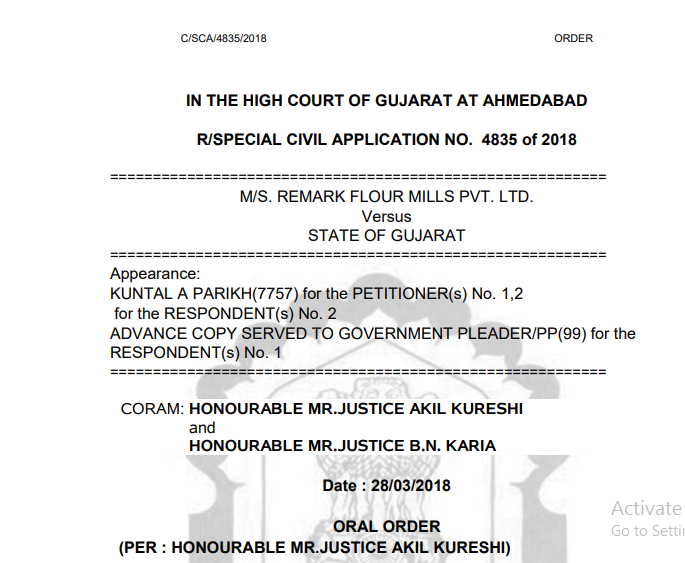

Gujarat HC in the case of M/s. Remark Flour Mills

Case Covered:

M/s. Remark Flour Mills Pvt. Ltd.

Versus

State of Gujarat

Oral Order:

The petitioners are registered dealers under the Central Goods and Services Tax Act and are engaged in the business of manufacture and supply of wheat flour, meslin flour, cereal flours, etc. The GST authorities had conducted a search at the business premises of the petitioners and carried a prima facie belief that the petitioners were selling branded goods without paying necessary taxes thereon.

A notice dated 27.2.2018 came to be issued by the Assistant Commissioner of State Tax, Vadodara under section 74(1) of the CGST Act estimating the petitioners’ total tax and other liabilities at Rs.30.88 lacs (rounded off) calling upon the petitioners to remain present on 5.3.2018 showing cause why such amount should not be collected.

On 27.2.2018, the said officer wrote two separate letters to the petitioners’ banks i.e. IDBI bank, Alkapuri, and Union Bank of India, Nizampura provisionally attaching the bank accounts for the due amount of Rs. 30.88 lacs of taxes. On 19.3.2018, said officer issued a further notice in purported exercise of powers under subsection(3) of section 74 of the CGST Act estimating the petitioners’ taxes and other dues at Rs.1.29 crores (rounded off).

The petitioners have essentially challenged the attachment of the bank accounts as also the further notice dated 19.3.2018.

Related Topic:

Gujarat HC in the case of M/s. AAP And Co. Versus Union of India

Counsel for the petitioners submitted that the State authorities had under coercion forcibly collected taxes of Rs.19,74,886/ which was wholly impermissible. Counsel further submitted that the action of attaching the bank accounts of the petitioners is a drastic measure and in the facts of the present case could not have been exercised. Reliance is placed on the decision of this Court in the case of Automark Industries (I) Ltd v. State of Gujarat and others reported in 2014 SCC Online Guj 14217. Counsel also contended that the further notice dated 19.3.2018 covered the same period for which the previous notice dated 27.2.2018 was issued. Subsection(3) of section 74 permits the authority to issue the notice for a period other than the period for which notice under subsection(1) of section 74 of the CGST Act has been issued. Subsequent notice dated 19.3.2018 was, therefore, without jurisdiction.

Notice returnable on 12.4.2018.

Counsel for the petitioners submitted that even before the final assessment is made, the authorities have exercised drastic powers of attaching the bank accounts and eventually stifle the petitioners’ business. The petitioners have a balance of approximately Rs. 4 lacs in Union Bank of India and approximately Rs.44 lacs in IDBI bank. Additionally, the petitioners also have stock of goods worth Rs. 90 lacs approximately.

By way of ad-interim relief, the above attachment is suspended of both the bank accounts on the condition that :

1) The balance as of today in both the bank accounts shall be maintained.

2) The petitioners shall maintain a minimum stock balance of Rs. 50 lacs

Direct service is permitted.

Read & download the order in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.