The Banning of Unregulated Deposit Schemes Ordinance, 2019

The Banning of Unregulated Deposit Schemes Ordinance, 2019

Dear Readers,

Why does every action of government conceive as a step to kill the business of MSME’s?, Rather we must seek that the measures taken by the central government are to have a mature and transparent economy. Going by the ordinance and the objective behind promulgating the same, we understand that the ordinance is brought to provide a comprehensive mechanism to ban the Unregulated Deposit Scheme (UDS) and to protect the interest of the depositors (common man ) who invest in such schemes. Due to Regulatory gap Government have not been able to completely address the issue of unregulated deposit schemes run by unscrupulous elements was highlighted in the twenty-first Report of the Parliamentary Related Standing Committee on Finance (Sixteenth Lok Sabha) titled as “Efficacy of Regulation of Collective Investment Schemes, Chit Funds, etc.”. The Committee recommended the requirement of “appropriate legislative provisions, coupled with effective administrative and enforcement measures to protect the hard-earned savings and investments made by millions of people”. As there are unregulated schemes and arrangements in existence which leads to an unauthorized/ fraudulent collection of money and deposits, by inducing the public to invest in such schemes promising high returns /other benefits, the objective of promulgating this ordinance is to curb such malpractices.

Download PDF by clicking the below image:

Objective of The Banning of Unregulated Deposit Schemes Ordinance-

Safeguard interest of depositors from unregulated deposit schemes by bringing transparency and accountability

“Deposit” means;

an amount of money received by way of an advance or loan or in any other form,

by any deposit taker

with a promise to return whether after a specified period or otherwise,

either in cash or in kind or in the form of a specified service, with or without any benefit in the form of interest, bonus, profit or in any other form Exclusions:

Loan from Banks, FI, NBFC and Insurance Cos.

Loan from Government

Loan from Foreign Government/Banks/Residents

Partner’s Contribution in firm or LLP

Amounts received by an ARC and Political Party

Amount received for business other than business by way of deposits**

Credit received by a buyer from a seller on the sale of any property (whether movable or immovable)

Loan received by an individual from his relatives#

Loan received by any firm from the relatives# of any of its partners #

Meaning of relative as per Companies Act, 2013

Members of HUF

Husband & Wife

Persons’s Father, Mother, Son, brother, sister, [including step]

Son’s wife , daughter , daughter’s husband

AMOUNT RECEIVED FOR BUSINESS OTHER THAN BUSINESS BY WAY OF DEPOSITS An amount received in the course of, for the purpose of, business and bearing a genuine connection to such business are not termed as deposits. These transactions INCLUDES—

i. Advance received for the supply or hire of goods or provision of services;

ii. Advance received in connection with consideration of an immovable property subject to the condition that such advance is adjusted against such immovable property

iii. Security or dealership deposited for the performance of the contract iv. Advance under the longterm projects for supply of capital goods except those specified in item (ii)

v. Refundable deposits, if not refunded on the expiry of 15 days from the date on which they become due for refund would be termed as deemed deposits

Deposit taker means;

i. Any individual or group of individuals

ii. a proprietorship concern;

iii. a partnership firm;

iv. a limited liability partnership;

v. a company;

vi. an association of persons;

vii. a trust;

viii. a multi-State co-operative society;

ix. or any other arrangement, receiving or soliciting deposits But does not include;

i. a Corporation incorporated under an Act of Parliament or a State Legislature and

ii. a banking company, a corresponding new bank, SBI, a co-operative bank or a multi-State cooperative bank

“Person” includes—

i. An individual;

ii. a Hindu Undivided Family;

iii. a company;

iv. a trust;

v. a partnership firm;

vi. a limited liability partnership;

vii. an association of persons;

viii. a co-operative society registered under any law for the time being in force relating to co-operative societies; or

ix. every artificial juridical person, not falling within any of the preceding sub-clauses;

Regulated Deposit Scheme by following organization [ Sec 2 (14) r.w First Schedule ]

Securities and Exchange Board of India

Reserve Bank Of India

The Insurance Regulatory and Development Authority of India

State Government or Union territory Government

National Housing Bank

Pension Fund Regulatory and Development Authority

Employees Provident Fund Organisation

Central Registrar, Multi-State Cooperative Societies

Ministry of Corporate Affairs, Government of India Un-Regulated Deposit Scheme [ Sec 2 (17) ]

Unregulated Deposit Scheme” means a Scheme or an arrangement under which deposits are accepted or solicited by any deposit taker By Way Of BUSINESS and which is Not A REGULATED DEPOSIT SCHEME.

Our view: Dictionary meaning of word BY WAY OF means constituting. It therefore covers only those persons who takes /accepts the deposits in the course to lend it further. i.e. who are into the business of accepting deposits under a Scheme or arrangement.

1. Mr A, a sole proprietor dealing in jewellry takes loans from various person other than his relatives for the business purpose, will he be treated as deposit taker ? A. Since the money taken in form of loan is for business purpose the same will not be considered as deposits and Mr A will not be treated as deposit taker 2. What is the Effective Date of the said ordinance? A. The said ordinance would be applicable from the 21st February 2019 CONCLUSION FAQ DEFINITION EXCLUSIONS DEPOSITS OBJECTIVE 3. Only schemes specified in First Schedule are regulated deposit scheme ? A. As on the date, only the schemes specified in First Schedule are regulated one rest all schemes are unregulated deposit schemes and are banned from 21st February 2019.

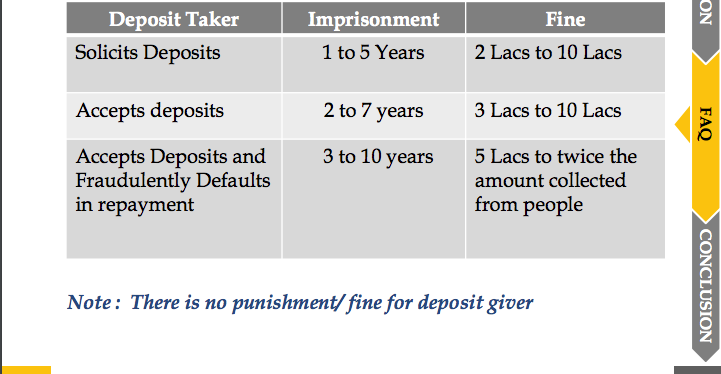

4. What are the penalty for non compliance?

A. Deposit taker who solicits, accepts or fraudulently defaults in repayment of money under unregulated Deposits scheme

The Banning of Unregulated Deposit Schemes Ordinance

Watch out for Businessmen post Banning of Unregulated Deposits Scheme Ordinance, 2019

Persons into Ponzi deposit schemes shall be liable to captive punishment

Persons conducting business of accepting deposits by way of a scheme or arrangement (unregulated) for further investing / onward lending will need to realign their modus operandi to become eligible to register under Regulated Deposit Schemes

Deposit taker who wish to continue or intends to commence business shall intimate the same to the competent authority to be appointed under the said ordinance.

A Company who accepts deposit under Chapter V of Co’s Act 2013 also need to intimate the same to the authority.

Person must evaluate whether the loan taken has direct nexus to the core business or not. If the person is not into the business of accepting deposits and taking loans , this ordinance would not have any bearing on them.

News agencies and media house need to be cautious in publication of advertisement of Unregulated Deposit Scheme.

Rahul Nahata

Sd/- Founder Partner

R A N K & Associates

If you already have a premium membership, Sign In.