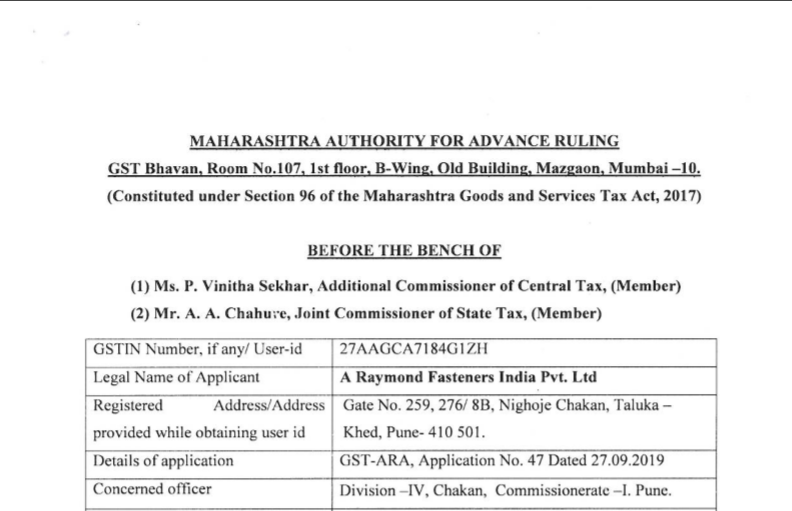

Maharashtra AAR in the case of A Raymond Fasteners India Pvt. Ltd

Case Covered:

A Raymond Fasteners India Pvt. Ltd

facts of the case:

The present application has been filed under section 97 of the Central Goods and Services Tax Act, 2017 and Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and the MGST Act” respectively] by M/s. A Raymond Fasteners India Pvt. Ltd, the applicant, seeking an advance ruling in respect of the following questions.

A.1 Whether threaded metal nuts which function the same as standard nut, merits classification under the Tariff item 7318 1600 and not under Tariff item 8708 9900?

A.2 Whether Plastic rivets not only being capable of being used in the fitment of trims on the body of a motor vehicle but in other industries for similar functionality, merits classification under Tariff item 3926 9099 and not under Tariff item 8708 9900?

Observations:

We, therefore, come to the conclusion that the subject products are covered under Chapter 7318 1600. Now, since the applicant is also selling these products to vehicle manufacturers, we will discuss their classification vis-a-vis Chapter 8708 (Parts and Accessories of the motor vehicles of headings 8701 to 8705). Here section Note 2(b) clearly states that the expressions “parts” and “parts and accessories” do not apply to parts of general use, as defined in Note 2 to Section XV, of base metal (Section XV). Thus, it is clear that the subject goods which in our opinion, are parts of general use, are barred from being considered as parts and accessories of motor vehicles.

in view of the above, we agree with both, the applicant as well as the jurisdictional officer that the subject goods namely, ‘Metal nuts with metrical threads, Metal nuts without metrical threads and Metal Spring nuts’ should be classified under Chapter 7318 1600 since the said goods are being supplied to be used in many fields including electronic goods, solar energy, and vehicles.

Ruling:

For reasons as discussed in the body of the order, the questions are answered thus-

Q.No. A.1 Whether threaded metal nuts which function the same as standard nut, merits classification under the Tariff item 7318 1600 and not under Tariff item 8708 9900?

Answer:- In view of the discussion made above, Threaded metal nuts merit classification under the Tariff item 7318 1600.

Read & Download the full decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.