SC levied Penalty of Rs. 25000 on Deptt in Vishnu Aroma Pouching P Ltd Vs UOI

The penalty of Rs. 25000 on Deptt

A penalty of Rs. 25000 on deptt is levied by the SC in case of Vishnu Aroma Pouching P Ltd Vs. UOI. The taxpayer won the case back in 2019. But the department went to file an SLP in the supreme court. According to the court, it’s too late. SC levied a penalty for wasting the time of the honorable court. SLP was filed almost two years later. The court said that this much lethargy in spite of computerization is not acceptable.

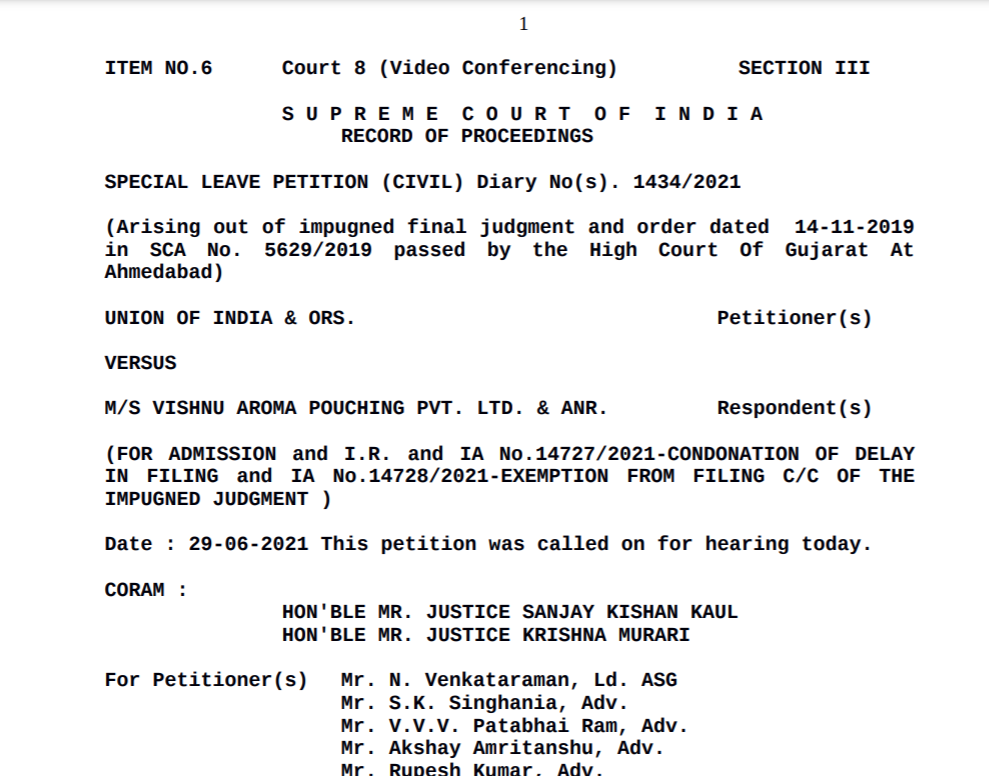

Facts and background of the case-

The taxpayer was unable to file the GST return due to the GSTIN glitches. Then they approached the high court. Gujarat high court decided in the favor of the taxpayer. The decision was pronounced on 14-11-2019. The proposal for SLP was sent on 20.5.2020. It took six months to send the proposal. Then it took another three months to decide to file an SLP.

Another important observation of the court was that they don’t want the state governments and public authorities to approach SC with such an approach. They generally ignore the period of limitation under the statute. They think that limitation doesn’t apply to them.

Related Topic:

SC in the case of Shakti Bhog Food Industries Ltd. Versus The Central Bank of India

The court categorized these kinds of cases as certificate cases. Just to prove that nothing could have done. The objective is to

complete a mere formality and save the skin of the officers who may be in default in following the due process or may have done it deliberately.

With this observation a penalty of Rs. 25000 was levied on the petitioner. It was levied for the wastage of judicial time. the same be deposited with the Supreme Court Advocates On Record Welfare Fund within four weeks. The court went on one step further to ensure that the amount of penalty to be recovered from the officers responsible for the delay.

Related Topic:

Tripura HC Order in the case of Shri Sentu Dey Versus The State of Tripura

Copy of Order of SC-

The order is attached here for detailed perusal.

SC in case of Vishnu Aroma

Penalty of Rs. 25000 on Deptt

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.