Memorandum Explaining The Provisions In The Finance Bill, 2021

Memorandum Explaining The Provisions In The Finance Bill, 2021

Provisions Relating To Direct Taxes

Introduction

The provisions of Finance Bill, 2021 (hereafter referred to as “the Bill”), relating to direct taxes seek to amend the Income-tax Act, 1961 (hereafter referred to as ‘the Act’), Prohibition of Benami Property Transactions Act, 1988 (hereafter referred to as ―PBPT Act”), Finance (No 2) Act, 2004 and Finance Act, 2016 and the Direct Tax Vivad se Vishwas Act, 2020 to continue reforms indirect tax system through tax-incentives, removing difficulties faced by taxpayers and rationalization of various provisions.

With a view to achieving the above, the various proposals for amendments are organized under the following heads:—

(A) Rates of income-tax;

(B) Tax incentives;

(C) Removing difficulties faced by taxpayers;

(D) Rationalisation of various provisions.

DIRECT TAXES

A. Rates of Income-Tax

I. Rates of income-tax in respect of income liable to tax for the assessment year 2021-22.

In respect of income of all categories of assessee liable to tax for the assessment year 2021-22, the rates of income-tax have either been specified in specific sections (like section 115BAA or section 115BAB for domestic companies, 115BAC for individual/HUF, and 115BAD for cooperative societies) or have been specified in Part I of the First Schedule to the Bill. There is no change proposed in tax rates either in these specific sections or in the First Schedule. The rates provided in sections 115BAA or 115BAB or 115BAC or 115BAD for the assessment year 2021-22 would be the same as already enacted. Similarly, rates laid down in Part III of the First Schedule to the Finance Act, 2020, for the purposes of computation of “advance tax”, deduction of tax at source from “Salaries” and charging of tax payable in certain cases for the assessment year 2021-22 would now become part I of the first schedule. Part III would now apply for the assessment year 2022-23 and would remain unchanged except that it would also apply to the proposed section 194P.

Related Topic:

PDF of Finance Act 2021 Passed by the Parliament

(1) Tax rates under section 115BAC and section 115BAD—

From the assessment year 2021-22 (FY 2020-21), individual and HUF taxpayers have an option to opt for taxation under section 115BAC of the Act and the resident co-operative society has an option to opt for taxation under the newly inserted section 115BAD of the Act.

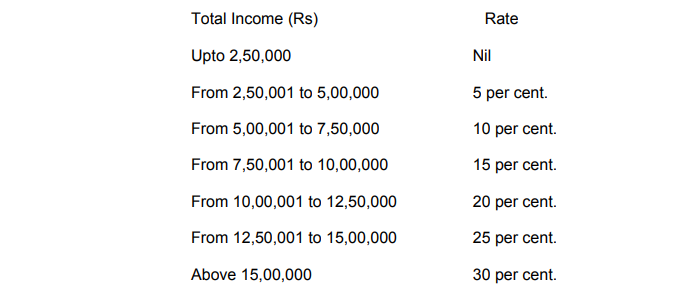

On satisfaction of certain conditions as per the provisions of section 115BAC, an individual or HUF shall, from the assessment year 2021-22 onwards, have the option to pay tax in respect of the total income at the following rates:

Similarly, a co-operative society resident in India shall have the option to pay tax at 22 percent for the assessment year 2021-22 onwards as per the provisions of section 115BAD, subject to fulfillment of certain conditions.

Related Topic:

MEMORANDUM FINANCE BILL, 2020

(2) Tax rates under Part I of the first schedule applicable for the assessment year 2021-22

A. Individual, HUF, association of persons, the body of individuals, an artificial juridical person. Paragraph A of Part-I of First Schedule to the Bill provides the following rates of income-tax:—

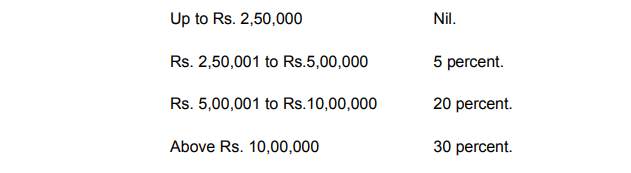

(i) The rates of income-tax in the case of every individual (other than those mentioned in (ii) and (iii) below) or HUF or every association of persons or body of individuals, whether incorporated or not or every artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2 of the Act (not being a case to which any other Paragraph of Part III applies) are as under:—

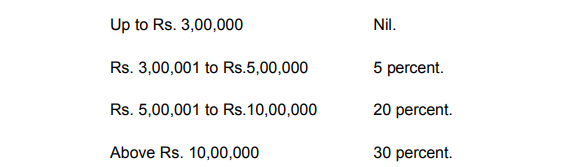

(ii) In the case of every individual, being a resident in India, who is of the age of sixty years or more but less than eighty years at any time during the previous year,—

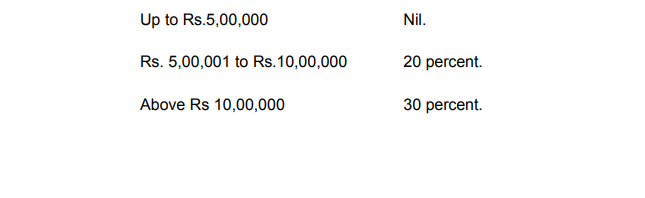

(iii) in the case of every individual, being a resident in India, who is of the age of eighty years or more at any time during the previous year,—

b. Co-operative societies

In the case of co-operative societies, the rates of income-tax have been specified in Paragraph B of Part I of the First Schedule to the Bill. They remain unchanged at (10% up to Rs 10,000; 20% between Rs 10,000 and Rs 20,000; and 30% in excess of Rs 30,000)

c. Firms

In the case of firms, the rate of income-tax has been specified in Paragraph C of Part I of the First Schedule to the Bill. They remain unchanged at 30%

d. Local authorities

The rate of income-tax in the case of every local authority has been specified in Paragraph D of Part I of the First Schedule to the Bill. They remain unchanged at 30%.

e. Companies

The rates of income-tax in the case of companies have been specified in Paragraph E of Part I of the First Schedule to the Bill. In the case of a domestic company, the rate of income-tax shall be twenty-five percent. of the total income, if the total turnover or gross receipts of the previous year 2018-19 does not exceed four hundred crore rupees and in all other cases, the rate of Income-tax shall be thirty percent. of the total income.

In the case of a company other than a domestic company, the rates of tax are the same as those specified for the FY 2019-20.

Read & Download the full copy in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.