Notification No. 78/2020 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 78/2020 – Central Tax

New Delhi, the 15th October 2020

G.S.R…..(E).—In exercise of the powers conferred by the first proviso to rule 46 of the Central Goods and Services Tax Rules, 2017, the Central Board of Indirect Taxes and Customs, on the recommendations of the Council, hereby makes the following amendment in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.12/2017 – Central Tax, dated the 28th June 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 660(E), dated the 28th June 2017, namely:–

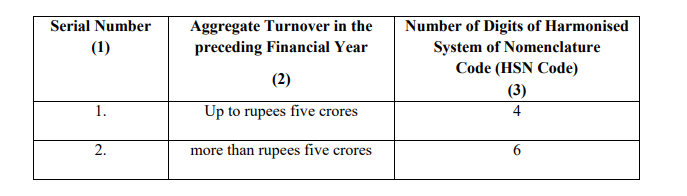

In the said notification, with effect from the 01st day of April 2021, for the Table, the following shall be substituted, namely, –

Related Topic:

Notification No. 74/2018 – Central Tax

“Table

Provided that a registered person having aggregate turnover up to five crores rupees in the previous financial year may not mention the number of digits of HSN Code, as specified in the corresponding entry in column (3) of the said Table in a tax invoice issued by him under the said rules in respect of supplies made to unregistered persons.”.

[F. No. CBEC-20/06/09/2019-GST]

(Pramod Kumar)

Director, Government of India

Note: The principal notification number 12/2017 – Central Tax, dated the 28th June 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.660(E), dated the 28th June 2017.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.