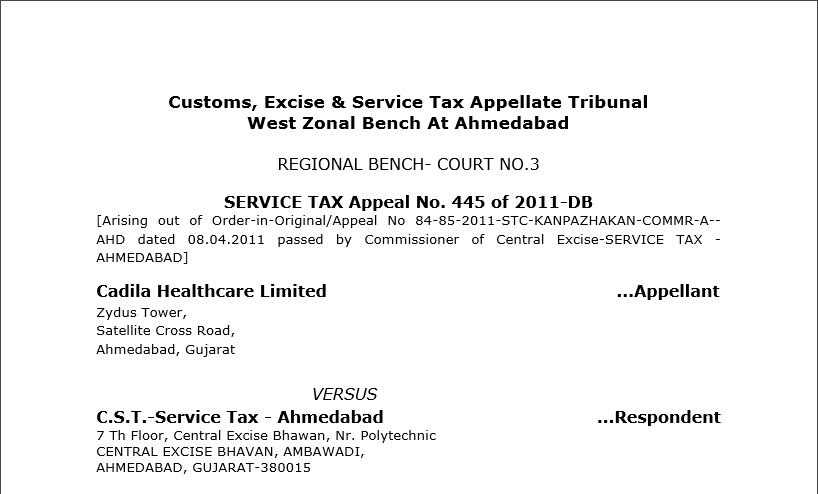

CESTAT Order in the case of Cadila Healthcare Limited Versus C.S.T.-Service Tax – Ahmedabad

Case Covered:

Cadila Healthcare Limited

Versus

C.S.T.-Service Tax – Ahmedabad

Facts of the Case:

The brief facts of the case are that the appellant M/s Cadila Health Care Ltd. is a public limited company engaged in the business of manufacturing pharmaceutical products as well as providing various services, i.e., Maintenance & Repair Services, Advertising Agency, Intellectual Property Services, Consulting Engineer, Management Consultants, Manpower Recruitment Agency, Business Auxiliary Services, and IPR services, Scientific & Technical Consulting Services, Online information, and Database Retrieval Services, Market Research Agency, Business Support Services, Clearing and Forwarding Services, Renting Of Immovable Property Services, Recovery Agents, Technical Inspection and Certification services, Banking & Financial Services which are classifiable under taxable services definition under section 65 of the Finance Act, 1994, for which they are registered with Service tax department. The appellant entered into a partnership agreement with a partnership firm M/s Zydus Healthcare wherein the appellant is a partner with 96% share and 2% each share of the other two partners namely Cadila Healthcare Staff Welfare Trust and German Remedies Ltd. In the partnership agreement, an addendum dated 01/04/2007 was added. As per the terms of the addendum of the partnership agreement, the appellant agreed to provide certain services to firm partnership M/s Zydus Healthcare related to promotion and marketing of firm‘s product and various related services. The appellant towards the said services received remuneration from M/s Zydus Healthcare on which they have paid the service tax and also paid interest whenever there is a delay in paying the service tax. Subsequently, when they realized on the basis of their consultant‘s advice that the services provided by a partner to a partnership firm do not fall under the ambit of services as per Finance Act, 1994, they had filed for refund claims. The said refund claims were rejected by the Assistant Commissioner of Service Tax, Ahmedabad. Being aggrieved by the rejection of the refund claim, the appellant filed appeals before the Commissioner (Appeals) which came to be rejected. Therefore, the present appeals filed by the appellant.

Observations:

From the above terms of the partnership deed, the appellant in its capacity as a partner of the partnership firm was obliged to carry out certain activities such as distribution of goods manufactured, marketing of the goods manufactured by the partnership firm, functioning as consignee, and sales agent of the partnership firm, etc. In terms of the above conditions, the appellant has carried out the activities which were assigned to the appellant by the partnership firm in the capacity of the partner. These activities were not undertaken pursuant to a separate and independent contract for the provision of services between the appellant of the partnership firm. Therefore, the activities carried out by the appellant for its partnership firm as part of its duties as a partner. In this arrangement, it cannot be said that the partner is a service provider and the partnership firm is the service recipient. It is also observed that the remuneration received by the appellant from the partnership firm has been accounted for as ―Remuneration received from partnership firm‖. Any activity can be brought under the Service tax ambit under the Finance Act, the important aspect is that there should be the existence of the service provider and the service recipient, and the service provider and the service recipient should be two different persons. In this regard, it is necessary to go through the definition of partnership provided in section 4 of the Partnership Act, 1944.

Order:

In the last second para on Pg 46 and Para 6 of Pg. 48, the appellant has clearly declared that they have not recovered the amount of Service Tax from Zydus Health Care and the burden of Service Tax was not passed on to the Zydus Health Care. It shows that both the authorities have ignored this declaration made by the appellant. Therefore, the contention made by them that the appellant has not satisfied that the incidence of Service Tax, for which refund claim was made, has not been passed on is apparently erroneous.

As per our above discussion and finding, the appellant is entitled to the refund of the claim made by them. Accordingly, all the impugned orders are set aside and appeals are allowed with consequential relief, in accordance with the law.

Related Topic:

CESTAT Order in the case of Ruchi Soya Industries Ltd

Read & Download the Full Order in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.