GSTR-2B: Everything you need to know: GSTN

GSTR-2B: Everything you need to know

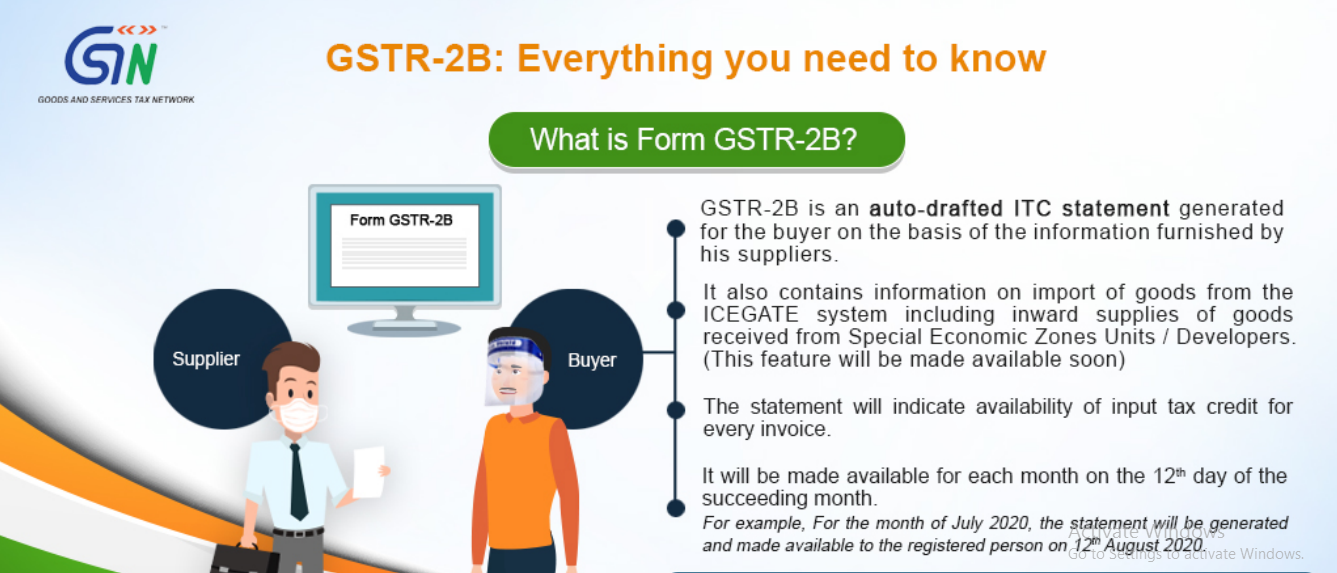

What is Form GSTR-2B?

GSTR-2B is an auto-drafted ITC statement generated for the buyer on the basis of the information furnished by his suppliers.

It also contains information on the import of goods from the ICEGATE system including inward supplies received from the Special Economic Zones Units/Developers. (This feature will be made available soon)

The statement will indicate the availability of input tax credit for every invoice.

It will be made available for each month on the 12th day of the succeeding month.

For example, For the month of July 2020, the statement will be generated and made available to the registered person on 12th August 2020.

Related Topic:

Demystifying The Interpretation of ‘A Proviso’

What does GSTR-2B consist of?

A summary statement that shows all the Input Tax Credit (ITC) available and non-available under each section.

Clarification on action to be taken by the taxpayers in Form-3B

Document-level details of all invoices, credit notes, debit notes, etc.

Cut off Dates and advisory for generation and use of GSTR-2B.

Information on the import of goods from overseas and SEZ Units/ Developers. (This feature will be made available soon)

How will Form-2B be auto-populated?

The details filed by your suppliers in their respective GSTR-1, 5 and 6 between the 12th of a month (M) and 11th of next month shall be automatically populated in your Form GSTR-2B

For example, GSTR-2B generated for the month of July 2020 will contain the details of all the documents filed by your suppliers in their GSTR-1, 5, and 6 from 00:00 hours on 12th July 2020 to 23:59 hours on 11th August 2020.

The dates for which the relevant data has been extracted for generation of GSTR-2B are available under the ‘View Advisory’ tab on the online portal.

Related Topic:

GST Portal – Known Issues & Suggested Solutions: GSTN

Unique features of GSTR-2B

- View and download (pdf) Summary Statement

- Instant section-wise details or full download

- Text search for all records generated

- Section-wise advisory

- View and filter as required

- Hide/View columns as required

- Sort data as required

- Taxpayers with more than 1000 records may either download the full GSTR-2B or do an advance search of records

Read & Download the full copy in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.