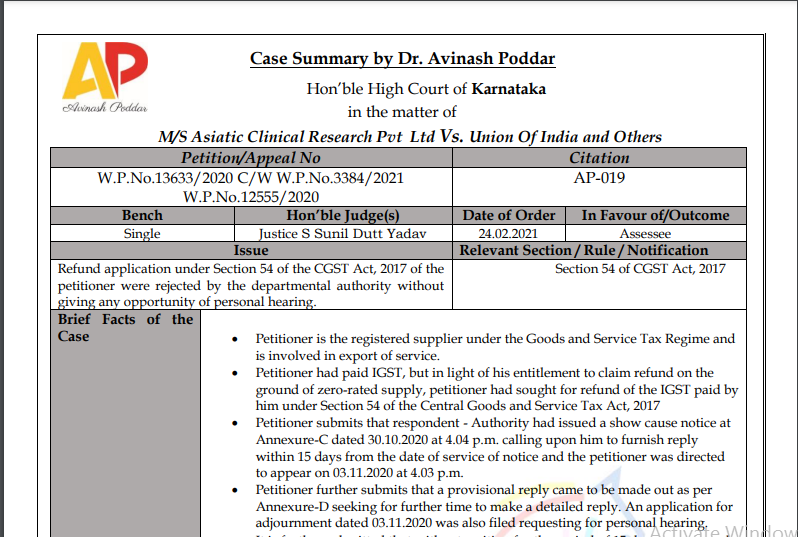

Karnataka HC in the case of M/s Asiatic Clinical Research Pvt Ltd Versus Union Of India

Case Covered:

M/s Asiatic Clinical Research Pvt Ltd

Versus

Union Of India

Issue:

Refund applications under Section 54 of the CGST Act, 2017 of the petitioner were rejected by the departmental authority without giving any opportunity for a personal hearing.

Brief Facts of the Case:

• Petitioner is the registered supplier under the Goods and Service Tax Regime and is involved in the export of service.

• Petitioner had paid IGST, but in light of his entitlement to claim a refund on the ground of zero-rated supply, petitioner had sought a refund of the IGST paid by him under Section 54 of the Central Goods and Service Tax Act, 2017

• Petitioner submits that respondent – Authority had issued a show-cause notice at Annexure-C dated 30.10.2020 at 4.04 p.m. calling upon him to furnish a reply within 15 days from the date of service of notice and the petitioner was directed

to appear on 03.11.2020 at 4.03 p.m.

• Petitioner further submits that a provisional reply came to be made out as per Annexure-D seeking further time to make a detailed reply. An application for adjournment dated 03.11.2020 was also filed requesting a personal hearing.

• It is further submitted that without waiting for the period of 15 days as was made available to make out his reply to the show-cause notice, the refund application of the petitioner came to be rejected on 12.11.2020.

• Authority had issued a show-cause notice at Annexure-C dated 30.10.2020 at 4.04 p.m. calling upon him to furnish a reply within 15 days from the date of service of notice and the petitioner was directed to appear on 03.11.2020 at 4.03 p.m.

• An application for adjournment dated 03.11.2020 was also filed requesting a personal hearing. It is further submitted that without waiting for the period of 15 days as was made available to make out his reply to the show-cause notice, the refund application of the petitioner came to be rejected on 12.11.2020.

Brief Arguments by Petitioner/ Appellant:

It is submitted that the order at Annexure-A for the month of October 2018 in W.P.No.13633/2020 and the orders at Annexures – A1 to A6 for the period from April 2018 to September 2018 in W.P.No.12555/2020 are in violation of the principles of natural justice as the entitlement of the petitioner to avail of the time period of 15 days to make out a detailed reply on merits and the request for a personal hearing has been denied.

Brief Arguments by Respondents:

Respondent contends that personal hearing was fixed originally on 12.01.2021 and the the petitioner ought to have availed of that opportunity and accordingly, the authority cannot be found to be in default as the impugned orders have considered in detail the submissions of the petitioner as made out in the reply to the show-cause notices.

Judgement/ Ratio (in brief):

Taking note that an opportunity of personal hearing was not availed, in the interest of justice, it would be appropriate if the petitioner is afforded an opportunity of personal hearing to substantiate the detailed replies made.

W.P. No. 3384/2021:

Petitioner was issued with notice at Annexure-C dated 05.01.2021 calling upon him to be present on 12.01.2021 and notice at Annexure-C1 dated 06.01.2021 calling upon him to be present on 14.01.2021. It is submitted that the said notices also provided an opportunity of 15 days to reply to the said notices. Petitioner further submits that he had sought for extension of time as per the request made on 12.01.2021 vide Annexure-D and had further requested that personal hearing be fixed on 14.01.2021 in order to hear both the matters for the period of November 2018 and December 2018. It is submitted that a detailed reply was made out to the show cause notices issued. However, it is submitted that despite the request of the petitioner to fix the date as 14.01.2021, the rejection order came to be passed as per the orders at Annexures-A and A1 both dated 21.01.2021. Accordingly, it is submitted that his request for affording a personal hearing on 14.01.2021 has not been considered and impugned orders have been passed.

However, taking note that an opportunity of personal hearing was not availed, in the interest of justice, it would be appropriate if the petitioner is afforded an opportunity of personal hearing to substantiate the detailed replies made, as per the acknowledgments at Annexures F and F1. Accordingly, the orders at Annexures-A and A1 are set aside.

Petitioner to be present for availing of an opportunity of personal hearing, when such an opportunity is granted while disposing of the application of the petitioner as regards to the subject matter in W.P.No. 12555/2020, W.P.No. 13633/2020 and W.P.No. 3384/2021, and a common date may be fixed in order to avoid conflicting orders to be passed as the factual matrix is similar and question of consideration is also identical. Learned counsel for the petitioner submits that he would avail of the opportunity on the date that is fixed for hearing and would co-operate for expeditious disposal of the matter.

Accordingly, W.P.Nos. 12555/2020, 13633/2020, and 3384/2021 are disposed of.

Head Note/ Judgement in Brief:

Petitioner’s application of refund under Section 54 of the CGST Act, 2017 for the Zero-rated supply is rejected and the order has been passed, without giving the opportunity of personal hearing is in violation of principles of natural justice.

Views of Author:

In this order, the court has viewed that there is clear violations of principles of natural justice and the opportunity of personal hearing was not given to the petitioner at the time of issuance of an order

If you already have a premium membership, Sign In.

Dr. Avinash Poddar

Dr. Avinash Poddar

Ahemdabad, India

Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).