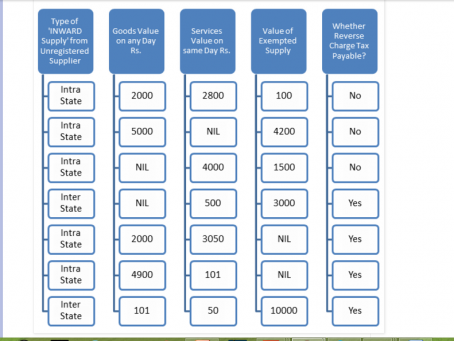

Manoj Agarwal wrote a new post, All About Reverse Charge Exemption of Rs. 5000/Day 7 years, 10 months ago

All About Reverse Charge Exemption of Rs. 5000/Day

The Central Government has issued Exemption Notification No. 8/2017-CT (Rate) dated 28-06-2017 giving relaxation to Registered Persons under GST from major (and […]

-

Manoj Agarwal wrote a new post, New Income Disclosure Scheme by Manoj Agarwal 8 years, 6 months ago

Proposed Salient Features of New Income Disclosure Scheme for disclosing black money held as cash. This new income disclosure scheme is proposed to be passed in parliament.

1.This income disclosure scheme will […] -

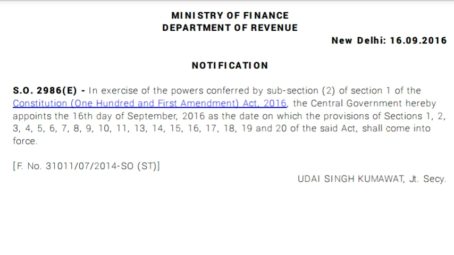

Manoj Agarwal wrote a new post, Whether the GST Council is formed without having constitution power: By Mr.Manoj Agarwal 8 years, 7 months ago

GST Council is formed without having constitution power-

All the provisions of The Constitution (101st Amendment) Act, 2016 comes into effect from 16/09/2016. Section 1 is also effective w.e.f. 16/09/16, which […]

-

Manoj Agarwal‘s profile was updated 8 years, 7 months ago

-

Manoj Agarwal became a registered member 10 years ago

Manoj Agarwal

GST Expert

@manoja

Not recently active