THE FOREIGN TRADE (DEVELOPMENT AND REGULATION) ACT, 1992

THE FOREIGN TRADE (DEVELOPMENT AND REGULATION) ACT, 1992:

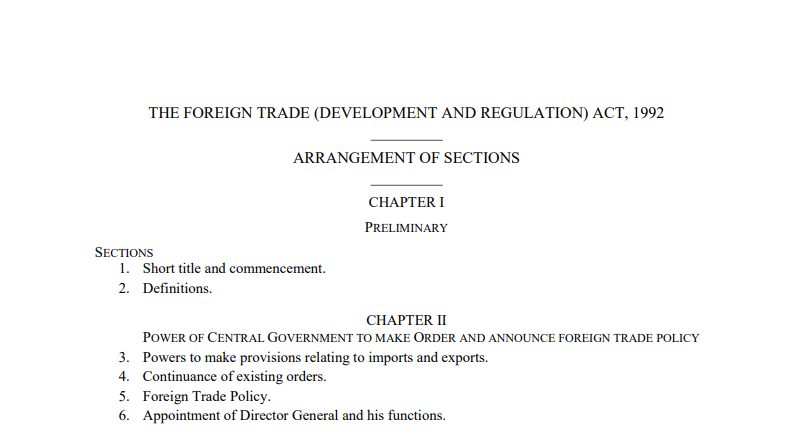

ARRANGEMENT OF SECTIONS CHAPTER I PRELIMINARY SECTIONS 1. Short title and commencement. 2. Definitions. CHAPTER II POWER OF CENTRAL GOVERNMENT TO MAKE ORDER AND ANNOUNCE FOREIGN TRADE POLICY 3. Powers to make provisions relating to imports and exports. 4. Continuance of existing orders. 5. Foreign Trade Policy. 6. Appointment of Director General and his functions. CHAPTER III IMPORTER-EXPORTER CODE NUMBER AND LICENCE 7. Importer-exporter Code Number. 8. Suspension and cancellation of Importer-exporter Code Number. 9. Issue, suspension and cancellation of licence. CHAPTER IIIA QUANTITATIVE RESTRICTIONS 9A.Power of Central Government to impose quantitative restrictions. CHAPTER IV SEARCH, SEIZURE, PENALTY AND CONFISCATION 10. Power relating to search and seizure. 11. Contravention of provisions of this Act, rules, orders and foreign trade policy. 11A. Crediting sums realised by way of penalties in Consolidated Fund of India 11B. Empowering Settlement Commission for regularisation of export obligation default 12. Penalty or confiscation not to interfere with other punishment. 13. Adjudicating Authority. 14. Giving of opportunity to the owner of the goods (including the goods connected with services or technology), etc. CHAPTER IVA CONTROLS ON EXPORT OF SPECIFIED GOODS, SERVICES AND TECHNOLOGY 14A. Controls on export of specified goods, services and technology. 14B. Transfer controls. 14C. Catch-all controls. 14D. Suspension or cancellation of a licence. 14E. Offences and penalties. CHAPTER V APPEAL AND REVIEW SECTIONS 15. Appeal. 16. Review. 17. Powers of Adjudicating and other Authorities. CHAPTER VI MISCELLANEOUS 18. Protection of action taken in good faith. 18A. Application of other laws not barred. 19. Power to make rules. 20. Repeal and savings. THE FOREIGN TRADE (DEVELOPMENT ANDREGULATION) ACT, 1992 ACT NO. 22 OF 1992 [7th August, 1992.] An Act to provide for the development and regulation of foreign trade by facilitating imports into, and augmenting exports from, India and for matters connected therewith or incidental thereto. BE it enacted by Parliament in the Forty-third Year of the Republic of India as follows:— CHAPTER I PRELIMINARY 1. Short title and commencement.—(1) This Act may be called the Foreign Trade (Development and Regulation) Act, 1992. (2) Sections 11 to 14 shall come into force at once and the remaining provisions of this Act shall be deemed to have come into force on the 19th day of June, 1992. 2. Definitions.—In this Act, unless the context otherwise requires,— (a) “Adjudicating Authority” means the authority specified in, or under, section 13; (b) “Appellate Authority” means the authority specified in, or under, sub-section (1) of section 15; (c) “conveyance” means any vehicle, vessel, aircraft or any other means of transport including any animal; (d) “Director General” means the Director General of ForeignTrade appointed under section 6; 1 [(e) “import” and “export” means,— (I) in relation to goods, bringing into, or taking out of, India any goods by land, sea or air; (II) in relation to services or technology,— (i) supplying, services or technology— (A) from the territory of another country into the territory of India; (B) in the territory of another country to an Indian service consumer; (C) by a service supplier of another country, through commercial presence in India; (D) by a service supplier of another country, through presence of their natural persons in India; (ii) supplying, services or technology— (A) from India into the territory of any other country; (B) in India to the service consumer of any other country; (C) by a service supplier of India, through commercial presence in the territory of any other country; (D) by a service supplier of India, through presence of Indian natural persons in the territory of any other country: Provided that “import” and “export” in relation to the goods, services and technology regarding Special Economic Zone or between two Special Economic Zones shall be governed in accordance with the provisions contained in the Special Economic Zones Act, 2005 (28 of 2005).] (f) “Importer-exporter Code Number” means the Code Number granted under section 7; (g) “licence” means a licence to import or export and includes a customs clearance permit and any other permission issued or granted under this Act; (h) “Order” means any Order made by the Central Government under section 3; and (i) “prescribed” means prescribed by rules made under thisAct. [(j) “services” means service of any description which is made available to potential users and includes all the tradable services specified under the General Agreement on Trade in Services entered into amongst India and other countries who are party to the said Agreement: Provided that, this definition shall not apply to the domain of taxation; (k) “service supplier” means any person who supplies a service and who intends to take benefit under the foreign trade policy; (l) “specified goods or services or technology” means the goods or services or technology, the export, import, transfer, re-transfer, transit and transshipment of which is prohibited or restricted because of imposition of conditions on the grounds of their being pertinent or relevant to India as a Nuclear Weapon State, or to the national security of India, or to the furtherance of its foreign policy or its international obligations under any bilateral, multilateral or international treaty, covenant, convention or arrangement relating to weapons of mass destruction or their means of delivery to which India is a party or its agreement with a foreign country under the foreign trade policy formulated and notified under section 5 of the Act; (m) “technology” means any information (including information embodied in software), other than information in the public domain, that is capable of being used in— (i) the development, production or use of any goods or software; (ii) the development of, or the carrying out of, an industrial or commercial activity or the provision of service of any kind. Explanation.—For the purpose of this clause— (a) when technology is described wholly or partly by reference to the uses to which it (or the goods to which it relates) may be put, it shall include services which are provided or used, or which are capable of being used in the development, production or use of such technology or goods; (b) “public domain” shall have the same meaning as assigned to it in clause (i) of section 4 of the Weapons of Mass Destruction and their Delivery System (Prohibition of Unlawful Activities) Act, 2005 (21 of 2005).] CHAPTER II POWER OF CENTRAL GOVERNMENT TO MAKE ORDER AND ANNOUNCE 2 [FOREIGN TRADE POLICY] 3. Powers to make provisions relating to imports and exports.—(1) The Central Government may, by Order published in the Official Gazette, make provision for the development and regulation of foreign trade by facilitating imports and increasing exports. (2) The Central Government may also, by Order published in the Official Gazette, make provision for prohibiting, restricting or otherwise regulating, in all cases or in specified classes of cases and subject to such exceptions, if any, as may be made by or under the Order, the 1 [import or export of goods or services or technology]: 2 [Provided that the provisions of this sub-section shall be applicable, in case of import or export of services or technology, only when the service or technology provider is availing benefits under the foreign trade policy or is dealing with specified services or specified technologies. (3) All goods to which any Order under sub-section (2) applies shall be deemed to be goods the import or export of which has been prohibited under section 11 of the Customs Act, 1962 (52 of 1962) and all the provisions of that Act shall have effect accordingly. 2 [(4) Without prejudice to anything contained in any other law, rule, regulation, notification or order, no permit or licence shall be necessary for import or export of any goods, nor any goods shall be prohibited for import or export except, as may be required under this Act, or rules or orders made thereunder.] 4. Continuance of existing orders.—All Orders made under the Imports and Exports (Control) Act, 1947 (18 of 1947), and in force immediately before the commencement of this Act shall, so far as they are not inconsistent with the provisions of this Act, continue to be in force and shall be deemed to have been made under this Act. [5. Foreign Trade Policy.—The Central Government may, from time to time, formulate and announce, by notification in the Official Gazette, the foreign trade policy and may also, in like manner, amend that policy: Provided that the Central Government may direct that, in respect of the Special Economic Zones, the foreign trade policy shall apply to the goods, services and technology with such exceptions, modifications and adaptations, as may be specified by it by notification in the Official Gazette.] 6. Appointment of Director General and his functions.—(1) The Central Government may appoint any person to be the Director General of Foreign Trade for the purposes of this Act. (2) The Director General shall advise the Central Government in the formulation of the 4 [foreign trade policy] and shall be responsible for carrying out that policy. (3) The Central Government may, by Order published in the Official Gazette, direct that any power exercisable by it under this Act (other than the powers under sections 3, 5, 15, 16 and 19) may also be exercised, in such cases and subject to such conditions, by the Director General or such other officer subordinate to the Director General, as may be specified in the Order. CHAPTER III IMPORTER-EXPORTER CODE NUMBER AND LICENCE 7. Importer-exporter Code Number.—No person shall make any import or export except under an Importer-exporter Code Number granted by the Director General or the officer authorised by the Director General in this behalf, in accordance with the procedure specified in this behalf by the Director General: 5 [Provided that in case of import or export of services or technology, the Importer-exporter Code Number shall be necessary only when the service or technology provider is taking benefits under the foreign trade policy or is dealing with specified services or specified technologies.] 8. Suspension and cancellation of Importer-exporter Code Number.—1 [(1) Where— (a) any person has contravened any of the provisions of this Act or any rules or orders made thereunder or the foreign trade policy or any other law for the time being in force relating to Central excise or customs or foreign exchange or has committed any other economic offence under any other law for the time being in force as may be specified by the Central Government by notification in the Official Gazette; or (b) the Director General or any other officer authorised by him has reason to believe that any person has made an export or import in a manner prejudicial to the trade relations of India with any foreign country or to the interests of other persons engaged in imports or exports or has brought disrepute to the credit or the goods of, or services or technology provided from, the country; or (c) any person who imports or exports specified goods or services or technology, in contravention of any provision of this Act or any rules or orders made thereunder or the foreign trade policy the Director General or any other officer authorised by him may call for the record or any other information from that person and may, after giving to that person a notice in writing informing him of the grounds on which it is proposed to suspend or cancel the Importer-exporter Code Number and after giving him a reasonable opportunity of making a representation in writing within such reasonable time as may be specified in the notice and, if that person so desires, of being heard, suspend for a period, as may be specified in the order, or cancel the Importer-exporter Code Number granted to that person.] (2) Where any Importer-exporter Code Number granted to a person has been suspended or cancelled under sub-section (1), that person shall not be entitled to 2 [import or export any goods or services or technology] except under a special licence, granted, in such manner and subject to such conditions as may be prescribed, by the Director General to that person. 9. Issue, suspension and cancellation of licence.—(1) The Central Government may levy fees, subject to such exceptions, in respect of such person or class of persons making an application for3 [licence, certificate, scrip or any instrument bestowing financial or fiscal benefits] of in respect of any 3 [licence, certificate, scrip or any instrument bestowing financial or fiscal benefits] granted or renewed in such manner as may be prescribed. [(2) The Director General or an officer authorised by him may, on an application and after making such inquiry as he may think fit, grant or renew or refuse to grant or renew a licence to import or export such class or classes of goods or services or technology as may be prescribed and, grant or renew or refuse to grant or renew a certificate, scrip or any instrument bestowing financial or fiscal benefit, after recording in writing his reasons for such refusal.]

(3) A 3 [licence, certificate, scrip or any instrument bestowing financial or fiscal benefits] granted or renewed under this section shall— (a) be in such form as may be prescribed; (b) be valid for such period as may be specified therein;and (c) be subject to such terms, conditions and restrictions as may be prescribed or as specified in the 3 [licence, certificate, scrip or any instrument bestowing financial or fiscal benefits] with reference to the terms, conditions and restrictions so prescribed. (4) The Director General or the officer authorised under sub-section (2) may, subject to such conditions as may be prescribed, for good and sufficient reasons, to be recorded in writing,suspend or cancel any 3 [licence, certificate, scrip or any instrument bestowing financial or fiscal benefits] granted under this Act: Provided that no such suspension or cancellation shall be made except after giving the holder of the 1 [licence, certificate, scrip or any instrument bestowing financial or fiscal benefits]a reasonable opportunity of being heard. (5) An appeal against an order refusing to grant, or renew or suspending or cancelling, a 1 [licence, certificate, scrip or any instrument bestowing financial or fiscal benefits] shall lie in like manner as an appeal against an order would lie under section 15. 2 [CHAPTER IIIA QUANTITATIVE RESTRICTIONS 9A. Power of Central Government to impose quantitative restrictions.—(1) If the Central Government, after conducting such enquiry as it deems fit, is satisfied that any goods are imported into India in such increased quantities and under such conditions as to cause or threaten to cause serious injury to domestic industry, it may, by notification in the Official Gazette, impose such quantitative restrictions on the import of such goods as it may deem fit: Provided that no such quantitative restrictions shall be imposed on any goods originating from a developing country so long as the share of imports of such goods from that country does not exceed three per cent. or where such goods originate from more than one developing country, then, so long as the aggregate of the imports from all such countries taken together does not exceed nine per cent. of the total imports of such goods into India. (2) The quantitative restrictions imposed under this section shall, unless revoked earlier, cease to have effect on the expiry of four years from the date of such imposition: Provided that if the Central Government is of the opinion that the domestic industry has taken measures to adjust to such injury or threat thereof and it is necessary that the quantitative restrictions should continue to be imposed to prevent such injury or threat and to facilitate the adjustments, it may extend the said period beyond four years: Provided further that in no case the quantitative restrictions shall continue to be imposed beyond a period of ten years from the date on which such restrictions were first imposed. (3) The Central Government may, by rules provide for the manner in which goods, the import of which shall be subject to quantitative restrictions under this section, may be identified and the manner in which the causes of serious injury or causes of threat of serious injury in relation to such goods may be determined. (4) For the purposes of this section— (a) “developing country” means a country notified by the Central Government in the Official Gazette, in this regard; (b) “domestic industry” means the producers of goods (including producers of agricultural goods)— (i) as a whole of the like goods or directly competitive goods in India; or (ii) whose collective output of the like goods or directly competitive goods in India constitutes a major share of the total production of the said goods in India; (c) “serious injury” means an injury causing significant overall impairment in the position of a domestic industry; (d) “threat of serious injury” means a clear and imminent danger of serious injury.] CHAPTER IV SEARCH, SEIZURE, PENALTY AND CONFISCATION 10. Power relating to search and seizure.—1 [(1) The Central Government may, by notification in the Official Gazette, authorise any person for the purposes of exercising such powers with respect to,— (a) entering such premises where the goods are kept, stored or processed, manufactured, traded or supplied or received for the purposes of import or export and searching, inspecting and seizing of such goods, documents, things and conveyances connected with such import and export of goods; (b) entering such premises from which the services or technology are being provided, supplied, received, consumed or utilised and searching, inspecting and seizing of such goods, documents, things and conveyances connected with such import and export of services and technology, subject to such requirements and conditions and with the approval of such officer, as may be prescribed: Provided that the provisions of clause (b) shall be applicable, in case of import or export of services or technology, only when the service or technology provider is availing benefit under the foreign trade policy or is dealing with specified services or specified technologies.] (2) The provisions of the Code of Criminal Procedure, 1973 (2 of 1974) relating to searches and seizures shall, so far as may be, apply to every search and seizure made under this section. [11. Contravention of provisions of this Act, rules, orders and foreign trade policy.—(1) No export or import shall be made by any person except in accordance with the provisions of this Act, the rules and orders made thereunder and the foreign trade policy for the time being in force. (2) Where any person makes or abets or attempts to make any export or import in contravention of any provision of this Act or any rules or orders made thereunder or the foreign trade policy, he shall be liable to a penalty of not less than ten thousand rupees and not more than five times the value of the goods or services or technology in respect of which any contravention is made or attempted to be made, whichever is more (3) Where any person signs or uses, or causes to be made, signed or used, any declaration, statement or document submitted to the Director General or any officer authorised by him under this Act, knowing or having reason to believe that such declaration, statement or document is forged or tampered with or false in any material particular, he shall be liable to a penalty of not less than ten thousand rupees or more than five times the value of the goods or services or technology in respect of which such declaration, statement or document had been submitted, whichever is more. (4) Where any person, on a notice to him by the Adjudicating Authority, admits any contravention, the Adjudicating Authority may, in such class or classes or cases and in such manner as may be prescribed, determine, by way of settlement, an amount to be paid by that person. (5) A penalty imposed under this Act may, if it is not paid by any person, be recovered by any one or more of the following modes, namely:— (a) the Director General may deduct or require any officer subordinate to him to deduct the amount payable under this Act from any money owing to such person which may be under the control of such officer; or (b) the Director General may require any officer of customs to deduct the amount payable under this Act from any money owing to such person which may be under the control of such officer of customs, as if the said amount is payable under the Customs Act, 1962 (52 of 1962); or (c) the Director General may require the Assistant Commissioner of Customs or Deputy Commissioner of Customs or any other officer of Customs to recover the amount so payable by detaining or selling any goods (including the goods connected with services or technology) belonging to such person which are under the control of the Assistant Commissioner of Customs or Deputy Commissioner or Customs or any other officer of Customs, as if the said amount is payable under the Customs Act, 1962 (52 of 1962); or (d) if the amount cannot be recovered from such person in the manner provided in clauses (a), (b) and (c),— (i) the Director General or any officer authorised by him may prepare a certificate signed by him specifying the amount due from such person and send it to the Collector of the District in which such person owns any property or resides or carries on business and the said Collector on receipt of such certificate shall proceed to recover from such person the amount specified thereunder as if it were an arrear of land revenue; or (ii) the Director General or any officer authorised by him (including an officer of Customs who shall then exercise his powers under the Customs Act, 1962 (52 of 1962) ) and in accordance with the rules made in this behalf, detain any movable or immovable property belonging to or under the control of such person, and detain the same until the amount payable is paid, as if the said amount is payable under the Customs Act, 1962; and in case, any part of the said amount payable or of the cost of the distress or keeping of the property, remains unpaid for a period of thirty days next after any such distress, may cause the said property to be sold and with the proceeds of such sale, may satisfy the amount payable and costs including cost of sale remaining unpaid and shall render the surplus, if any to such person. (6) Where the terms of any bond or other instrument executed under this Act or any rules made thereunder provide that any amount due under such instrument may be recovered in the manner laid down in sub-section (5), the amount may, without prejudice to any other mode of recovery, be recovered in accordance with the provisions of that sub-section. (7) Without prejudice to the provisions contained in this section, the Importer-Exporter Code Number of any person who fails to pay any penalty imposed under this Act, may be suspended by the Adjudicating Authority till the penalty is paid or recovered, as the case may be. (8) Where any contravention of any provision of this Act or any rules or orders made thereunder or the foreign trade policy has been, is being, or is attempted to be, made, the goods (including the goods connected with services or technology) together with any package, covering or receptacle and any conveyances shall, subject to such conditions and requirement as may be prescribed, be liable to confiscation by the Adjudicating Authority. (9) The goods (including the goods connected with services or technology) or the conveyance confiscated under sub-section (8) may be released by the Adjudicating Authority, in such manner and subject to such conditions as may be prescribed, on payment by the person concerned of the redemption charges equivalent to the market value of the goods or conveyance, as the case may be.] [11A. Crediting sums realised by way of penalties in Consolidated Fund of India.—All sums realised by way of penalties under this Act shall be credited to the Consolidated Fund of India. 11B. Empowering Settlement Commission for regularisation of export obligation default.— Settlement of customs duty and interest thereon as ordered by the Settlement Commission as constituted under section 32 of the Central Excise Act, 1944 (1 of 1944), shall be deemed to be a settlement under this Act.] 12. Penalty or confiscation not to interfere with other punishments.—No penalty imposed or confiscation made under this Act shall prevent the imposition of any other punishment to which the person affected thereby is liable under any other law for the time being in force 13. Adjudicating Authority.—Any penalty may be imposed or any confiscation may be adjudged under this Act by the Director General or, subject to such limits as may be specified, by such other officer as the Central Government may, by notification in the Official Gazette, authorise in this behalf. 14. Giving of opportunity to the owner of the 1 [goods (including the goods connected with services or technology)], etc.—No order imposing a penalty or of adjudication of confiscation shall be made unless the owner of the 1 [goods (including the goods connected with services or technology)] or conveyance, or other person concerned, has been given a notice in writing— (a) informing him of the grounds on which it is proposed to impose a penalty or to confiscate such 1 [goods (including the goods connected with services or technology)] or conveyance; and (b) to make a representation in writing within such reasonable time as may be specified in the notice against the imposition of penalty or confiscation mentioned therein, and, if he so desires, of being heard in the matter. [CHAPTER IVA CONTROLS ON EXPORT OF SPECIFIED GOODS, SERVICES AND TECHNOLOGY 14A. Controls on export of specified goods, services and technology.—(1) In regard to controls on export of specified goods, services and technology referred to in this Chapter, the Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Act, 2005 (21 of 2005) shall apply to exports, transfers, re-transfers, brought in transit, trans-shipment of, and brokering in specified goods, technology or services. (2) All terms, expressions or provisions of the Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Act, 2005 (21 of 2005) shall apply to the specified goods, services or technology with such exceptions, modifications and adaptations as may be specified by the Central Government by notification in the Official Gazette.

(3) The Central Government may, by notification in the Official Gazette, direct that any of the provisions of this Chapter— (a) shall not apply to any goods, services or technologies, or (b) shall apply to any goods, services or technologies with such exceptions, modifications and adaptations as may be specified in the notification. 14B. Transfer controls.—(1) The Central Government may, by notification in the Official Gazette, make rules in conformity with the provisions of the Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Act, 2005 (21 of 2005) for, or, in connection with, the imposition of controls in relation to transfer of specified goods, services or technology. (2) No goods, services or technology notified under this Chapter shall be exported, transferred, re-transferred, brought in transit or transshipped except in accordance with the provisions of this Act, the Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Act, 2005 (21 of 2005) or any other relevant Act. 14C. Catch-all controls.—No person shall export any material, equipment or technology knowing that such material, equipment or technology is intended to be used in the design or manufacture of a biological weapon, chemical weapon, nuclear weapon or other nuclear explosive device, or in their missile delivery systems. 14D. Suspension or cancellation of a licence.—The Director General or an officer authorised by him may, by order, suspend or cancel a licence to import or export of specified goods or services or technology without giving the holder of the licence a reasonable opportunity of being heard but such person shall be given a reasonable opportunity of being heard within six months of such order and thereupon the Director General or the officer so authorised may, if necessary, by order in writing, confirm, modify or revoke such order. 14E. Offences and penalties.—(1) In case of a contravention relating to specified goods, services or technologies, the penalty shall be in accordance with the provisions of the Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Act, 2005 (21 of 2005). (2) Where any person contravenes or attempts to contravene or abets, any of the provision(s) of this Chapter in relation to import or export of any specified goods or services or technology, he shall, without prejudice to any penalty which may be imposed on him, be punishable with imprisonment for a term stipulated in the Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Act, 2005 (21 of 2005). (3) No court shall take cognizance of any offence punishable under this Chapter without the previous sanction of the Central Government or any officer authorised in this behalf by the Central Government by general or special order.] CHAPTER V APPEAL AND 1 [REVIEW] 15. Appeal.—(1) Any person aggrieved by any decision or order made by the Adjudicating Authority under this Act may prefer an appeal,— (a) where the decision or order has been made by the Director General, to the Central Government; (b) where the decision or order has been made by an officer subordinate to the Director General, to the Director General or to any officer superior to the Adjudicating Authority authorised by the Director General to hear the appeal, within a period of forty-five days from the date on which the decision or order is served on such person: Provided that the Appellate Authority may, if it is satisfied that the appellant was prevented by sufficient cause from preferring the appeal within the aforesaid period, allow such appeal to be preferred within a further period of thirty days: Provided further that in the case of an appeal against a decision or order imposing a penalty or redemption charges, no such appeal shall be entertained unless the amount of penalty or redemption charges has been deposited by the appellant: Provided also that, where the Appellate Authority is of opinion that the deposit to be made will cause undue hardship to the appellant, it may, at its discretion, dispense with such deposit either unconditionally or subject to such conditions as it may impose. (2) The Appellate Authority may, after giving to the appellant a reasonable opportunity of being heard, if he so desires, and after making such further inquiries, if any, as it may consider necessary, make such orders as it thinks fit, confirming, modifying or reversing the decision or order appealed against, or may send back the case with such directions, as it may think fit, for a fresh adjudication or decision, as the case may be, after taking additional evidence, if necessary: Provided that an order enhancing or imposing a penalty or redemption charges or confiscating 2 [the goods (including the goods connected with services or technology)] of a greater value shall not be made under this section unless the appellant has been given an opportunity of making a representation, and, if he so desires, of being heard in his defence. (3) The order made in appeal by the Appellate Authority shall be final. [16. Review.—The Central Government, in the case of any decision or order made by the Director General, or the Director General in the case of any decision or order made by any officer subordinate to him, may on its or his own motion or otherwise, call for and examine the records of any proceeding, for the purpose of satisfying itself or himself, as the case may be, as to the correctness, legality or propriety of such decision or order and make such orders thereon as may be deemed fit: Provided that no decision or order shall be varied under this section so as to prejudicially affect any person unless such person— (a) has, within a period of two years from the date of such decision or order, received a notice to show cause why such decision or order shall not be varied; and (b) has been given a reasonable opportunity of making representation and, if he so desires, of being heard in his defence.] 17. Powers of Adjudicating and other Authorities.—(1) Every authority making any adjudication or hearing any appeal or exercising any powers of 1 [review] under this Act shall have all the powers of a civil court under the Code of Civil Procedure, 1908 (5 of 1908), while trying a suit, in respect of the following matters, namely:— (a) summoning and enforcing the attendance of witnesses; (b) requiring the discovery and production of any document; (c) requisitioning any public record or copy thereof from any court or office; (d) receiving evidence on affidavits; and (e) issuing commissions for the examination of witnesses or documents. (2) Every authority making any adjudication or hearing any appeal or exercising any powers of 1 [review] under this Act shall be deemed to be a civil court for the purposes of sections 345 and 346 of the Code of Criminal Procedure, 1973 (2 of 1974). (3) Every authority making any adjudication or hearing any appeal or exercising any powers of 1 [review] under this Act shall have the power to make such orders of an interim nature as it may think fit and may also, for sufficient cause, order the stay of operation of any decision or order. (4) Clerical or arithmetical mistakes in any decision or order or errors arising therein from any accidental slip or omission may at any time be corrected by the authority by which the decision or order was made, either on its own motion or on the application of any of the parties: Provided that where any correction proposed to be made under this sub-section will have the effect of prejudicially affecting any person, no such correction shall be made except after giving to that person a reasonable opportunity of making a representation in the matter and no such correction shall be made after the expiry of two years from the date on which such decision or order was made. CHAPTER VI MISCELLANEOUS 18. Protection of action taken in good faith.—No order made or deemed to have been made under this Act shall be called in question in any court, and no suit, prosecution or other legal proceeding shall lie against any person for anything in good faith done or intended to be done under this Act or any order made or deemed to have been made thereunder 2 [18A.Application of other laws not barred.—The provisions of this Act shall be in addition to, and not in derogation of, the provisions of any other law for the time being in force.] 19. Power to make rules.—(1) The Central Government may, by notification in the Official Gazette, make rules for carrying out the provisions of this Act. (2) In particular, and without prejudice to the generality of the foregoing power, such rules may provide for all or any of the following matters, namely:— (a) the manner in which and the conditions subject to which a special licence may be issued under sub-section (2) of section 8; (b) the exceptions subject to which and the person or class of persons in respect of whom fees may be levied and the manner in which a 1 [licence, certificate, scrip or any instrument bestowing financial or fiscal benefits] may be granted or renewed under sub-section (1) of section 9; 2 [(c) the class or classes of goods (including the goods connected with service or technology) for which a licence, certificate, scrip or any instrument bestowing financial or fiscal benefits may be granted under sub-section (2) of section 9;] (d) the form in which and the terms, conditions and restrictions subject to which1 [licence, certificate, scrip or any instrument bestowing financial or fiscal benefits] may be granted under sub-section (3) of section 9; (e) the conditions subject to which a 1 [licence, certificate, scrip or any instrument bestowing financial or fiscal benefits] may be suspended or cancelled under sub-section (4) of section 9; 3 [(ea) the matter in which goods the import of which shall be subject to quantitative restrictions, may be identified and the manner in which the causes of serious injury or causes of threat of serious injury in relation to such goods may be determined under sub-section (3) of section 9A;] (f) the premises,4 [goods (including the goods connected with the service or technology)], documents, things and conveyances in respect of which and the requirements and conditions subject to which power of entry, search, inspection and seizure may be exercised under sub-section (1) of section10; (g) the class or classes of cases for which and the manner in which an amount, by way of settlement, may be determined under 5 [sub-section (4) of section 11]; 6 [(h) the requirements and conditions subject to which goods (including the goods connected with the service or technology) and conveyances shall be liable to confiscation under sub-section (8) of section 11;] 7 [(i) the manner in which and the conditions subject to which goods (including the goods connected with the service or technology) and conveyances may be released on payment of redemption charges under sub-section (9) of section 11;] (j) any other matter which is to be, or may be, prescribed, or in respect of which provision is to be, or may be, made by rules. (3) Every rule and every Order made by the Central Government under this Act shall be laid, as soon as may be after it is made, before each House of Parliament, while it is in session, for a total period of thirty days which may be comprised in one session or in two or more successive sessions, and if, before the expiry of the session immediately following the session or the successive sessions aforesaid, both Houses agree in making any modification in the rule or the Order or both Houses agree that the rule or the Order should not be made, the rule or the Order, as the case may be, shall thereafter have effect only in such modified form or be of no effect, as the case may be; so, however, that any such modification or annulment shall be without prejudice to the validity of anything previously done under that rule or the Order. 20. Repeal and savings.—(1) The Imports and Exports (Control) Act, 1947 (18 of 1947) and the Foreign Trade (Development and Regulation) Ordinance, 1992 (Ord. 11 of 1992) are hereby repealed. (2) The repeal of the Imports and Exports (Control) Act, 1947 (18 of 1947) shall, however, not affect,— (a) the previous operation of the Act so repealed or anything duly done or suffered thereunder; or (b) any right, privilege, obligation or liability acquired, accrued or incurred under the Act so repealed; or (c) any penalty, confiscation or punishment incurred in respect of any contravention under the Act so repealed; or (d) any proceeding or remedy in respect of any such right, privilege, obligation, liability, penalty, confiscation or punishment as aforesaid, and any such proceeding or remedy may be instituted, continued or enforced, and any such penalty, confiscation or punishment may be imposed or made as if that Act had not been repealed. (3) Notwithstanding the repeal of the Foreign Trade (Development and Regulation) Ordinance, 1992 (Ord. 11 of 1992), anything done or any action taken under the said Ordinance shall be deemed to have been done or taken under the corresponding provisions of this Act. Download the copy:

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.