Circular No. 10/2021: CBDT

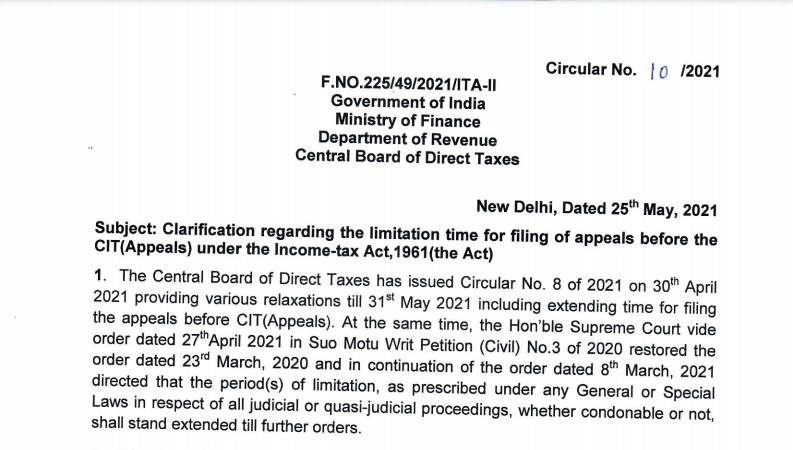

Circular No. 10/2021

F. NO. 225/49/2021/ITA-II

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, Dated 25th May 2021

Subject: Clarification regarding the limitation time for filing of appeals before the CIT(Appeals) under the Income-tax Act, 1961 (the Act)

1. The Central Board of Direct Taxes has issued Circular No. 8 of 2021 on 30th April 2021 providing various relaxations till 31st May 2021 including extending the time for filing the appeals before CIT(Appeals). At the same time, the Hon’ble Supreme Court vide order dated 27th April 2021 in Suo Motu Writ Petition (Civil) No. 3 of 2020 restored the order dated 23rd March 2020 and in continuation of the order dated 8th March 2021 directed that the period(s) of limitation, as prescribed under any General or Special Laws in respect of all judicial or quasi-judicial proceedings, whether condonable or not, shall stand extended till further orders.

Related Topic:

2. The Central Board of Direct Taxes, clarifies that if different relaxations are available to the taxpayers for particular compliance, the taxpayer is entitled to the relaxation which is more beneficial to him. Thus, for the purpose of counting the period(s) of limitation for filing of appeals before the CIT(Appeals) under the Act, the taxpayer is entitled to a relaxation which is more beneficial to him and hence the said limitation stands extended till further orders as ordered by the Hon’ble Supreme Court in Suo Motu Writ Petition (Civil) 3 of 2020 vide order dated 27th April 2021.

Related Topic:

CBDT grants further relaxation in electronic filing of Income Tax Forms 15CA/15CB

(Prajna Paramita)

Director to the Government of India.

Copy to:

1. PS to M./ PS to MoS (F).

2. PS to Revenue Secretary.

3. Chairman (CBDT) & All Members of CBDT.

4. All CCsIT/CCsIT/Pr. DGslT/DGsIT.

5. All Joint Secretaries/CsIT, CBDT.

6. Directors/Deputy Secretaries/Under Secretaries of CBDT.

7. Web Manager, with a request to place the order on the official Income-tax website.

8. CIT (M&TP), Official Spokesperson of CBDT with a request to publicize widely.

9. JCIT, Data Base Cell for placing it on gov. in.

10. The Institute of Chartered Accountants of India, IP Estate, New Delhi.

11. All Chambers of Commerce.

12. The Guard File.

Related Topic:

Related Topic:

Circular No. 20/2020: CBDT

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.