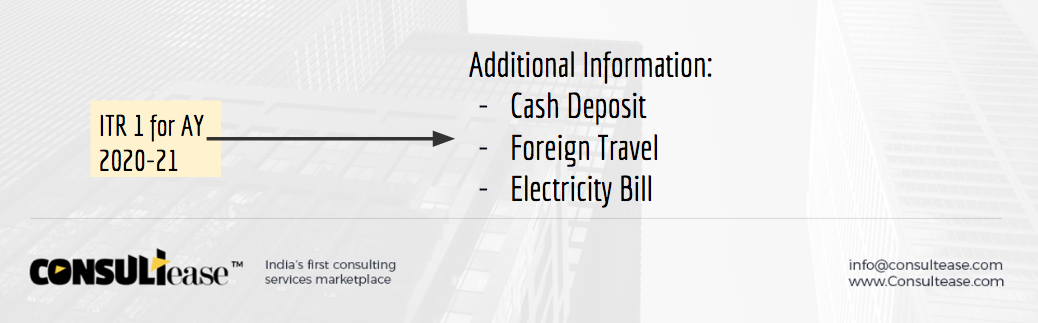

Additional information in ITR 1 for AY 2020-21

Who can file?

Income tax forms are released by CBDT. ITR 1 for AY 2020-21 is also notified. It is also called ITR SUGAM. There is some additional information required this year. The basic form for an Income-tax return in ITR 1. It can be filed by the entire salary class except for some exceptions.(See all notified Forms for FY 2020-21 here)

- Non Resident

- Income more than Rs. 50 lac

- Agriculture income more than Rs. 5000

- Income from heads other than Salary and house property. (Only up to one house property)

Where to access this form?

It can be downloaded from the website of income tax. You can download its excel utility. It can be filled by the assessee himself. You can also use some software to file it. But Softwares are more useful for consultants who are required to file any returns. Individual can file it via utility downloaded from the income tax portal easily.

Whether the form is the same for all years?

No, The forms are notified by CBDT for every year. They are not the same. Information in income tax form changes every year. Only the notified form for a particular year can be used to file that year’s return.

When an Income tax return is mandatory?

If the revenue is more than Rs. 5 lac in a year. The income tax return is mandatory.

What is additional information required in ITR 1 of AY 2020-21?

ITR 1 for AY 2020-21 is notified. It contains the following additional information for this year.

Cash Deposit

Have you deposited amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current account during the previous year? (Yes/No). A checkbox is there in form to fill.

Foreign Travel:

Have you incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person? (Yes/ No)

Electricity Bill:

Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on consumption of electricity during the previous year? (Yes/No)

The amount of all of these three will be filled in blank space given in the form. You can fill the amount there. Most of the other parts of the return are the same. The utility of these forms can be downloaded from the income tax website.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.