Amended Section 10 of the CGST Act: Composition Levy (Updated till on October 2023)

- What is composition levy for small taxpayers in GST covered by section 10 of the CGST Act?

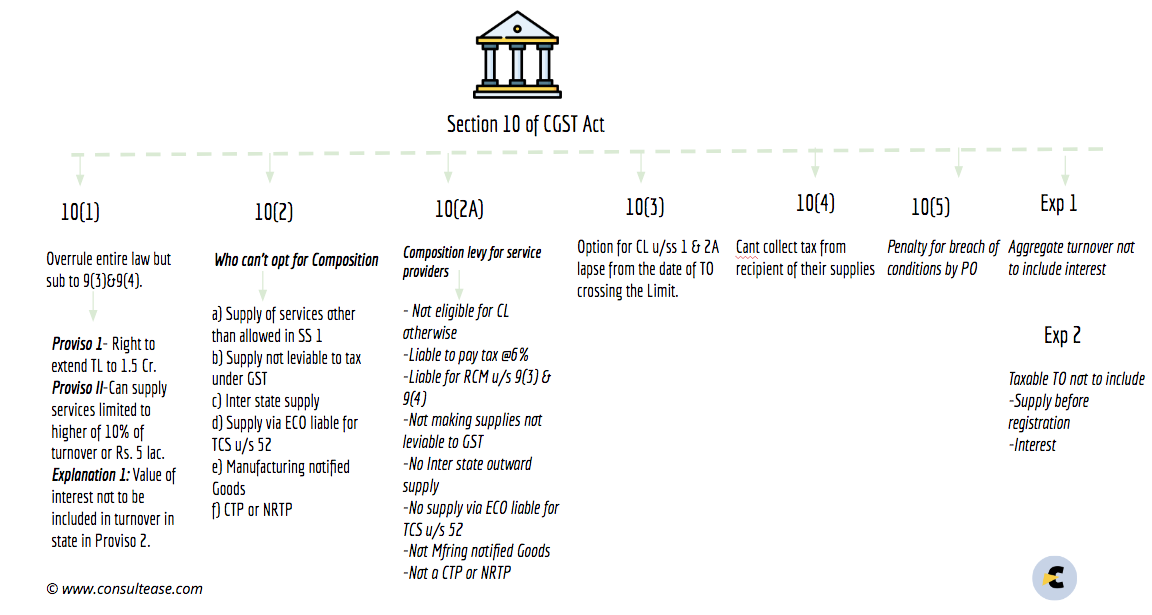

- A brief summary of Section 10 of the CGST Act

- What are the benefits of composition levy?

- What are the setbacks in the composition levy of GST?

- Section 10 of the CGST Act as given in Act itself.

- First proviso-

- Explanation 2.

- Important rule related to section 10 of the CGST Act: Composition levy

What is composition levy for small taxpayers in GST covered by section 10 of the CGST Act?

Composition levy is a scheme for small taxpayers. They can opt for this scheme to reduce their compliance. A composition taxpayer is required to file only 4 returns in a year on a quarterly basis. Then 1 return on an annual basis.

A brief summary of Section 10 of the CGST Act

What are the benefits of composition levy?

There are many benefits of opting for the composition levy.

- Fewer compliances in GST. No need to maintain a full set of books of accounts.

- No need to issue a tax invoice.

- Lesser tax rates

- Simplified quarterly return.

Related Topic:

Rule 142 of the CGST Act – Notice and order for demand of amounts payable under the Act.

What are the setbacks in the composition levy of GST?

Although it is made for small taxpayers but still there are many restrictions in composition levy. They make it less lucrative.

- It is only good for the B2C supplier. Tax paid via composition invoice is not allowed as an input tax credit.

- The composition dealer is not allowed to collect tax from the buyer. He needs to mention on his specific invoice also that he is not eligible to collect the tax.

- He is not eligible to claim the input tax credit of the tax he has paid on his purchases.

- A composition dealer is also liable for the payment of tax in RCM. The tax paid in reverse charge is not allowed as ITC as well.

- He is not rescued from all the compliance. He is also required to maintain stock.

- It is viable for very few businesses.

Section 10 of the CGST Act as given in Act itself.

it is amended from time to time. Here I have tried to incorporate all the amendments.

Section 10 of the CGST Act contains the provision for composition levy in GST. Composition rules are also released by the GST council.

10.(1) Notwithstanding anything to the contrary contained in this Act but subject to the provisions of sub-sections (3) and (4) of section 9, a registered person, whose aggregate turnover in the preceding financial year did not exceed fifty lakh rupees, may opt to pay, in lieu of the tax payable by him under sub-section (1) of section (9), an amount calculated at such rate as may be prescribed, but not exceeding, ––

(a) one percent. of the turnover in State or turnover in Union territory in case of a manufacturer,

(b) two and a half percent. of the turnover in State or turnover in Union territory in case of persons engaged in making supplies referred to in clause (b) of paragraph 6 of Schedule II, and

(c) half percent. of the turnover in State or turnover in Union territory in case of other suppliers,

subject to such conditions and restrictions as may be prescribed:

Provided that the Government may, by notification, increase the said limit of fifty lakh rupees to such a higher amount, not exceeding one crore and fifty lakh rupees, as may be recommended by the Council.

“Provided further that a person who opts to pay tax under clause (a) or clause (b) or clause (c) may supply services (other than those referred to in clause (b) of paragraph 6 of Schedule II), of value not exceeding ten percent. of turnover in a State or Union territory in the preceding financial year or five lakh rupees, whichever is higher.

“Explanation.–– For the purposes of the second proviso, the value of exempt supply of services provided by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount shall not be taken into account for determining the value of turnover in a State or Union territory.”;

(2) The registered person shall be eligible to opt under sub-section (1), if: —

(a) save as provided in sub-section (1) he is not engaged in the supply of services other than supplies referred to in clause (b) of paragraph 6 of Schedule II;

(b) he is not engaged in making any supply of goods or services which are not leviable to tax under this Act;

(c) he is not engaged in making any inter-State outward supplies of goods or services;

(d) he is not engaged in making any supply of goods or services through an electronic commerce operator who is required to collect tax at source under section 52; and

(e) he is not a manufacturer of such goods as may be notified by the Government on the recommendations of the Council; and

(f) he is neither a casual taxable person nor a non-resident taxable person

Provided that where more than one registered persons are having the same Permanent Account Number [issued under the Income-tax Act, 1961(43 of 1961)], the registered person shall not be eligible to opt for the scheme under sub-section (1) unless all such registered persons opt to pay tax under that sub-section

(2A) Notwithstanding anything to the contrary contained in this Act, but subject to the provisions of sub-sections (3) and (4) of section 9, a registered person, not eligible to opt to pay tax under sub-section (1) and sub-section (2), whose aggregate turnover in the preceding financial year did not exceed fifty lakh rupees, may opt to pay, in lieu of the tax payable by him under sub-section (1) of section 9, an amount of tax calculated at such rate as may be prescribed, but not exceeding three percent. of the turnover in State or turnover in Union territory, if he is not

(a) engaged in making any supply of goods or services which are not leviable to tax under this Act;

(b) engaged in making any inter-State outward supplies of goods or services;

(c) engaged in making any supply of goods or services through an electronic commerce operator who is required to collect tax at source under section 52;

(d) a manufacturer of such goods or supplier of such services as may be notified by the Government on the recommendations of the Council; and

(e) a casual taxable person or a non-resident taxable person: Provided that where more than a one registered person are having the same Permanent Account Number issued under the Income-tax Act, 1961, the registered person shall not be eligible to opt for the scheme under this sub-section unless all such registered persons opt to pay tax under this subsection.”;

Related Topic:

Summons, Cross-Examination, And Arrest, Under CGST Act, 2017

First proviso-

Provided that where more than one registered persons are having the same Permanent Account Number (issued under the Income-tax Act, 1961), the registered person shall not be eligible to opt for the scheme under sub-section (1) unless all such registered persons opt to pay tax under that sub-section.

(3) The option availed of by a registered person under sub-section (1) sub-section 2A as the case may be shall lapse with effect from the day on which his aggregate turnover during a financial year exceeds the limit specified under sub-section (1) sub-section 2A as the case may be.

(4) A taxable person to whom the provisions of sub-section (1) as the case may be sub-section 2A apply shall not collect any tax from the recipient on supplies made by him nor shall he be entitled to any credit of input tax.

(5) If the proper officer has reasons to believe that a taxable person has paid tax under subsection (1) despite not being eligible, such person shall, in addition to any tax that may be payable by him under any other provisions of this Act, be liable to a penalty and the provisions of section 73 or section 74 shall, mutatis mutandis, apply for a determination of tax and penalty.

Explanation 1.

–– For the purposes of computing aggregate turnover of a person for determining his eligibility to pay tax under this section, the expression “aggregate turnover” shall include the value of supplies made by such person from the 1st day of April of a financial year up to the date when he becomes liable for registration under this Act, but shall not include the value of exempt supply of services provided by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount.

Explanation 2.

–– For the purposes of determining the tax payable by a person under this section, the expression “turnover in State or turnover in Union territory” shall not include the value of following supplies, namely: ––

(i) supplies from the first day of April of a financial year up to the date when such person becomes liable for registration under this Act; and

(ii) exempt supply of services provided by way of extending deposits, loans, or advances in so far as the consideration is represented by way of interest or discount.’.

(Section 10 of CGST Act as provided in law)

Important rule related to section 10 of the CGST Act: Composition levy

| 1. | Rule 3 | Intimation for composition levy |

| 2. | Rule 4 | Effective date for composition levy |

| 3. | Rule 5 | Conditions and restrictions for composition levy |

| 4. | Rule 6 | Validity of composition levy |

| 5. | Rule 7 | Rate of tax of the composition levy |

Thus you need to know all these provisions. We post updated provisions here. The rules are updated until June 2020.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.