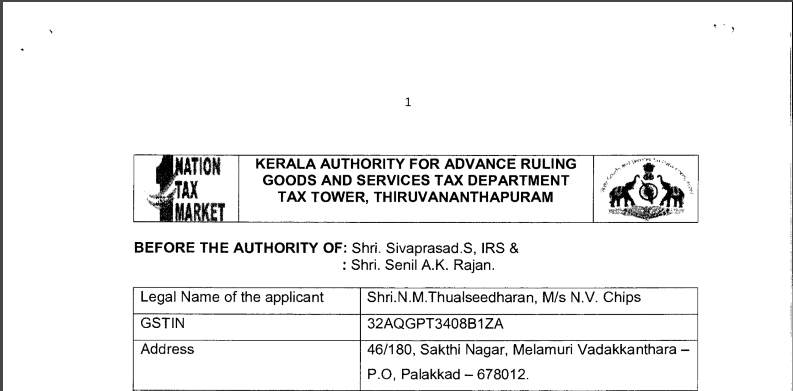

Kerala AAR in the case of Shri N.M. Thualseedharan, M/s. N.V. Chips

Case Covered:

Shri N.M. Thualseedharan, M/s. N.V. Chips

Facts of the Case:

The applicant requested for advance ruling on the following;

1. Whether jack fruit chips sold without BRAND NAME are classifiable as NAMKEENS and are covered by HSN code 2106.90.99 and taxable under Entry 101A of Schedule of Central Tax (Rate) Notification No.1 / 2017?

2. Whether the classification of jack fruit chips by my supplier under HSN code 1903 is correct? Whether roasted and salted/salted/roasted preparations such as of groundnuts, cashew

3. nut and other seeds are NAMKEENS and when sold without a brand name can they be classified under HSN 2106.90.99 and taxed under Entry 101A of Schedule 1 of Central Tax (Rate) Notification No.1 / 2017?

4. Whether salted and masala chips of Potato and Tapioca are classifiable as Namkeens and when sold without a brand name can they be classified under HSN 2106.90.99 and taxed under Entry 101A of Schedule 1 of Central Tax (Rate) Notification No.1 of 2017?

Observations:

The matter was examined in detail. The issue to be determined is the classification and rate of tax of Jackfruit Chips, Tapioca Chips. Potato Chips and roasted/salted/roasted and salted preparations of groundnuts, cashew nut, and other seeds supplied / to be supplied by the applicant. The contention of the applicant is that all the products fall under the category of “Namkeens” and hence is appropriately classifiable under Customs Tariff Heading 2106 90 and is liable to GST at the rate of 5% as per entry at SI No. 101A of Schedule I of Notification No. 01/2017 Central Tax (Rate) dated 06.28.2017.

Chapter 21 of the Customs Tariff covers “Miscellaneous edible preparations”. The Heading 2106 of Chapter 21 covers food preparations not elsewhere specified or included. Those food preparations not specified or included elsewhere in the tariff being preparations for use either directly or after processing for human consumption are to be classified under this head. Therefore, it is evident that the entry is a residual entry in respect of edible preparations and hence the edible preparations shall be classified under this entry only if the same are not classifiable under any of the other specific entries for edible preparations.

Ruling:

1. Whether Jackfruit Chips sold without BRAND NAME are classifiable as NAMKEENS and are covered by HSN code 2106.90.99 and taxable under Entry 101A of Schedule of Central Tax (Rate) Notification No.1 / 2017?

No. The Jackfruit Chips are classifiable under Customs Tariff Heading 2008.19.40 and is liable to GST at the rate of 12% [6% – CGST + 6% – SGST] as per Entry at SI No. 40 of Schedule II of Notification No. 01 / 2017 Central Tax (Rate) dated 28.06.2017.

2. Whether the classification of Jackfruit Chips by my supplier under HSN code 1903 is correct?

No.

3. Whether roasted and salted/salted/roasted preparations such as ground nuts, cashew nut, and other seeds are NAMKEENS and when sold without a brand name can they be classified under HSN 2106.90.99 and taxed under Entry 101A of Schedule 1 of Central Tax (Rate) Notification No.1 / 2017?

No. Roasted/salted/roasted and salted Cashew nuts are classifiable under Customs Tariff Heading 2008.19.10 and roasted/salted / roasted and salted Groundnuts and other nuts are classifiable under Customs Tariff Heading 2008.19.20 and is liable to GST at the rate of 12% [6% – CGST + 6% – SGST] as per Entry at SI No. 40 of Schedule Il of Notification No. 01 / 2017 Central Tax (Rate) dated 06.28.2017.

4. Whether salted and masala chips of Potato and Tapioca are classifiable as Namkeens and when sold without a brand name can they be classified under HSN 2106.90.99 and taxed under Entry 101A of Schedule 1 of Central Tax (Rate) Notification No.1 of 2017?

No. The salted and masala chips of Potato and Tapioca are classifiable under Customs Tariff Heading 2008.19.40 and is liable to GST at the rate of 12% [6% – CGST + 6% – SGST] as per Entry at SI No. 40 of Schedule II of Notification No.01 / 2017 Central Tax (Rate) dated 28.06.2017.

Read & Download the full Ruling in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.