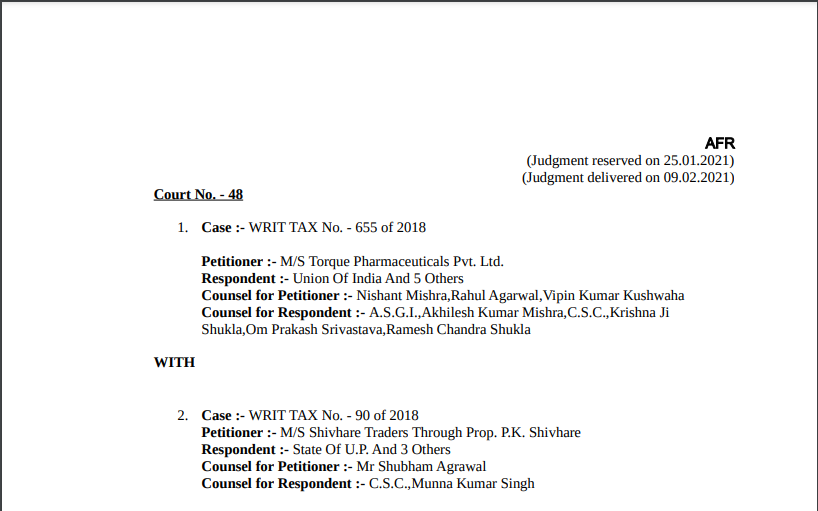

Allahabad HC in the case of M/s Torque Pharmaceuticals Pvt. Ltd. Versus Union Of India

Case Covered:

M/s Torque Pharmaceuticals Pvt. Ltd.

Versus

Union Of India

Facts of the Case:

Briefly stated facts of the present case are that the impugned orders passed in this batch of writ petitions are appealable before the Appellate Tribunal under Section 112 of the CGST Act/ U.P. GST Act but the petitioners have filed these writ petitions for reason that the Tribunal under Section 109 of the CGST Act has not been constituted so far by the Government, i.e. the Central Government, under Section 109 of the CGST Act. Since the challenge to the impugned orders relates to questions of fact and the Appellate Tribunal is the last fact-finding authority, therefore, we leave it open for all the petitioners to challenge the impugned orders before the Appellate Tribunal under Section 112 of the CGST Act/ U.P. GST Act as and when the State Bench and Area Benches of the Appellate Tribunal are constituted in the State of Uttar Pradesh.

Observations:

It is pertinent to mention that dealers in the State of Uttar Pradesh falling under the CGST Act/ U.P. GST Act and aggrieved with the orders of the first appellate authority under Section 107 have been left remediless inasmuch as Appellate Tribunal under the Act is not available in the State of Uttar Pradesh for preferring appeals under Section 112 of the CGST Act/ U.P. GST Act. The Appellate Tribunal is the last fact-finding authority and its not availability in the State of Uttar Pradesh, is causing serious prejudice to the rights of aggrieved persons for statutory appeal which is continuing since the enactment of the CGST Act/ U.P. GST Act. Therefore, in peculiar facts and circumstances of the case and in view of the legislative mandate of Section 109(6) of the CGST Act, we direct as under:

(i) The GST Council shall forward its recommendation of Agenda Item No.6 of the 39th Meeting held on 14.03.2020 to the Central Government/ respondent No.1 within two weeks from today.

(ii) Thereafter, respondent No.1/ Central Government shall, within the next four weeks, specify by notification in terms of sub-Section (6) of Section 109 of the CGST Act the “State Bench” at Prayagraj (Allahabad), of the Goods and Services Tax Appellate Tribunal and four Area Benches at Ghaziabad, Lucknow, Varanasi, and Agra, in the State of Uttar Pradesh for exercising the powers of the Appellate Tribunal.

(iii) The respondent Nos.1, 2, 3, and 6 shall ensure that the State Bench and the Area Benches of the Appellate Tribunal (Goods and Service Tax Appellate Tribunal) in the State of Uttar Pradesh are made functional as far as possible from 01.04.2021.

(iv) Since the challenge to the impugned orders relates to questions of fact and the Appellate Tribunal is the last fact-finding authority, therefore, we leave it open for all the petitioners to challenge the impugned orders before the Appellate Tribunal under Section 112 of the CGST Act/ U.P. GST Act as and when the State Bench and Area Benches of the Appellate Tribunal are constituted in the State of Uttar Pradesh. However, till the expiry of the period of limitation for filing appeals under Section 112 of the CGST Act after the establishment of the State Bench and Area Benches or till appeals are filed, whichever is earlier, no coercive action shall be taken against the petitioners herein pursuant to the impugned orders passed by the first authority or the first appellate authority. Liberty is also granted to the petitioners to avail such remedy as available to them under the law in respect of other reliefs that have not been considered and decided by this judgment.

Related Topic:

Uttar Pradesh AAR in the case of M/s. Dwarikesh Sugar Industries Limited

The Decision of the Court:

For all the reasons stated above, the writ petitions are disposed of off as indicated above. Accordingly, the relief Nos.(A), (D-1), and (E-1), are granted. There shall be no order as to costs.

We hope and trust that the respondent Nos.1, 2, 3, and 6 shall ensure compliance with this order within the stipulated time frame.

Read & Download the Full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.