Compliances of GST in Banking Sector: ICAI

Chapter 1 Banking Sector – An Overview

Service Tax Applicability On Banks

Service Tax was introduced in India on 01.07.1994. However, Banking and Other Financial Services had been brought within the ambit of Service Tax w.e.f. 16.07.2001.

Services mentioned in section 65(12)(a) of the Finance Act, 1994 were made taxable, if provided by:

(a) Banking company and financial institution including NBFCs from July 16, 2001; or

(b) Any other body corporate from August 16, 2002; or

(c) Any other commercial concern from September 10, 2004.

Services mentioned in section 65(12)(b) of the Finance Act, 1994 are taxable, if provided by:

(a) Banking companies, financial institutions including NBFCs and other body corporates from July 1, 2003; or

(b) Commercial Concerns from September 10, 2004.

Further, with effect from May 16, 2008, section 65(12) has been amended to levy service tax on foreign exchange broking and purchase or sale of foreign currency, including money changing, provided by a foreign exchange broker or an authorized dealer in foreign exchange or an authorized money changer also.

Related Topic:

Documents required for Registration under GST of AOP/BOI/Trust/Local authorities

Banking Services under Negative List of Services w.e.f. July 1, 2012

After the introduction of Negative List i.e. with effect from July 1, 2012, Service Tax was applicable on all services provided by banks except followings:

- Services by the Reserve Bank of India;

- Services by way of—

(i) extending deposits, loans, or advances in so far as the consideration is represented by way of interest or discount;

(ii) inter se sale or purchase of foreign currency amongst banks or authorised dealers of foreign exchange or amongst banks and such dealers.

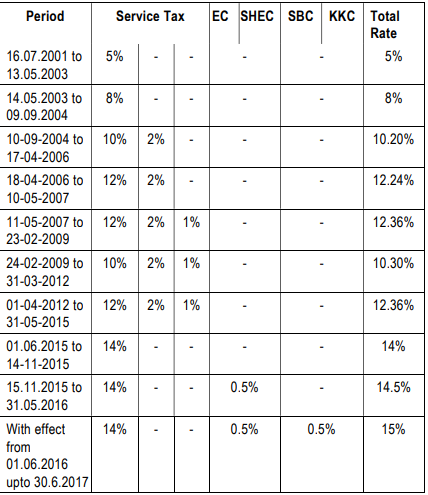

Rate of Service Tax

Banking Services under GST w.e.f. July 1, 2017

GST is applicable on Banking services as far as it qualifies the taxable event i.e Supply of Services. However, the following Supplies made without consideration as specified in Schedule I of the Central Goods and Services Act, 2017 (“the CGST Act”) are subject to tax, which is a paradigm shift from the earlier regime:

- Permanent transfer or disposal of business assets where input tax credit (“ITC”) has been availed on such assets.

- Inter Unit Supply: Supply of goods/ services or both between related persons or between distinct persons as specified in section 25, when made in the course or furtherance of business.

Therefore, any supply of goods or services or both supplied or received by one branch bank to another or by Head office bank to branch bank or vice versa without consideration, shall be considered as supply under GST for payment of tax.

- Activity performed by an employer to the employee without consideration will be taxable under GST, except where the value of such supply does not exceed ` 50,000 in a financial year.

Although no consideration is involved yet, payment of tax needs to done on the value determined in terms of section 15 of the CGST Act read with Rule 28 of the Central Goods and Services Rules, 2017 (“the CGST Rules”).

Since such transactions are generally not captured in books of accounts, therefore, the auditor should apply a substantial audit procedure to check compliances.

Related Topic:

GST compliances for Goods transport agency

Tax Framework

Service Tax under earlier regime was levied and collected by the Central Government, however, with the implementation of GST, CGST/SGST is levied by Central / State Government respectively on all intra-State supply and IGST is levied by the Central Government on all inter-State supplies

Related Topic:

Compliances of GST in Banking Sector: ICAI

Relevant Exemptions under GST

GST is applicable on all services provided by the banks except followings:

- Services by the Reserve Bank of India;

- Services by way of—

(i) extending deposits, loans, or advances in so far as the consideration is represented by way of interest or discount (other than interest involved in credit card services);

(ii) inter se sale or purchase of foreign currency amongst banks or authorized dealers of foreign exchange or amongst banks and such dealers.

Where-

(zk) “interest” means interest payable in any manner in respect of any amounts of money borrowed or debt incurred (including a deposit, claim, or other similar right or obligation) but does not include any service fee or other charge in respect of the money borrowed or debt incurred or in respect of any credit facility which has not been utilised;

- Services provided by a banking company to Basic Saving Bank Deposit (BSBD) account holders under Pradhan Mantri Jan Dhan Yojana (PMJDY). [inserted w.e.f. 01-01-2019 vide Notification No. 28/2018- Central Tax (Rate), dated 31-12-2018 in CGST and vide Notification No. 29/2018-Integrated Tax (Rate), dated 31-12-2018 in IGST.]

- Services by an acquiring bank, to any person in relation to settlement of an amount up to ` 2,000 in a single transaction transacted through credit card, debit card, charge card, or other payment card service.

Explanation. — For the purposes of this entry, “acquiring bank” means any banking company, financial institution including a non-banking financial company or any other person, who makes the payment to any person who accepts such card.

- Services supplied by Central Government, State Government, Union territory to their undertakings or Public Sector Undertakings (PSUs) by way of guaranteeing the loans taken by such undertakings or PSUs from the banking companies and financial institutions. [Intially this exemption was inserted w.e.f. 27-07-2018 vide Notification No. 14/2018-Central Tax (Rate), dated 26-07-2018 in CGST and vide Notification No. 15/2018- Integrated Tax (Rate), dated 26-07-2018 in IGST. Latter, the words “banking companies and” were inserted w.e.f. 01-01-2019 vide Notification No. 28/2018-Central Tax (Rate), dated 31-12-2018 in CGST and vide Notification No. 29/2018-Integrated Tax (Rate),dt.31-12-2018.]

- Services by way of the collection of contribution under the Atal Pension Yojana

- Services by way of the collection of contribution under any pension scheme of the State Governments

Read & Download the full Copy in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.