MCA clarified that any contribution made to PM CARES Fund shall qualify as CSR expenditure under the CA, 2013

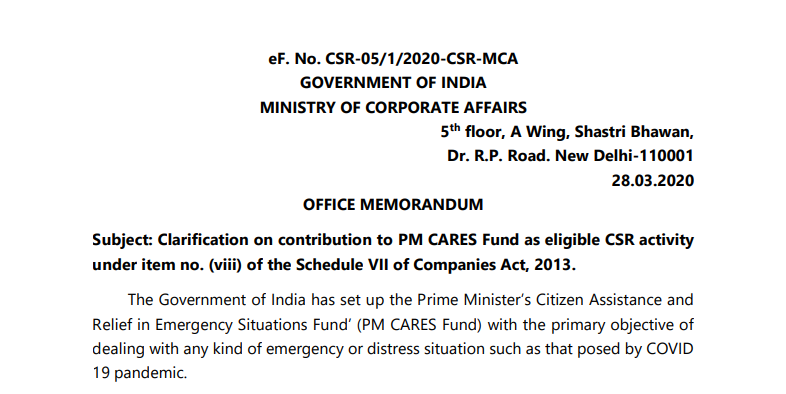

OFFICE MEMORANDUM

Subject: Clarification on contribution to PM CARES Fund as eligible CSR activity under item no. (viii) of the Schedule VII of Companies Act, 2013.

The Government of India has set up the Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund’ (PM CARES Fund) with the primary objective of dealing with any kind of emergency or distress situation such as that posed by COVID 19 pandemic.

2. Item no. (viii) of Schedule VII of the Companies Act, 2013, which enumerates activities that may be undertaken by companies in the discharge of their CSR obligations, inter alia provides that contribute to any fund set up by the Central Government for socio-economic development and relief qualifies as CSR expenditure. The PM-CARES Fund has been set up to provide relief to those affected by any kind of emergency or distress situation. Accordingly, it is clarified that any contribution made to the PM CARES Fund shall qualify as CSR expenditure under the Companies Act 2013.

3. This issues with the approval of the competent authority.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.