Madras HC Order in the case of Greenwood Owners Association Versus The Union of India

Case Covered:

Greenwood Owners Association

Versus

The Union of India

Facts of the Case:

The petitioner in W.P.No.27100 of 2019 challenges an order of the Authority for Advance Ruling (AAR) levying tax on the entirety of the contribution by him to an RWA and the petitioners in W.P.Nos.5518 and 1555 of 2020 and 30004 of 2019 challenge Circular No.109/28/2019 dated 22.07.2019, also on the same issue.

Related Topic:

Madras HC Order in the case of M/S DY Beathel Enterprises Vs. State Tax Officer

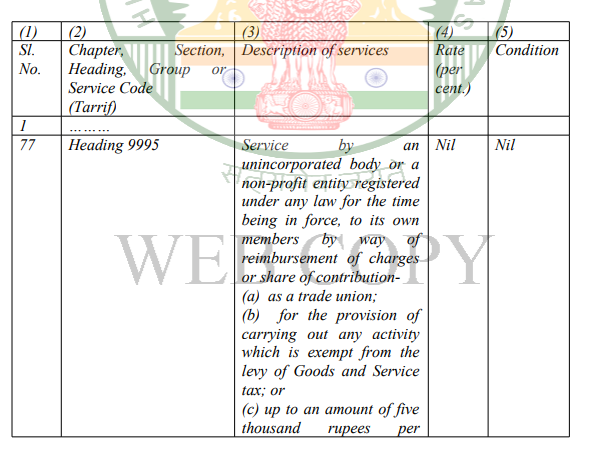

We are concerned with the period post 01.07.2017 when the Goods and Services Tax Act, 2017 (GST Act) was introduced. With the onset of GST, various services in respect of which GST was to be levied and collected came under the scanner. Exemptions were granted under Notification 12/17- CT dated 28.06.2017. The Circular to the extent to which it is relevant is extracted below:

Exemption from CGST on specified intra-State services.

Related Topic:

Gujarat HC in the case of Messrs Vishnu Aroma Pouching Pvt Ltd Versus Union Of India

In exercise of the powers conferred by sub-section (1) of Section 11 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on being satisfied that it is necessary for the public interest so to do, on the recommendations of the Council, hereby exempts the intra-State supply of services of description as specified in column (3) of the Table below from so much of the central tax leviable thereon under sub-section (1) of section 9 of the said Act, as is in excess of the said tax calculated at the rate as specified in the corresponding entry in column (4) of the said Table, unless specified otherwise, subject to the relevant conditions as specified in the corresponding entry in column (5) of the said Table namely,

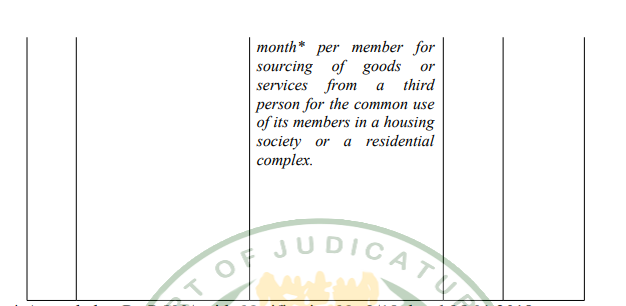

* Amended to Rs.7,500/- vide Notification No.2/18 dated 25.01.2018.

Thus, an exemption was granted to contributions made to RWA up to an amount of Rs.7,500/- per month per member for sourcing of goods and services from a third person for the common use of the members of RWA, i.e., housing complexes or residential complexes. Since contributions solicited from members of RWA were on some occasions more than Rs.7,500/- as well, one of the questions that arose was whether, in a case where the contribution exceeded the amount of Rs.7,500/-, the resident in that RWA would lose the entitlement to exemption altogether, as a result, that the entire contribution would be liable to GST or whether the exemption would still continue to be available up to to a sum of Rs.7,500/- and only the difference (excess) becoming exigible to tax.

Related Topic:

Supreme Court in the case of Gajendra Sharma Versus Union of India

The Order of the Hon’ble Court:

As regards the argument concerning slab rate, a slab is a measure of determining tax liability. The prescription of a slab connotes that income up to that slab would stand outside the purview of tax on exigible to a lower rate of tax and income above that slab would be treated differently. The intendment of the exemption Entry in question is simply to exempt contributions till a certain specified limit. The clarification by the GST Department even as early as in 2017 has taken the correct view.

Related Topic:

Madras HC in the case of M/s. Sun Dye Chem Versus The Assistant Commissioner

The discussion as above leaves me no doubt that the conclusion of the AAR as well as the Circular to the effect that any contribution above Rs.7,500/- would disentitle the RWA to exemption, is contrary to the express language of the Entry in question and both stands quashed. To clarify, it is only contributions to RWA in excess of Rs.7,500/- that would be taxable under GST Act.

Related Topic:

Supreme Court in the case of Madras Bar Association Versus Union of India

These Writ Petitions are allowed. No costs. Connected Miscellaneous Petitions are closed.

Read & Download the full Order in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.