Changes in GST Law Effective from 01.01.2022

Introduction

- GST law has been rapidly evolving with the addition and deduction of provisions in the past four years.

- Now, as we welcome the New Year 2022, the Government has presented us with some changes to be made effective from the 1st of January, 2022.

- Today we will focus on these newly introduced changes to be made effective from1st January 2022 based mainly on the footing of the amendments as proposed in the Finance Act by the Budget 2021 and suggestions extended in the GST Council Meetings during the year 2021.

The gist of Changes to be effective from 01.01.2022

- Matching of Input Tax Credit – GSTR 2B

- Blocking of filing of GSTR-1

- Recovery of Tax without Show Cause Notice

- Increased Scope of Provisional Attachment of Property

- Power to Call for Information

- Inclusion of Services by Club or Associations as Supply

- Pre-deposit for Appeal for Section 129(3)

- Works Contract Services To Governmental Authority Or Government Entity

- Detention of Goods & Conveyances in Transit & Confiscation-Section 129&130

- GST On E-Commerce Operators

- No more Inverted Duty structure in the Footwear and Textiles sector

- GST on Job-work related to Dyeing and Printing of Textile Hiked

- Aadhaar Authentication for GST Refund & Revocation application

Matching of Input Tax Credit – GSTR 2A/2B

W.e.f. 01.01.2022 ITC in GSTR-3B can be availed only when the invoice details have been furnished by the Supplier in its GSTR-1 and the same has been communicated to the recipient in GSTR-2B.

Background

- Presently as per Rule 36(4), Input Tax Credit can be availed up to 105% of GST paid on inward supplies the details of which are uploaded by Supplier on GSTN Portal and reflected in GSTR 2A of the recipient in a tax period.

- Various Writ Petitions to challenge this condition have been filed by taxpayers mainly on the grounds that the said condition is imposed through Rules only and is not provided under the CGST/SGST Act.

- Section 16(2) of the CGST Act provides the conditions to avail the ITC wherein a new condition under Section 16(2)(aa) of CGST Act has been inserted to amend the GST provision related to details of invoice or debit note furnished by the Supplier and communicated to the Recipient.

Newly Inserted Clause in Section 16

“(aa) the details of the invoice or debit note referred to in clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37”.

Rule 36(4) – Substituted w.e.f. 01.01.2022

(i) in rule 36, for sub-rule (4), the following sub-rule shall be substituted, with effect from the 1st day of January 2022, namely: –

“(4) No input tax credit shall be availed by a registered person in respect of invoices or debit notes the details of which are required to be furnished under subsection (1) of section 37 unless,-

(a) the details of such invoices or debit notes have been furnished by the supplier in the statement of outward supplies in FORM GSTR-1 or using the invoice furnishing facility; and

(b) the details of such invoices or debit notes have been communicated to the registered person in FORM.

GSTR-2B under sub-rule (7) of rule 60.”;

Blocking of filing of GSTR-1

W.e.f. 01.01.2022 the GSTR-1 return filing facility will be blocked if you have not submitted the return in FORM GSTR-3B for the previous month/return period.

For example, if a taxpayer has not filed GSTR-3B for November 2021, the GSTR-1 filing facility for the month of December 2021 will be blocked.

Background

- Sometimes the Suppliers file GSTR-1 and the details are also reflected in GSTR-2A/2B but the Suppliers do not pay taxes to the Government. However, to curb such issues the Government has mandated the filing of GSTR-3B before filing GSTR-1 of the subsequent period.

- Currently, a registered person was not allowed to furnish the details of outward supplies in FORM GSTR-1, if he had not furnished the return in FORM GSTR-3B for the preceding two months/quarters.

Amended Rule 59(6)

“(6) Notwithstanding anything contained in this rule, – (a) a registered person shall not be allowed to furnish the details of outward supplies of goods or services or both under section 37 in FORM GSTR-1 if he has not furnished the return in FORM GSTR-3B for the preceding month”.

Recovery of Tax without Show Cause Notice

W.e.f. 01.01.2022, details of outward supplies reflected in GSTR-1 but not in GSTR-3B, shall be considered as Self-assessed Tax for Recovery u/s 79 of the CGST Act without initiation of proceedings under Section 73/74 of the CGST Act.

Background

- Until now, SCNs were first issued, and then the recovery process was initiated in such cases of mismatch in GSTR1 and GSTR-3B.

- But now, an explanation has been inserted to clarify that ‘self-assessed tax’ for recovery shall include the amount of tax payable regarding details of outward supplies furnished in GSTR-1, but not included in GSTR-3B, and hence not paid.

Newly Inserted Explanation to Section 75(12)

“For the purposes of this subsection, the expression “self-assessed tax” shall include the tax payable in respect of details of outward supplies furnished under section 37, but not included in the return furnished under section 39.”

Points to Ponder…

- What about unidentified Errors at the taxpayer’s end?

- Trouble would be in cases where even inadvertently “1” is shown as “10” or the amount will be reflected in the wrong tax head and time limit to amend GSTR-1 lapsed. – If no prior opportunity to explain differences will be given by the department, unnecessary hassles have to be faced by taxpayers.

- Correct and vigilant filing of GSTR-1 is very essential now. Organizations can make a system for Quarterly/Half-yearly Reviews of returns by independent persons other than those who have prepared and filed the returns.

- ASMT-10 [Notice for Discrepancy on scrutiny of returns]– Is it still required to be issued ???

- Better to ask reasons of difference from taxpayers prior to initiating recovery proceedings.

Increased Scope of Provisional Attachment of Property

W.e.f. 01.01.2022, the Scope of provisional attachment of property under section 83 has been expanded, and now property can be attached after initiation of any proceeding under Chapter XII [assessment], Chapter XIV [inspection, search, seizure, and arrest], or Chapter XV [demand and recovery], which includes the issuance of summoning also.

Background

- Presently it can be done for Proceedings under Section 62, 63, 64, 67, 73 and 74

- But now, the Commissioner has been empowered to initiate provisional attachment proceedings even during the assessment, investigation, etc., if he feels that PA is necessary to protect the revenue. However, for the time being, the rule is that for initiating the PA proceedings, it is necessary to determine the liability and give reasonable time to discharge the obligation.

Amended Section 83(1)

“(1) Where, after the initiation of any proceeding under Chapter XII, Chapter XIV of Chapter XV, the Commissioner is of the opinion that for the purpose of protecting the interest of the Government revenue it is necessary so to do, he may, by order in writing, attach provisionally, any property, including bank account, belonging to the taxable person or any person specified in sub-section (1A) of section 122, in such manner as may be prescribed.”

Power to Call for Information

W.e.f. 01.01.2022, the Commissioner or an officer authorized by him may, by an order, direct any person to furnish information relating to any matter dealt with in connection with this Act, within such time, in such form, and in such manner, as may be specified therein.

Background

At present, the Commissioner has the right to demand the Statistics only by issuing a notification.

But now, he will be empowered to direct any person to furnish information relating to any matter dealt with in connection with this Act, within such time, in such form, and such manner, as may be specified therein. And the person in front will be obliged to give that information.

Newly Substituted Section 151

“Power to call for information: The Commissioner or an officer authorized by him may, by an order, direct any person to furnish information relating to any matter dealt with in connection with this Act, within such time, in such form, and in such manner, as may be specified therein.”

Inclusion of Services by Club or Associations as Supply

Retrospectively w.e.f. 01.07.2017, the scope of supply under Section 7 has been expanded by including activities of the club, association, etc. to its members or vice versa for consideration.

Background

- The Hon’ble Supreme Court in the case of Calcutta Club Limited has upheld the principle of mutuality between a club and its members despite the deeming fiction of Article 366 (29A)(e) of Constitution of India and held that in absence of specific provisions to overcome mutuality, Article 366 (29A)(e) would not affect the taxability of member’s club.

- Presently under GST Law also supply made by the club to its members does not constitute taxable supply based on the principle of mutuality.

- So now, to overcome the concept of Mutuality between Clubs/Associations and its Members, it has been explained that the person and its members or constituents shall be deemed to be two separate persons and the supply of activities or transactions inter se shall be deemed to take place from one such person to another.

Amendment

- Clause (aa) inserted in Section 7(1) retrospectively w.e.f. 01.07.2017(aa) the activities or transactions, by a person, other than an individual, to its members or constituents or vice-versa, for cash, deferred payment, or other valuable consideration.

- Entry 7 of Schedule-II shall also be omitted w.e.f. 01.07.2017 (N.No. 39/2021-CT).

Pre-deposit for Appeal For Section 129(3)

W.e.f 01.01.2022, the minimum pre-deposit for filing an appeal filed against section 129(3) order (Transit violations) will be 25% of the penalty amount. (Penalty Amount=200% of Tax Payable)

Background

- Presently for filing the first appeals (Commissioner), Section 107(6) of the CGST Act, 2017 provides a predeposit of 10% of the disputed tax amount for all sorts of appeals and staying the recovery.

- However now, an amendment has been made in the context of the orders passed levying penalty u/s 129(3) for Eway bill violations to provide that the quantum of the pre-deposit in such cases shall be equal to 25% of the penalty ordered, to be deposited.

Newly inserted proviso to Section 107(6)

“Provided that no appeal shall be filed against an order under sub-section (3) of section 129 unless a sum equal to twenty-five percent of the penalty has been paid by the appellant.”

Works Contract Services To Governmental Authority Or Government Entity

W.e.f. 01.01.2022 there will be a hike in GST rate on works contract services for specified contracts to Government authority and Government entities.

Background

- Presently, works contract services provided for specified contracts to Government Authority or Government Entity attracted the reduced tax rate entry of GST @5%/12%.

- Now, those specified works contract services which have been excluded from the reduced tax rate entry of GST @5%/12% w.e.f 01.01.2022 will be taxable at residual tax rate @18% under entry 3 (xii) of tax rate notification no 11/2017- CT(R).

- The contractor and the sub-contractor (providing services to the main contractor) providing works contract services to the Government Authority or Government Entity must revisit their contracts to check the implications in their ongoing projects and to ensure compliance with the said amendment effective from 01.01.2022.

Amended

Relevant amended Entry no 3 of tax rate notification no 11/2017- CT(R) attached.

Amended Entry no. 3 of Tax RateNotification No 11/2017- CT(R)

The definition of Government Authority and Government Entity is extracted hereunder:

|

Changes in GST rate for Works contract applicable from 01.01.2022 |

|||

| Description of service | Old Rate (percent) |

New Rate (percent) |

Condition |

(iii) Composite supply of works contract as defined in clause (119) of section 2 of the Central Goods and Services Tax Act, 2017, supplied to the Central Government, State Government, Union territory, a local authority, a Governmental Authority or a Government Entity by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of, –

|

12% | 18% | |

| (vi) Composite supply of works contract as defined in clause (119) of section 2 of the Central Goods and Services Tax Act, 2017 other than that covered by items (i), (ia), (ib), (ic), (id), (ie) and (if) above, provided to the Central Government, State Government, Union Territory, a local authority, a G overnmental Authority or a Government Entity by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of –

Explanation. – For the purposes of this item, the term ‘business’ shall not include any activity or transaction undertaken by the Central Government, a State Government or any local authority in which they are engaged as public authorities |

12% | 18% |

| (vii)Composite supply of works contract as defined in clause (119) of section 2 of the Central Goods and Services Tax Act, 2017, involving predominantly earthwork (that is, constituting more than 75per cent. of the value of the works contract) provided to the Central Government, State Government, Union territory, local authority, a Governmental Authority or a Government Entity. | 5% | 18% | |

| (ix) Composite supply of works contract as defined in clause (119) of section 2 of the Central Goods and Services Tax Act, 2017 provided by a sub-contractor to the main contractor providing services specified in item (iii) or item (vi) above to the Central Government, State Government, Union territory, a local authority, a Governmental Authority or a Government Entity. |

12% | 18% |

| (x) Composite supply of works contract as defined in clause (119) of section 2 of the Central Goods and Services Tax Act, 2017 provided by a sub-contractor to the main contractor providing services specified in the item (vii) above to the Central Government, State Government, Union territory, a local authority, a Governmental Authority or a Government Entity. |

5% | 18% |

(ix) ‘Governmental Authority means an authority or a board or any other body, –

(i) set up by an Act of Parliament or a State Legislature; or

(ii) established by any Government,

with 90per cents. or more participation by way of equity or control, to carry out any function entrusted to a Municipality under article 243 W of the Constitution or to a Panchayat under article 243 G of the Constitution.

(x) ‘Government Entity’ means an authority or a board or any other body including a society, trust, corporation,

i) set up by an Act of Parliament or State Legislature; or

ii) established by any Government,

with 90per cents. or more participation by way of equity or control, to carry out a function entrusted by the Central Government, State Government, Union Territory or local authority.’.]

Detention of Goods & Conveyances in Transit

W.e.f 01.01.2022, more stringent provisions and consequences introduced for the detention of goods & conveyances in transit.

Background

- Presently goods and conveyance after detention or seizure were released on payment of the applicable tax and penalty equal to one hundred percent.

- But now, the release will be carried out on payment of hiked penalty to 200% of tax payable.

- Provision for provisional release on bond/ security has been omitted.

- The proper officer detaining or seizing goods or conveyance shall issue a notice within seven days of such detention or seizure, specifying the penalty payable, and thereafter, pass an order within a period of seven days from the date of service of such notice, for payment of penalty.

- Department now has the power to sell the goods after 15 days from the date of order.

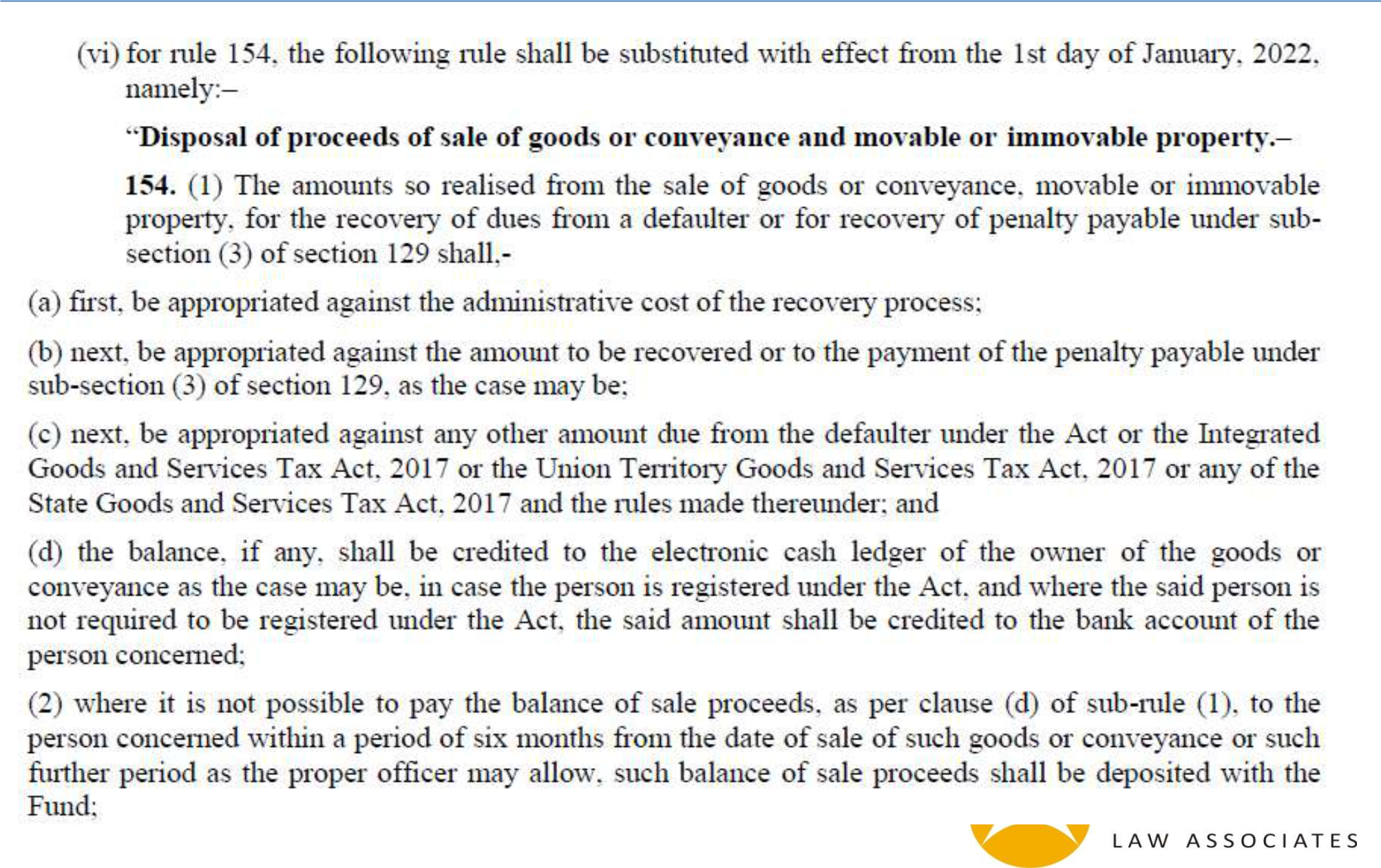

- Vide N.No. 40/2021-CT(R) dated 29.12.2021 – Rule 144A inserted for the manner of Recovery of penalty by the sale of goods or conveyance detained or seized in transit – Rule 154 substituted for the manner of Disposal of proceeds of the sale of goods or conveyance and movable or immovable property.

Related amendments in Sections 73/74

- The proceedings initiated u/s 129 & 130 for E-way bill violations, i.e. detention, seizure, and confiscation of goods or conveyances shall be independent proceedings, and closure of parallel proceedings u/s 73 or 74 (in respect of any person including the subject person) shall not result in the deemed closure of the proceedings initiated u/s 129 & 130.

- Section 129 -Detention, seizure, and release of goods and conveyance in transit and Section 130 – Confiscation of goods or conveyance and levy of penalty has been delinked from explanation 1, in clause (ii) specified in Section 74 of the CGST Act as to make a separate proceeding from the recovery of tax under Section 73 or Section 74.

“(ii) where the notice under the same proceedings is issued to the main person liable to pay tax and some other persons, and such proceedings against the main person have been concluded under section 73 or section 74, the proceedings against all the persons liable to pay penalty under sections 122 and 125129 and 130are deemed to be concluded.”

Amendments in Section 129

In sub-section (1), for clauses (a) and (b), the following clauses shall be substituted, namely:

“(a) on payment of a penalty equal to two hundred percent. of the tax payable on such goods and, in case of exempted goods, on payment of an amount equal to two percent. of the value of goods or twenty-five thousand rupees, whichever is less, where the owner of the goods comes forward for payment of such penalty;

(b) on payment of a penalty equal to fifty percent. of the value of the goods or two hundred percent. of the tax payable on such goods, whichever is higher, and in case of exempted goods, on payment of an amount equal to five percent. of the value of goods or twenty-five thousand rupees, whichever is less, where the owner of the goods does not come forward for payment of such penalty

Sub-section (2) shall be omitted:

The provisions of sub-section (6) of section 67 shall, mutatis mutandis, apply for detention and seizure of goods and conveyances.

For sub-section (3), the following sub-section shall be substituted, namely:

(3) The proper officer detaining or seizing goods or conveyance shall issue a notice within seven days of such detention or seizure, specifying the penalty payable, and thereafter, pass an order within a period of seven days from the date of service of such notice, for payment of penalty under clause (a) or clause (b) of sub-section (1)

In sub-section (4), for the words “No tax, interest or penalty”, the words “No penalty” shall be substituted; No penalty shall be determined under sub-section (3) without giving the person concerned an opportunity of being heard.

For sub-section (6), the following sub-section shall be substituted, namely: ––

(6) Where the person transporting any goods or the owner of such goods fails to pay the amount of penalty under sub-section (1) within fifteen days from the date of receipt of the copy of the order passed under sub-section (3), the goods or conveyance so detained or seized shall be liable to be sold or disposed of otherwise, in such manner and within such time as may be prescribed, to recover the penalty payable under sub-section (3): Provided that the conveyance shall be released on payment by the transporter of penalty under sub-section (3) or one lakh rupees, whichever is less:

Provided further that where the detained or seized goods are perishable or hazardous in nature or are likely to depreciate in value with the passage of time, the said period of fifteen days may be reduced by the proper officer.

Substituted Rule 154

GST On E-Commerce Operators

W.e.f. 01.01.2022, E-Commerce Operators are being made liable to pay tax on the following services provided through them –

(i) Transport of passengers, by any type of motor vehicles through it.

(ii) Restaurant services provided through it with some exceptions.

Proposed in GST Council Meeting on 17th September 2022 and notified vide Notification No. 17/2021- CT(R)

Section 9(5) of the CGST Act

The Government may, on the recommendations of the Council, by notification, specify categories of services the tax on intra-State supplies of which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services:

No more Inverted Duty structure in the Footwear and Textiles sector

W.e.f 01.01.2022 rate of textile & footwear items increased from 5 % to 12%.

- all footwear, irrespective of prices will attract GST at 12 %

- barring cotton, all textile products including readymade garments will have GST at the rate of 12 %.

Increase in GST Rate on Job-work related to Dyeing and Printing of Textile

W.e.f. 01.01.2022, job work service of dyeing and printing on the textile yarn and fabric has been removed from 5% GST rate and now the same would fall under 12% rate or 18% rate depending on the person to whom the services are provided (registered or unregistered)

Amendment in N.No. 11/2017 Dt. 28.06.2017

“(ii) against serial number 26, in column (3), in the heading “Description of Service”, in item (i), in clause (b), after the words, numbers, figures, and brackets “Customs Tariff Act, 1975 (51 of 1975)” the words “except services by way of dyeing or printing of the said textile and textile products” shall be inserted.”

Aadhaar Authentication for GST Refund & Revocation application

Mandatory Aadhar Authentication

Rule 10B has been inserted which advocates mandatory Aadhar authentication for the

following-

– For filing application for revocation of cancellation of registration in Form GST REG-21 under Rule 23

– For filing of refund application in form GST-RFD-01 under Rule 89

– For a refund under Rule 96 of the IGST paid on goods exported out of India

Linkage of PAN/Aadhaar with the bank account for Refund purposes

Refund to be disbursed in the bank account, which is linked with the same PAN on which registration has been obtained under GST.

Rule 10A has been amended as under-

10A. Furnishing of Bank Account details

After a certificate of registration in Form GST REG-06 has been made available on the common portal and a Goods and Services Tax Identification Number has been assigned, the registered person, except those who have been granted registration under Rule 12 or, as the case may be under Rule 16, shall as soon as maybe, but not later than forty-five days from the date of grant of registration or the date on which the return required under section 39 is due to be furnished, whichever is earlier, furnish information with respect to

details of bank account which is in the name of the registered person and obtained on Permanent Account Number of the registered person, or any other information, as may be required on the common portal in order to comply with any other provision.

Provided that in case of a proprietorship concern, the Permanent Account Number of the proprietor shall also, be linked with the Aadhar Number of the proprietor.

Few Changes in Section 130

In sub-section (1), for the words “Notwithstanding anything contained in this Act, before if ”, the word “Where” shall be substituted;

(1) Notwithstanding anything contained in this Act, if anywhere person’

(i) supplies or receives any goods in contravention of any of the provisions of this Act or the rules made thereunder with intent to evade payment of tax; or

(ii) does not account for any goods on which he is liable to pay tax under this Act; or

(iii) supplies any goods liable to tax under this Act without having applied for registration; or

(iv) contravenes any of the provisions of this Act or the rules made thereunder with intent to evade payment of tax;

or

(v) uses any conveyance as a means of transport for carriage of goods in contravention of the provisions of this act or the rules made thereunder unless the owner of the conveyance proves that it was so used without the knowledge or connivance of the owner himself, his agent if any, and the person in charge of the conveyance,

then, all such goods or conveyances shall be liable to confiscation and the person shall be liable to penalty under section 122.

Changes in Section 130

In sub-section (2), in the second proviso, for the words, brackets, and figures “amount of penalty leviable under sub-section (1) of section 129”, the words “penalty equal to hundred percent. of the tax payable on such goods” shall be substituted;

2) Whenever confiscation of any goods or conveyance is authorized by this Act, the officer adjudging it shall give to the owner of the goods an option to pay in lieu of confiscation, such fine as the said officer thinks fit:

Provided that such fine leviable shall not exceed the market value of the goods confiscated, less the tax chargeable thereon:

Provided further that the aggregate of such fine and penalty leviable shall not be less than the amount of penalty leviable under sub-section (1) of section 129 penalty equal to hundred percent. of the tax payable on such goods

Provided also that where any such conveyance is used for the carriage of the goods or passengers for hire, the owner of the conveyance shall be given an option to pay in lieu of the confiscation of the conveyance a fine equal to the tax payable on the goods being transported thereon.

Changes in Section 130

Sub-section (3) shall be omitted.

Where any fine in lieu of confiscation of goods or conveyance is imposed under subsection (2), the owner of such goods or conveyance or the person referred to in sub-section (1), shall, in addition, be liable to any tax, penalty and charges payable in respect of such goods or conveyance.

Important Changes in Provisions of Zero-rated Supply (Section 16 of IGST Act)

- Section 16(1)(b)

Supply to SEZ Developer or SEZ Unit for its “Authorized Operations” shall be considered as Zero-rated Supply. Earlier there was no such condition.

- Section 16(3) substituted along with Proviso for condition

In March 2020, Rule 96B of CGST Rules was inserted to provide the condition of realization of export proceeds within the time period prescribed under FEMA in respect to the export of goods. However, the said condition was not provided under the IGST Act. Now, Section 16 of the IGST Act is amended to provide legal sanctity to Rule 96B.

- Section 16(4) inserted

Option of Zero-rated Supply on payment of IGST and Refund of IGST so paid shall only be available to:

(i) Notified Class of Persons

(ii) Notified class of goods or services

optional file name

optional file name

If you already have a premium membership, Sign In.

Adv. Pawan Arora

Adv. Pawan Arora

Adv. Pawan Arora, Partner at Athena Law Associates Experience of Advisory and Litigation of GST, VAT, and Service Tax to more than 25 Reputed Real Estate and Infrastructure Construction Companies. 10 Years of relentless and steady experience of Advisory and Litigation in GST and other Indirect Taxes and handled matters of clients from diverse industries and field of specialization is Indirect Taxes.