[Stayed by Calcutta HC] TDS on Cash Withdrawal u/s 194N wef 1st July 2020

Calcutta high court stayed this section-

The section is challanged in Calcutta high court. It is celled ultra vires of the parliament. Considering the above facts, Justice Md. Nizamuddin granted an interim order restraining the respondent’s authorities concerned from deducting tax on the source on the basis of the aforesaid provisions of Section 194N till 30th September 2021. You can read the full story here.

Section 194 N: TDS on Cash Withdrawal

This section is introduced via the Finance Act 2020. TDS on cash withdrawal is applicable for a cash withdrawal from banks or financial institutions. The threshold to deduct TDS on Cash Withdrawal is Rs. 1 Crore. Thus the taxpayer will feel the heat of TDS on cash withdrawal.

But TDS is deductible only on the amount above Rs. 1 Crore. Also, this limit of one crore is for a year.

e.g. Mr.Cash crunch withdraws Rs. 50 lac on 1st April. Then he again withdraws Rs. 30 lac in May. On 30th June he again makes a withdrawal of Rs. 30 lacs. Now, TDS is deductible on Rs. 10 lac.

Related Topic:

ICAI announces various capacity building initiatives taken for Chartered Accountant in Practice

Rates of TDS on Cash Withdrawal:

The rates are revised from 1st July 2020. Up to 30th June 2020, the rate is 2%.

Who is liable to deduct TDS on cash withdrawal u/s 194 N of Income-tax Act?

Following entities are liable to deduct the TDS on Cash Withdrawal u/s 194N:

- Banks (including private or public sector banks)

- Co-operative banks

- Post office

Join our course on Income Tax to make your career in Income Tax compliances.

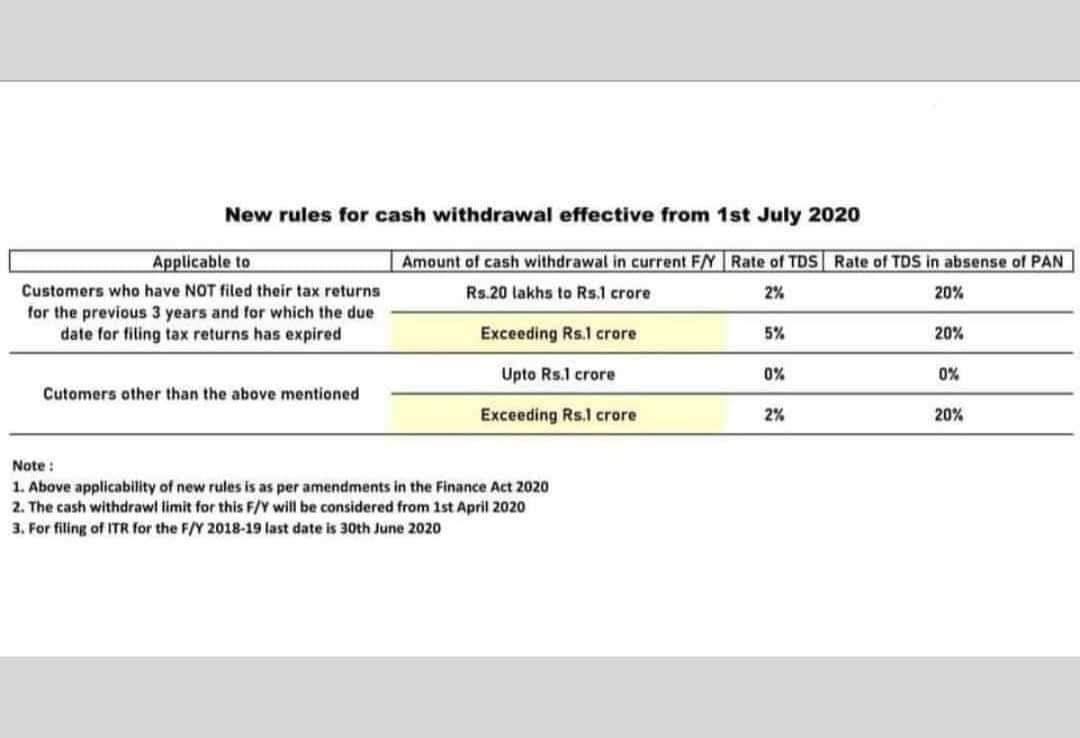

New Rules for TDS on Cash Withdrawal Effective From 1st July 2020

These rates are applicable from 1st July 2020. TDS rates for the absence of PAN are 20%. Because the government wants to link the PAN with financial transactions. Also, the non-filing of returns in the last three years may cost higher in terms of TDS. The limit is also amended. Earlier it was Rs. 1 Crore. But now for non-filers of return, it starts from rs. 20 lac.

| Applicable to | Amount of Cash Withdrawal in Current F/Y | Rate of TDS | Rate of TDS in the absence of PAN |

| Customers who have NOT filed their tax returns for the previous 3 years and for which the due date for filing the tax returns has expired | Rs. 20 Lakhs to Rs. 1 Crore | 2% | 20% |

| Exceeding Rs. 1 Crore | 5% | 20% | |

| Customers other than the above mentioned | Up to Rs. 1 Crore | 0% | 0% |

| Exceeding Rs. 1 Crore | 2% | 20% |

Note:

- The above applicability of new rules is as per amendments in the Finance Act, 2020.

- The cash withdrawal limit for this F/Y will be considered from 1st April 2020.

- For filing of ITR for the F/Y 2018-19 last date is 30th June 2020.

Read the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.