What is RCM in GST, Who is covered & penalty

What is RCM in GST?

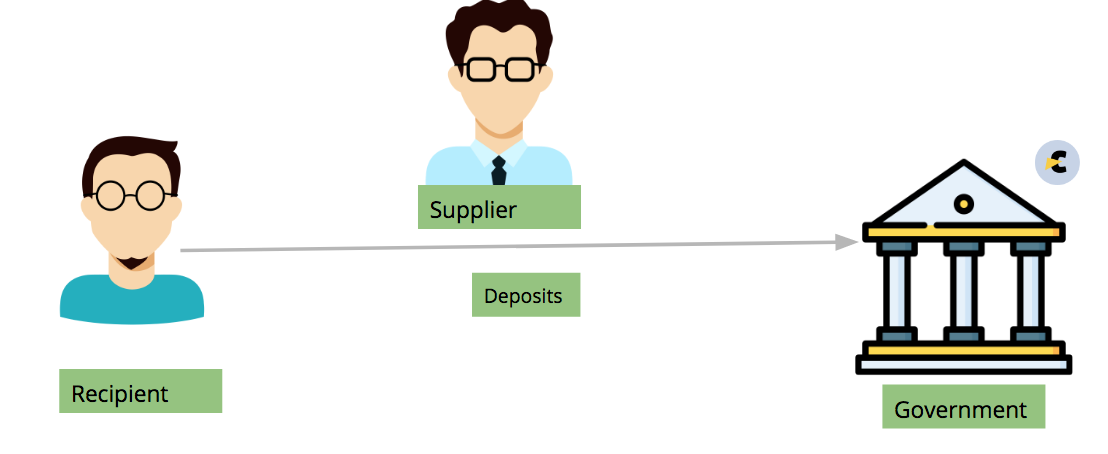

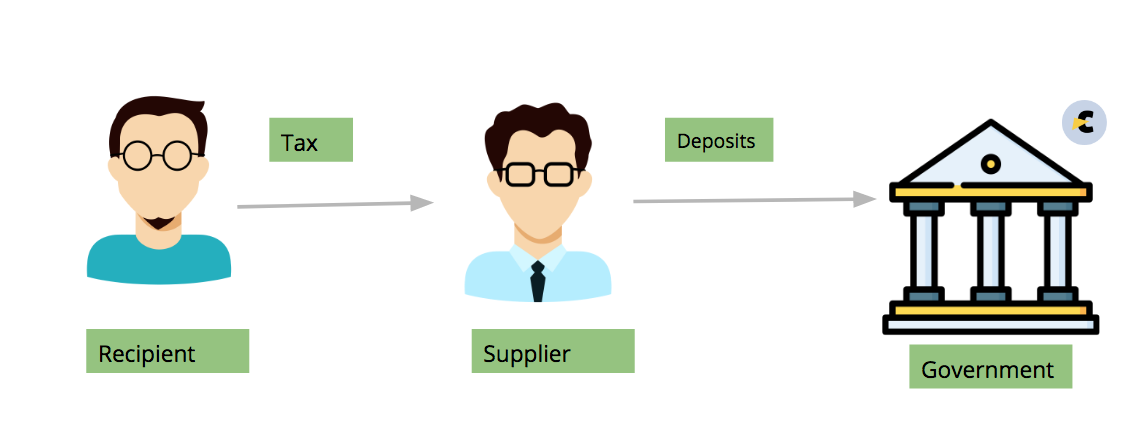

GST is also a value-added tax. We need to understand how GST works? The supplier collects the payment + tax from the recipient. Then he deposits that tax to the account of government. RCM is just one step lesser to it. In the case of RCM, the recipient himself deposits the tax to the government. This mechanism is called RCM in GST. It is also called a reverse charge mechanism. You can see the difference in RCM in image one and FCM in image 2.

Process in RCM

Process in a normal transaction

Related Topic:

RCM on services by a Director in GST

Who is liable to pay tax in RCM in GST?

A person covered by any of the following two sections is liable for RCM in GST.

- Section 9(3): For purchase of Goods notified by notification no. 4/2017 CTR& for services items covered in notification no. 13/2017 CTR as amended.

- Section 9(4): It is levied on notified purchase form an unregistered person.

Related Topic:

Can I claim the ITC of RCM in next year?

How an invoice is made for RCM (Reverse Charge) supplies?

There can be two scenarios:

- Purchase from a registered person: In this case invoice is made by the registered person himself. But he is not liable to pay tax. Thus he can mention in the invoice that tax is leviable on the RCM basis.

- Purchase from an unregistered person: In this case, the recipient is liable to make an invoice. It is called self invoicing.

Related Topic:

Reverse charge in GST: List updated 03.10.2019

How to take an input tax credit for Reverse charge (RCM) Supply?

The input tax credit is available in case of reverse charge payment The Taxpayer is required to make the payment of tax and then take its ITC in the same month. Restriction of section 16(4) is also applicable to ITC of RCM. You need to take the ITC before the last date of return of September return.

Related Topic:

GST on Sale of Old Vehicles ( From 1.1.17 Till Date)

How to show the RCM amount in GST return?

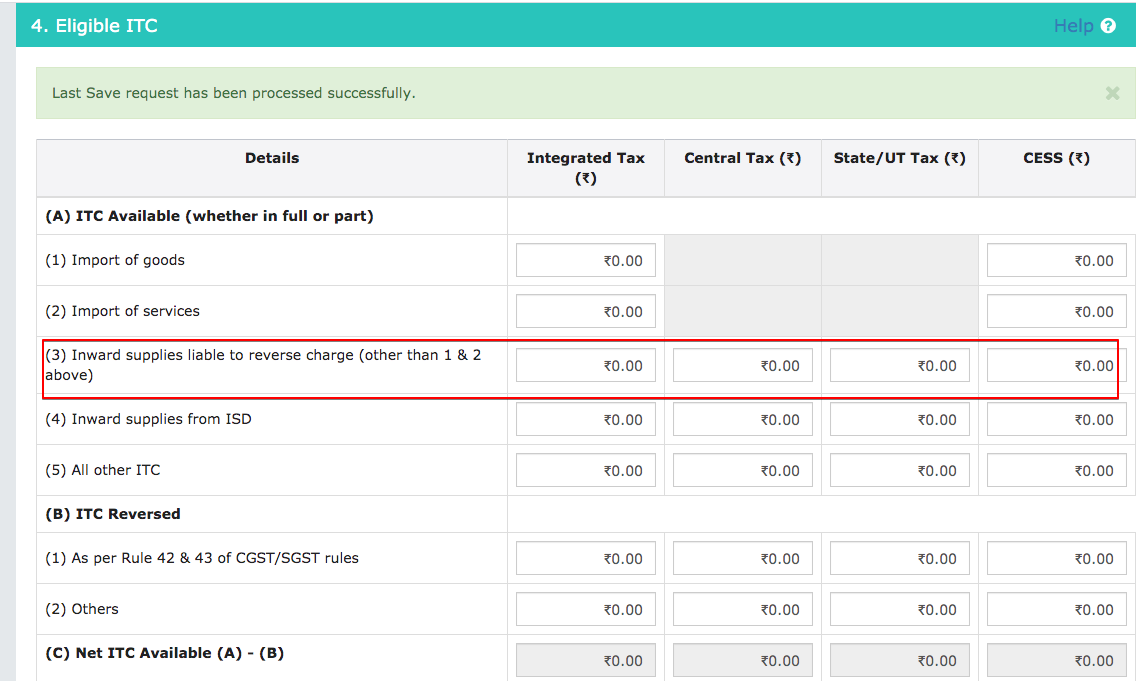

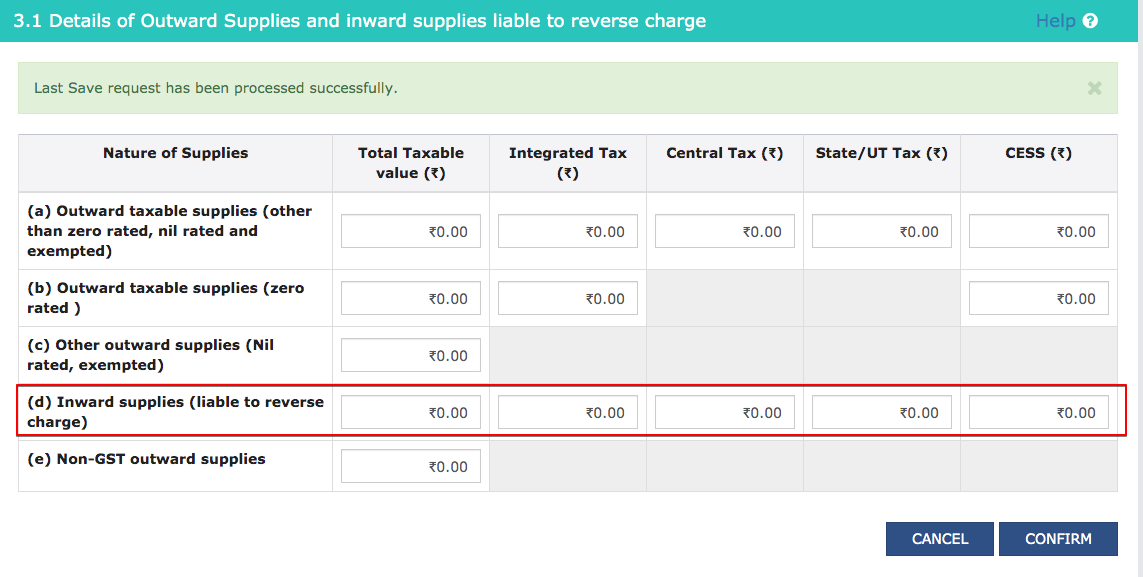

In GSTR 3b it is shown in two places.

In table 3.1.d: Inward supplies (liable to reverse charge)

Secondly, it is shown in table no. 4.3 as ITC.

Related Topic:

Raj Quarry works ,AAR Gujarat Royalty to state government is liable for RCM

Thus it is mentioned in the purchase as well as ITC. We can take this ITC instantly.

Thus you can refer to the above image to see how it is entered at the GST portal.

What are the important supplies covered in RCM (Reverse Charge) in GST?

Although there is a long list a brief list for general use is here.

- GTA or transporter is the payable amount is more than Rs. 750 for multiple loads and Rs. 1500 for a single load.

- Advocate

- Director payments other than Salary

- Ocean freight

- Sponsorship services

- Recovery Agent to bank or Agent to insurance company service, Bank or Insurance company is liable for RCM.

- Security services

In the case of goods following are covered in RCM:

- Cashew nuts, not shelled or Peeled

- Bidi wrapper leaves (tendu)

- Tobacco leaves

- Silk yarn

- Raw Cotton

- Supply of lottery.

- Used vehicles, seized and confiscated goods, old and used goods, waste and Scrap

- Priority Sector Lending Certificate

These goods are covered in RCM in GST. Thus you need to remember this list. You don’t need to bother for other supplies. Because this provision is limited to the notified list of items.

Related Topic:

RCM on renting of motor vehicle amended via 29/2019-CTR dt. 31-12-2019

List of GST reverse charge notification –

The base notification for GST reverse charge in 13/2017 & 4/2017. But they are updated from time to time. The Following list can help you to trace all those notifications.

Services – 13/2017

Amended by:

I- 22/2017 CTR

II- 33/2017 CTR

III- 3/2018 CTR

IV- 15/2018 CTR

V- 29/2018 CTR

VI- 5/2019 CTR

VII- 22/2019 CTR

VIII- 29/2019 CTR

Read updated reverse charge notification here.

Goods- 4/2017

Amended by:

Related Topic:

Important issues related to RCM on supply of security personnel

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.