Guidebook For Faceless Assessment: CBIC

Guidebook For Faceless Assessment: CBIC

CBIC has released a guidebook for Faceless Assessment to assist the concerned stakeholders in the successful implementation of Faceless Assessment across the country.

Chapter 1: Introduction to Faceless Assessment

1.1 Faceless Assessment, a component of the Turant Customs programme, is a path-breaking initiative aimed at introducing anonymity and uniformity in Customs assessments pan India.

1.2 Overview: The journey towards Faceless Assessment has been long. Decades ago, goods imported into India were assessed for Customs duty at the border by jurisdictional Customs officers on the basis of physical documents. The subsequent introduction of computers led to the automation of assessment. This was followed by a robust digital risk management system (RMS) for Customs clearance with minimal checks while interdicting risk-prone cargo for assessment and examination. In 2012, the Customs Act 1962, was amended to introduce self-assessment by importers/ exporters themselves. While digitization helped in streamlining of procedures, yet disparities in assessment prevailed due to interpretation issues. Customs officials recognized a dire need to provide uniformity and certainty in assessment practices. It was also clear that anonymity in assessment and load balancing of import documents that are required to be assessed would bring about more efficiency and help improve the speed of Customs clearances across India. This was the trigger for the conceptualization and development of Faceless Assessment.

1.3 Faceless Assessment a Balance between Anonymization and Specialization: Anonymity in assessment is a core feature of the Faceless Assessment initiative. This is aimed to reduce the unnecessary need for a face to face interaction with a Customs official. This measure will also encourage specialization and uniformity in the assessment of identified goods, as officers in a Faceless Assessment Group (FAG) would no longer be required to work on the assessment of all goods.

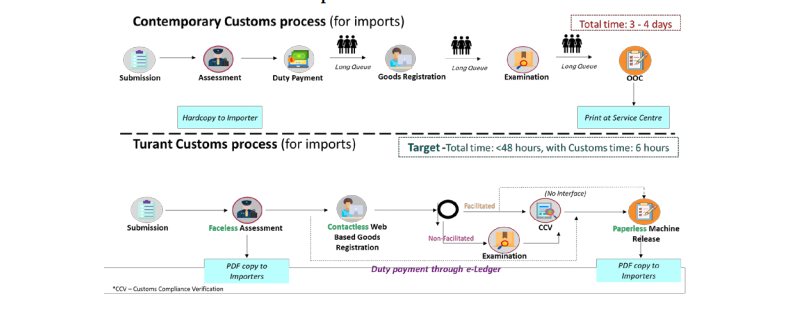

Overview of Customs processes before and after Turant Customs

1.4 At present, the Customs Zones, and Commissionerates are organized in different ways, as follows:

a. Customs Zones with Customs Commissionerates for all Customs Functions: In these Zones, all the Customs functions in relation to import and export are done in a single Commissionerate. An example is the Bengaluru Zone which has three self-contained Customs Commissionerates viz. Bengaluru Air Cargo Complex (ACC), Bengaluru, Inland Container Depot (ICD), and Mangalore Port. Likewise, Kolkata Zone has three self-contained Customs Commissionerates viz. Kolkata, Air Cargo Complex (ACC), Kolkata Port, and Kolkata Preventive Commissionerate.

b. Customs Zones with Customs Commissionerates, both self-contained and otherwise: In these Zones, all the Customs functions in relation to import and export are done either in a single self-contained Commissionerate or only specific Customs functions are done in a particular Commissionerate. An example is Delhi Zone, which has Inland Container Depot (ICD) Patparganj as a full-fledged self-contained Commissionerate along with Inland Container Depot (ICD), Tughlakabad (Import) and Delhi Air Cargo Complex (Import) as only Import Commissionerates and Inland Container Depot (ICD), Tughlakabad (Export) and Air Cargo Complex (Export) as only Export Commissionerates.

c. Customs Zones without Full-Fledged Commissionerate combined with Import and Export Commissionerates: In these Zones, a Commissionerate performs partial Customs functions. Examples of such zones are Chennai Zone, Mumbai-I, and II. In Chennai, Chennai-II Commissionerate does only assessment work in relation to imported goods whereas Chennai IV has all the CFS under it where the examination of imported goods is done, and ChennaiVII is a self-contained Commissionerate for air cargo. In Mumbai-II Zone, NS-I Commissionerate is meant for Assessment group I and II and related functions, NS-III deals with Assessment group III and IV and NS-V does the work related to Assessment Group V, VA, VB, and VI. Mumbai-I Zone also has a similar distribution in terms of assessment groups between Import-I and Import-II Commissionerate.

d. GST Zones Having Customs Commissionerates: In these GST Zones, there are Customs Commissionerate. Examples of such zones are Hyderabad, Meerut, Cochin, Visakhapatnam, Bhopal, and Shillong.

1.5 It was seen that despite a centralized automated IT framework for carrying out Customs assessment, the varying assessment structures in the Zones were not compatible with the CBIC’s mission of having a uniform and standardized Customs assessment practices. Moreover, as the assessment was being done in the port of import itself, local assessment practices would invariably creep in, despite all attempts at standardization. The different structures were also found to contribute to differences in dwell time of cargo, thereby bringing down the overall efficiency. Thus, it was clear that a fundamental change is warranted to meet the objective of the CBIC in providing the most efficient, transparent, and standardized Customs assessment experience.

1.6 The new Customs assessment structure moves away from the physical constraint of assessment by local Customs officers at the Port of Import. Faceless Assessment is being implemented taking into consideration the above-mentioned different structures of Customs zones and commissionerate. It redefines the roles of Customs officers for assessment, examination, and other related processes along with changes in ICES and creates a superstructure of Faceless Assessment Groups (FAGs), Port Assessment Group (PAG), National Assessment Centres (NACs), and Turant Suvidha Kendras (TSKs). The new dispensation virtually connects Customs assessment officers from different jurisdictions and provides for enhanced level monitoring of Customs assessments based on the assignment of import clearance documents by the Customs Automated System (CAS) to officers of the FAGs irrespective of the port of import of the goods.

1.7 A pilot of the initiative was initiated last year by CBIC and post validation of the expected outcomes, it has been decided to roll out the programme nationally. These Pilot Programmes helped test Faceless Assessment first in the same zone, then across zones. Faceless Assessment is now being extended across all Customs ports in India to usher a more modern, efficient, and professional Customs administration, with resultant benefits for trade and industry.

Chapter 2: Institutional setup

2.1 Faceless Assessment is based on the Customs Automated System assigning a Bill of Entry (BE) that is identified for scrutiny (non-facilitated BE) to an assessing officer, who is physically located at a Customs station, which is not the port of import. As aforementioned, the objectives of the initiative are to:

▪ Anonymize the assessment process by removing the physical interface with Customs

▪ Ensure uniformity of assessment across locations by promoting sector-specific and functional specialization

▪ Improve workload for efficient utilization of manpower and resources for Customs by automation of the end-to-end clearance process

The Faceless Assessment institutional set up has two levels, i.e., (i) Local and (ii) Virtual

2.2 Faceless Assessment set up

A. Local Setup

- Port of Import: The port of import is the Customs station of import where the goods lie and the importer has entered a BE for home consumption or warehousing. Its functions are as follows:

● It will have one Port Assessment Group (PAG) to assess cases referred to by the FAG in specific circumstances.

● Turant Suvidha Kendra (TSK) to be set up at Port of Import for various document/ report submission/ generation for the assessment.

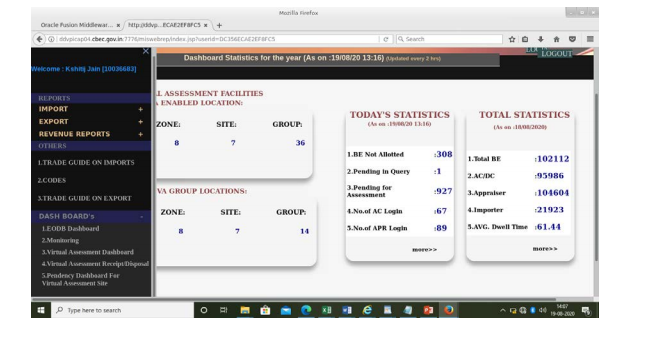

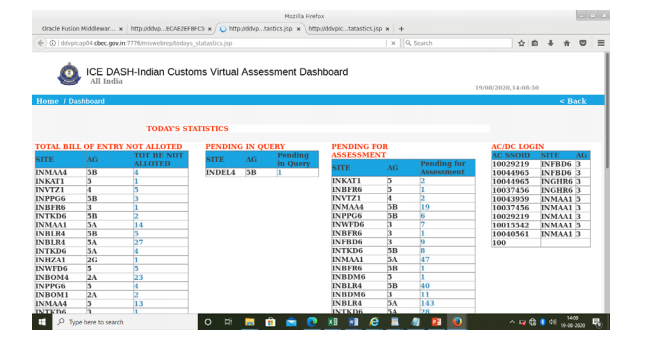

Dashboard for Port of Import Commissioner

- Port Assessment Groups: the equivalent of Appraising Group currently located in each port of import for verification of the assessment and other related functions as is the normal practice. Their functions include:

i. All functions pertaining to the BE which are not marked to the Faceless Assessment Group by the Customs Automated System.

ii. BEs that are referred by the Faceless Assessment Group to the port of import, for any reason.

iii. Handling of issues arising post assessment, relating to the BEs which were handled in the Faceless Assessment Group.

- Turant Suvidha Kendras: are facilitation centers which will handhold and facilitate trade, as it adapts to the new system. To reduce friction and to handhold stakeholders, TSK at the port of import will facilitate trade. Their functions illustratively include:

● Accept Bonds or Bank Guarantee;

● Carry out any other verifications that may be referred by FAGs;

● Defacing of documents/ permits licenses, wherever required;

● The debit of documents/ permits/ licenses, wherever required;

● Handle queries related to assessment, and

● Other functions determined by the Commissioner to facilitate trade

Read & Download the full Copy in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.