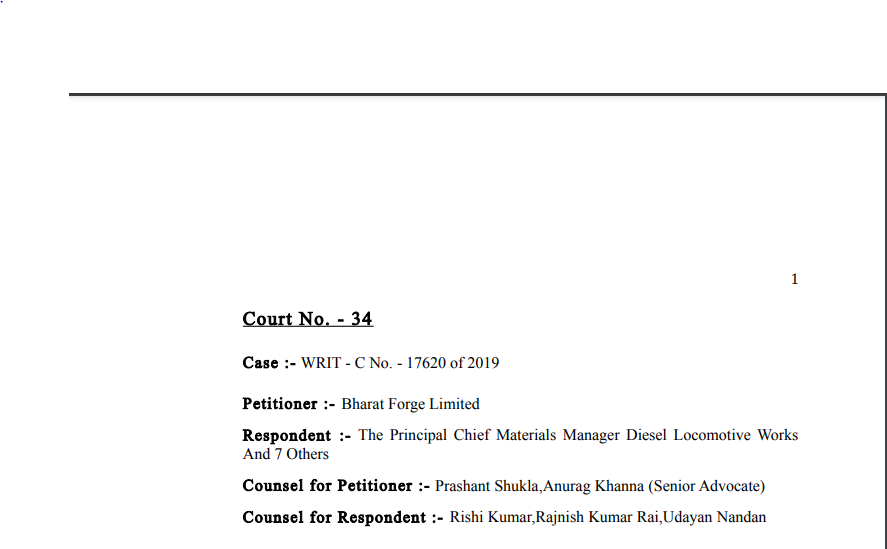

Allahabad HC in the case of Bharat Forge Limited

Case Covered:

Bharat Forge Limited

Versus

The Principal Chief Materials Manager Diesel Locomotive Works

Facts of the Case:

The petitioner herein is a company registered under the provisions of the Indian Companies Act having its registered office at Pune Cantonment, Mundhwa, Pune, Maharashtra.

Respondent no.1, Diesel Locomotive Works, Varanasi published a notice dated 11.4.2019 inviting e-tender for procurement of Turbo Wheel Impeller Balance Assembly to D.L.W Part no.16080385. The Turbo Wheel Impeller Balance Assembly (in short referred to as the “procurement product”) is an assembly critical to the 710G HHP locomotive run by the Railway. This product consists of a turbine and a compressor, coupled on a common shaft, and balanced to enable its rotation at speeds as high as 22,000 RPM(rounds per min). This assembly is an essentially moving part of the 710-G turbocharger. With the drop in higher temperature exhaust gases, there is rotational energy delivered to the turbine which in turn delivers its input to the compressor, enabling pumping of high-density air into engine cylinders, for combustion.

A reading of the tender document shows that the validity period of the offer was 120 days. The commercial compliance conditions of the tender, relevant for our purpose, are as under:-

“1. In case the successful tenderer is not liable to be registered under CGST/IGST/UTGST/SGST Act. The Railway shall deduct the applicable GST from his/their bills under reverse charge mechanism [RCM] and deposit the same to the concerned tax authority.”

“9. Please enter the percentage of local content in the material being offered. Please enter 0 for fully imported items, and 100 for fully indigenous items. The definition and calculation of local content shall be in accordance with the Make in India policy as incorporated in the tender conditions.”

10. Please enter the percentage of local content in the material being offered. Please enter 0 for fully imported items, and 100 for fully indigenous items. The definition and calculation of local content shall be in accordance with the Make in India policy as incorporated in the tender conditions.”

The Special Condition no.2 relevant to the case reads as under:-

“2. Instructions issued by Railway Board vide letter no.2015/RS G/779/5 No dated 03.08.2017 [uploaded with tender] on Preference to Make of India will also be applicable for this tender. In case, conditions given in this letter contradict with Para 1.24 of GT Bid Document, conditions of this letter will prevail.”

Observations:

In our considered opinion, if the GST value is to be added in the base price to arrive at the total price of offer for the procurement product in a tender, and is used to determine the interse ranking in the selection process, it is incumbent on the part of the respondent nos.1 and 2 to clarify the HSN Code, i.e. to clear their stand with regard to the applicable GST rate and HSN Code of the “procurement product”.

Thus, the mentioning of the HSN Code in the tender document itself shall resolve all disputes relating to fairness and transparency in the process of selection of bidder, by providing a ‘level playing field’ to all bidders/tenderers in the true spirit of Article 19(1)(g) of the Constitution of India. For any issue relating to the applicability of the correct HSN Code or GST rate, it would then be the duty of respondent nos.1 and 2 to seek clarification from the GST authorities. Respondent nos.1 and 2 cannot get away by saying that they are not required to mention the GST rate or HSN Code in the tender document, as it is integral to the process of selection of tenderer, more so, in view of the admission of the respondent no.1 in the counter affidavit that the offers have to be evaluated based on the GST rates as quoted by each bidder and same will be used to determine the interse ranking.

The Decision of the Court:

We, therefore, find it expedient to issue a direction to respondent no.2 namely, the General Manager, Diesel Locomotive Works, Varanasi that if the GST value is to be added to the base price to arrive at the total price of offer for the procurement of products in a tender and is used to determine interse ranking in the selection process, he would be required to clarify the issue, if any, with the GST authorities relating to the applicability of correct HSN Code of the procurement product and mention the same in the NIT (Notice inviting tender)tender/bid document, so as to ensure

uniform bidding from all participants and to provide all tenderers/bidders a ‘Level Playing Field’.

With the above observations and directions, the writ petition is disposed of.

Read & Download the full Order in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.