Remuneration to be Paid to Fund Manager of EIF

The Income-Tax( 10th Amendment) Rules, 2020 notified by CBDT in the exercise of the powers conferred by Section 295 of the Income Tax Act, 1961. Vide this notification Section 9A has been amended which deals with the provisions regarding the remuneration to be paid by a fund to the fund manager, eligible Investment Fund, FORM No. 3CEJA & FORM No 3CEK.

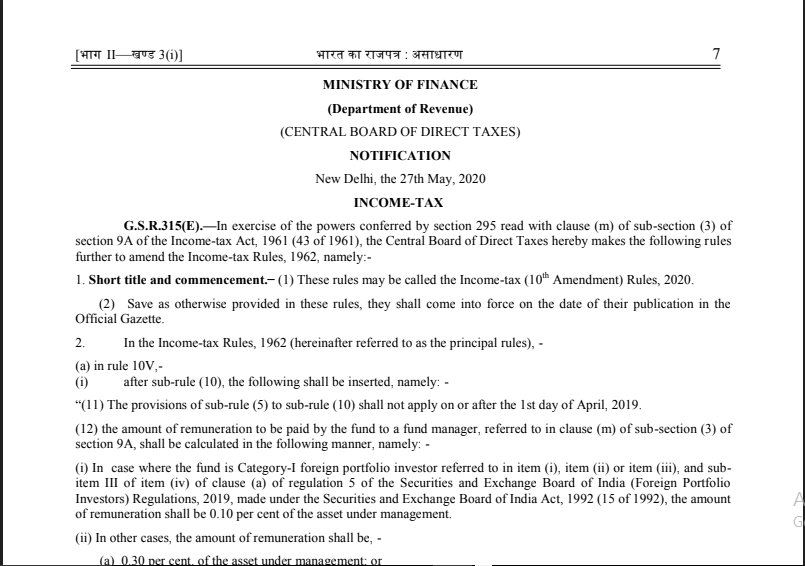

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 27th May 2020

INCOME-TAX

G.S.R.315(E).—In exercise of the powers conferred by section 295 read with clause (m) of sub-section (3) of section 9A of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:-

1. (1) These rules may be called the Income-tax (10th Amendment) Rules, 2020.

(2) Save as otherwise provided in these rules, they shall come into force on the date of their publication in the Official Gazette.

2. In the Income-tax Rules, 1962 (hereinafter referred to as the principal rules), –

(a) in rule 10V,-

(i) after sub-rule (10), the following shall be inserted, namely: –

“(11) The provisions of sub-rule (5) to sub-rule (10) shall not apply on or after the 1st day of April 2019.

(12) the amount of remuneration to be paid by the fund to a fund manager referred to in clause (m) of sub-section (3) of section 9A, shall be calculated in the following manner, namely: –

(i) In a case where the fund is Category-I foreign portfolio investor referred to in item (i), item (ii) or item (iii), and sub-item III of the item (iv) of clause (a) of regulation 5 of the Securities and Exchange Board of India (Foreign Portfolio Investors) Regulations, 2019, made under the Securities and Exchange Board of India Act, 1992 (15 of 1992), the amount of remuneration shall be 0.10 percent of the asset under management.

(ii) In other cases, the amount of remuneration shall be, –

(a) 0.30 percent. of the asset under management; or

(b) 10 percent. of profits derived by the fund in excess of the specified hurdle rate from the fund management activity is undertaken by the fund manager, where it is entitled only to remuneration linked to the income or profits derived by the fund; or

(c) 50 percent. of the management fee, whether in the nature of the fixed charge or linked to the income or profits derived by the fund from the management activity undertaken by the fund manager, paid by such fund in respect of the fund management activity is undertaken by the fund manager as reduced by the amount incurred towards operational expenses including distribution expenses if any:

Provided that the provisions of this sub-clause shall apply only in case the fund is also making payment of management fee to any other fund manager :

Provided further that in the case where the amount of remuneration is lower than the amount arrived at under clause (i) or clause (ii), the fund may, at its option, apply to the Member, Central Board of Direct Taxes referred to in sub-rule (2) of rule 10VA seeking approval of the Board under the said rule for that lower amount to be the amount of remuneration, and, on receipt of such application, the Board may, after satisfying itself considering the relevant facts, approve such lower amount to be the amount of remuneration.

Explanation – For the purposes of this rule.-

(a) “asset under management ” means the annual average of the monthly average of the opening and closing balance of the value of such part of the fund which is managed by the fund manager;

(b) “management fee” mean he amount as mentioned in the certificate obtained from an accountant, as defined in clause

(i) of Explanation to rule 11UB, for this purpose;

(c) “ specified hurdle rate” means a pre-defined threshold beyond which the fund agrees to pay a share of the profits earned by the fund from the fund management activity undertaken by the fund manager.

(13) The fund manager shall, in addition to any report required to be furnished by it under section 92E, obtain a report from the accountant in respect of activity undertaken for the fund and furnish such report on or before the specified date in the Form No. 3CEJA duly verified by such accountant in the manner indicated therein and all the provisions of the Act shall apply as if it is a report to be furnished under section 92E.”;

(ii) sub-rule (11) and sub-rule (12) shall be renumbered as sub-rule (14) and sub-rule (15) respectively ”;

(b) In the principal rules, in Appendix II, –

(i) after Form No 3CEJ, the following shall be inserted, namely: –

Read & Download Notification in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.