Brief Synopsis of Amendments as Notified CBIC on 01.06.2021

- Interest Liability on the amount paid through Electronic Cash Ledger shall be applicable retrospectively from 01.07.2017

- Due Date of Filing of GSTR 1 (Other than QRMP)

- Interest on Delay in Payment through Electronic Cash Ledger

- Reduced Late Fees for GSTR 3B- July 2017, Mar’21 to June’21 and June 2021 onwards

- Reduced Late Fees for GSTR 1- June 2021 onwards

- Reduced Late Fees for GSTR 4 (Composite Dealers)- FY 2021-22 and Onwards

- Reduced Late Fees for GSTR 7 (Tax Deductors)- June 2021 and Onwards

- Rules of E-Invoice not Applicable to Government Department, Local Authority

- General Extension of Time Limit for Compliance Subject To Conditions and Exceptions

- Due Date for Furnishing of GSTR 4

- Due Date for Furnishing of ITC 04

- Furnishing of Return through EVC, ITC availment, Due Date of Furnishing details in IFF

Interest Liability on the amount paid through Electronic Cash Ledger shall be applicable retrospectively from 01.07.2017

Notification No. 16/2021 – Central Tax

Section 112 of the Finance Act, 2021 shall be effective from 01.06.2021

As per Section 112 proviso shall be substituted and shall be deemed to have been substituted with effect from the 1st day of July 2017

Proviso to Section 50 of the CGST Act, 2017 read as follows

Interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39, except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period, shall be payable on that portion of the tax which is paid by debiting the electronic cash ledger.

Related Topic:

CBIC GST audit manual for departmental audits

Comments- Proviso relating Interest Payment limited to the amount debited through Electronic Cash Ledger shall have retrospective Effect from 01.07.2017

Due Date of Filing of GSTR 1 (Other than QRMP)

Notification No. 17/2021 – Central Tax

The Due Date for filing of GSTR 1 is the eleventh day of the month succeeding such tax period for the registered person falling under sub-section 1 of Section 39 having aggregate turnover exceeding Rs. 1.50 crore vide Notification No- 75/2020- Central Tax dated 15.10.2020.

The due Date for furnishing GSTR 1 for the tax period April 2021 was extended till the 26th day of the month succeeding such tax period from the 13th day of the month of the succeeding tax period vide Notification No- 12/2021- Central Tax dated 01.05.2021

Vide Notification No- 17/2021- Central Tax dated 01.06.2021, the due date for furnishing of GSTR 1 for the tax period of May 2021 is extended till the 26th day of the month succeeding the tax period of May 2021 from the 13th day of the month of the succeeding tax period

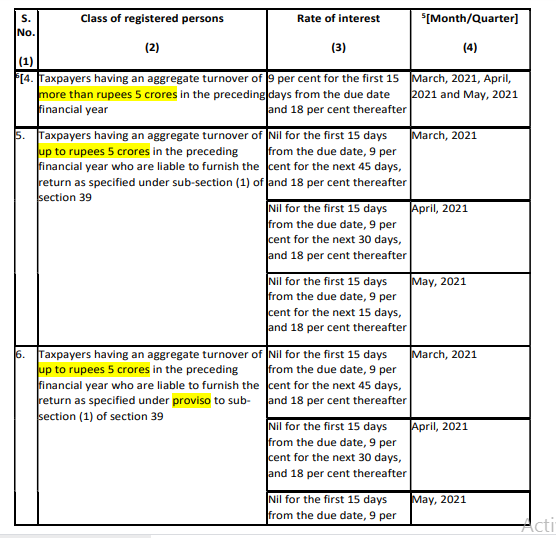

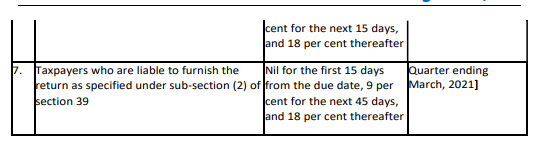

Interest on Delay in Payment through Electronic Cash Ledger

Notification No. 18/2021 – Central Tax

Vide Notification No. 18/2021 – Central Tax amendment has been made to the Notification No- 13/2017 dated 28.06.2017 providing in relaxation of interest for delay in the pay of tax through Electronic Cash Ledger

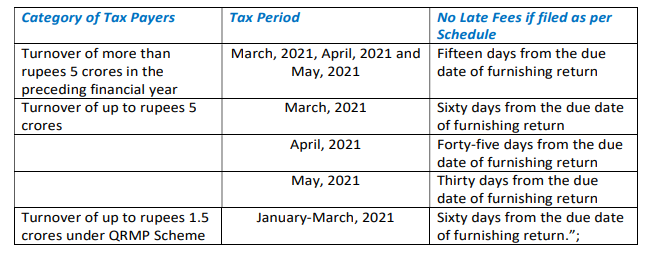

Reduced Late Fees for GSTR 3B- July 2017, Mar’21 to June’21 and June 2021 onwards

Notification No. 19/2021 – Central Tax

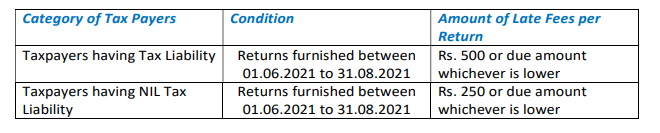

Category-I: Tax Payers- Delay in Filing of GSTR 3B for March, April, and May 2021

Category-II: Tax Payers- Delay in Filing of GSTR 3B for July 2017 to April 2021

Category-III: Tax Payers- Delay in Filing of GSTR 3B for June 2021 and Onwards

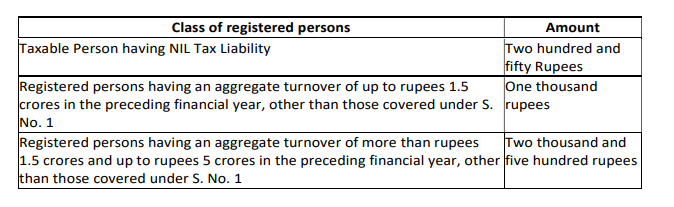

| S. No. | Category of Tax Payer | Maximum Late Fees per Return |

| 1 | Tax Payable is NIL | Two hundred and fifty Rupees |

| 2 | Aggregate turnover of up to rupees 1.5 crores in the preceding financial year, other than having NIL Tax Liability | One thousand rupees |

| 3 | Aggregate turnover of more than rupees 1.5 crores and up to rupees 5 crores in the preceding financial year | Two thousand and five hundred rupees”. |

No reduction in late fees is allowed for the taxpayers having aggregate turnover exceeding Rs. 5 crores in the preceding financial year

Note- Equivalent amount of late fees shall be payable under State GST Act, 2017

Related Topic:

Government notifies the draft of Drone Rules, 2021

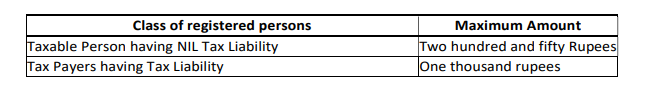

Reduced Late Fees for GSTR 1- June 2021 onwards

Notification No. 20/2021 – Central Tax

No reduction in late fees is allowed for the taxpayers having aggregate turnover exceeding Rs. 5 crores in the preceding financial year

Note- Equivalent amount of late fees shall be payable under State GST Act, 2017

Reduced Late Fees for GSTR 4 (Composite Dealers)- FY 2021-22 and Onwards

Notification No. 21/2021 – Central Tax

Note- Equivalent amount of late fees shall be payable under State GST Act, 2017

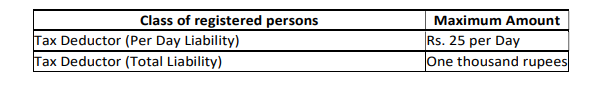

Reduced Late Fees for GSTR 7 (Tax Deductors)- June 2021 and Onwards

Notification No. 22/2021 – Central Tax

Note- Equivalent amount of late fees shall be payable under State GST Act, 2017

Rules of E-Invoice not Applicable to Government Department, Local Authority

Notification No. 23/2021 – Central Tax

Notification No. 13/2020–Central Tax dated 21.03.2020– Aggregate turnover in a financial year exceeds one hundred crore rupees, as a class of registered person who shall prepare an invoice and other prescribed documents, in terms of sub-rule (4) of rule 48 of the said rules in respect of the

supply of goods or services or both to a registered person

Rule 48(4) of the CGST Rules, 2017 refers to E-Invoice.

Vide Notification No- 23/2021- Central Tax, rules relating to the E-Invoice shall not be applicable to Government Department, Local Authority

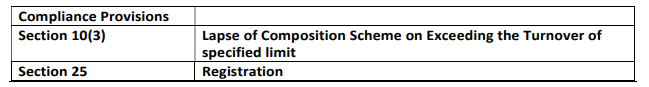

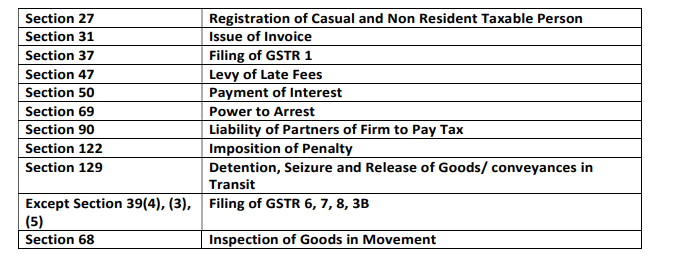

General Extension of Time Limit for Compliance Subject To Conditions and Exceptions

Notification No. 24/2021 – Central Tax

Any time limit for completion or compliance of any action, by any authority or by any person, has been specified in, or prescribed, or notified under the said Act, which falls during the period from the 15th day of April 2021 to the 29th day of June, 20201 and where completion or compliance of such action has not been made within such time, then, the time limit for completion or compliance of such action shall be extended up to the 30th day of June 2021

(a) completion of any proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval or such other action, by whatever name called, by any authority, commission or tribunal, by whatever name called, under the provisions of the Acts stated above; or

(b) filing of any appeal, reply or application or furnishing of any report, document, return, statement or such other record, by whatever name called, under the provisions of the Acts stated above;

Related Topic:

CBIC Notifies Extension of Due-Dates For Payment Under SVLDRS

However, the above extensions shall not be applicable for

E-way bill has been generated under rule 138 of the Central Goods and Services Tax Rules, 2017 and its period of validity expires during the period 20th day of March 2020 to the 15th day of April 2020, the validity period of such e-way bill shall be deemed to have been extended till the 30th day of April 2020.

Issuance of Order in Refund Cases being rejected Partially or Fully

If the notice has been issued either rejecting the refund claim fully or partly and issuance of the order falls during the period from the 15th day of April 2021 to the 29th day of June 2021, in such cases the time limit for issuance of the said order shall be extended to fifteen days after the receipt of the reply to the notice from the registered person or the 30th day of June 2021, whichever is later.

Due Date for Furnishing of GSTR 4

Notification No. 25/2021 – Central Tax

The due date for furnishing of GSTR 4 for the FY 2020-21 shall be the 31st day of July 2021

Due Date for Furnishing of ITC 04

Notification No. 26/2021 – Central Tax

The due date for furnishing of ITC 04 for the tax period January 2021 to March 2021 shall be the 30th day of June 2021

Furnishing of Return through EVC, ITC availment, Due Date of Furnishing details in IFF

Notification No. 27/2021 – Central Tax

Amendment to Rule 26- Submission of GSTR 1 and GSTR B in EVC Mode till 31.08.2021

A registered person registered under the provisions of the Companies Act, 2013 (18 of 2013) shall, during the period from the 27th day of April 2021 to the 31st day of August 2021, also be allowed to furnish the return under section 39 in FORM GSTR-3B and the details of outward supplies under section 37 in FORM GSTR-1 or using invoice furnishing facility, verified through electronic verification code (EVC).

Rule 36(4) in abeyance for April’ 21, May’ 21 however will apply cumulatively for June’ 2021

Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been furnished by the suppliers under sub-section (1) of section 37 in FORM GSTR-1 or using the invoice furnishing facility, shall not exceed 5 percent. of the eligible credit available in respect of invoices or debit notes the details of which have been furnished by the suppliers under sub-section (1) of section 37 in FORM GSTR-1 or using the invoice furnishing facility.

Provided further that such condition shall apply cumulatively for the period April, May, and June 2021, and the return in FORM GSTR-3B for the tax period June 2021 or quarter ending June 2021, as the case may be, shall be furnished with the cumulative adjustment of input tax credit for the said months in accordance with the condition above.

Furnishing of IFF by Taxpayers opted for QRMP Scheme

Registered Persons opted to file GST Returns under QRMP Scheme could furnish the details of the outward supplies to the registered person using IFF Facility. Such persons were required to furnish such details by the 13th day of the succeeding month.

However for the month of May 2021, details of outward supplies using the IFF facility can be furnished between the 1st day of June 2021 till the 28th day of June 2021

For the month of April’ 2021 details of outward supplies using the IFF facility can be furnished between from the 1st day of May 2021 till the 28th day of May 2021 (Notification No- 13/2021 dated 01.05.2021)

Disclaimer: The contents of this document are solely for informational purposes. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. The author is not liable for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon.

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal