GST update on various extensions/relaxations on account of pandemic

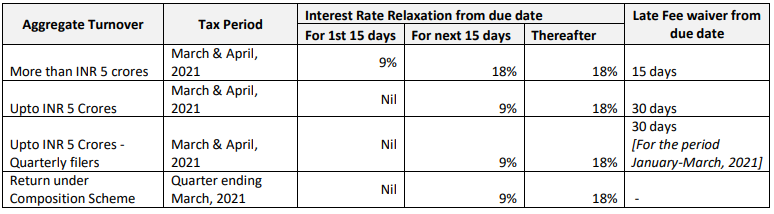

- Relaxation in the interest rate and late fees – NN 8/2021-CT & NN 9/2021 dated 1st May 2021 respectively

- Extension in the due date for filing GSTR 4 (Annual Return for person opted for Composition Scheme)– NN 10/2021-CT dated 1st May 2021

- Extension in the due date for filing GST ITC-04 – NN 11/2021-CT dated 1st May 2021

- Extension in the due date for filing GSTR 1 – NN 12/2021-CT dated 1st May 2021

- Extension in compliance with rule 36(4) – NN 13/2021-CT dated 1st May 2021

- Extension in compliance with rule 59(2) – NN 13/2021-CT dated 1st May 2021

- Relaxations in time limits for completion or compliance under the GST law – NN 14/2021-CT dated 1st May 2021

- Extension in the grant of registration – NN 14/2021-CT dated 1st May 2021

- Extension in the grant of registration – NN 14/2021-CT dated 1st May 2021

Relaxation in the interest rate and late fees – NN 8/2021-CT & NN 9/2021 dated 1st May 2021 respectively

• The NN 8/2021-CT comes from retrospective effect i.e. 18-4-2021

• The NN 9/2021-CT comes from retrospective effect i.e. 20-4-2021

• Chances of refund arise where the taxpayers have already filed returns for the month of March 2021 till 30th April 2021 along with payment of interest and late fee.

Extension in the due date for filing GSTR 4 (Annual Return for person opted for Composition Scheme)– NN 10/2021-CT dated 1st May 2021

• From 31st March 2021 till 31st May 2021

• Notification comes from retrospective effect i.e. 30-4-2021

Extension in the due date for filing GST ITC-04 – NN 11/2021-CT dated 1st May 2021

• In respect of goods dispatched to a job worker or received from a job worker, during the period from 1st January 2021 to 31st March 2021.

• Extended till 31st May 2021

• Notification comes from retrospective effect i.e. 25-4-2021

Extension in the due date for filing GSTR 1 – NN 12/2021-CT dated 1st May 2021

• In respect of April 2021

• Till 26th May 2021

Extension in compliance with rule 36(4) – NN 13/2021-CT dated 1st May 2021

• Such condition shall apply cumulatively for the period April and May 2021 and

• The return in FORM GSTR-3B for the tax period May 2021 shall be furnished with the cumulative adjustment of input tax credit for the said months in accordance with the condition above.

Extension in compliance with rule 59(2) – NN 13/2021-CT dated 1st May 2021

• For the tax period April 2021

• A registered person may furnish such details, using Invoice Furnishing Facility (IFF) from 1st May 2021 till 28th May 2021.

Relaxations in time limits for completion or compliance under the GST law – NN 14/2021-CT dated 1st May 2021

• Where, any time limit for completion or compliance of any action,

• by any authority or by any person,

• has been specified in, or prescribed or notified under the GST Act,

• which falls during the period from the 15th April 2021 to 30th May 2021, and

• where completion or compliance of such action has not been made within such time, then,

• the time limit for completion or compliance of such action shall be extended up to the 31st May 2021,

• INCLUDING for the purposes of –

(a)

▪ completion of any proceeding or

▪ the passing of any order or

▪ issuance of any notice, intimation, notification, sanction or approval or

▪ such other action, by whatever name, called,

by any authority, commission or tribunal, by whatever name called, under the provisions of the Acts stated above;

or

(b)

▪ filing of any appeal, reply or application or

▪ furnishing of any report, document, return, statement or

▪ such other record, by whatever name called,

▪ under the provisions of the Acts stated above;

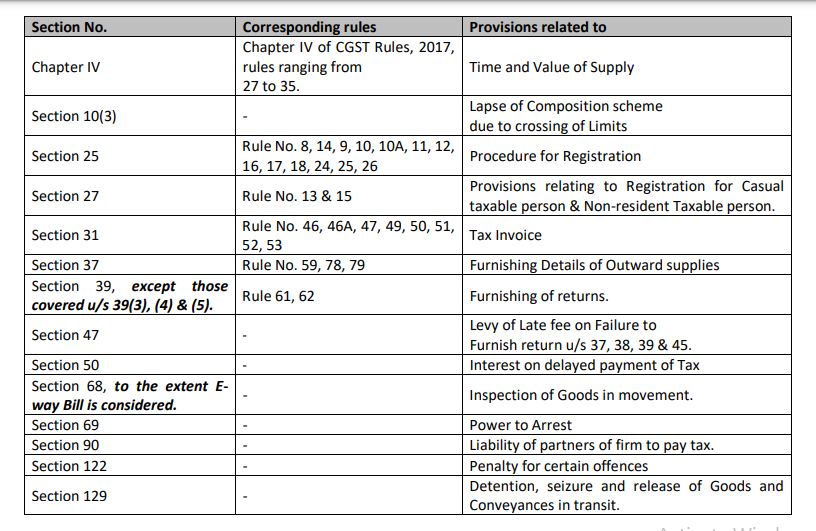

Non-applicability of aforesaid notification in certain cases

Such extension of time shall not be applicable for the compliances of the provisions of the said Act and Corresponding

Rules, as mentioned below –

• Notification comes from retrospective effect i.e. 15-4-2021

Extension in the grant of registration – NN 14/2021-CT dated 1st May 2021

• If verification of the application under rule 9,

• Falls during the period from the 1st May 2021 to the 31st May 2021,

• And if the same has not been made, then

• Extended up to the 15th June 2021

• Notification comes from retrospective effect i.e. 15-4-2021

Extension in the grant of registration – NN 14/2021-CT dated 1st May 2021

• Where a notice has been issued for rejection of refund claim, in full or in part and

• where the time limit for issuance of order as per section 54(5), read with section 54(7)

• falls during the period from the 15th April 2021 to 30th May 2021,

• in such cases the time limit for issuance of the said order

• shall be extended to (i) 15 days after the receipt of the reply to the notice from the registered person, or (ii) 31st May 2021, whichever is later.

• Notification comes from retrospective effect i.e. 15-4-2021

If you already have a premium membership, Sign In.