Market Committee is not a governmental authority: Parking services taxable

Case covered:

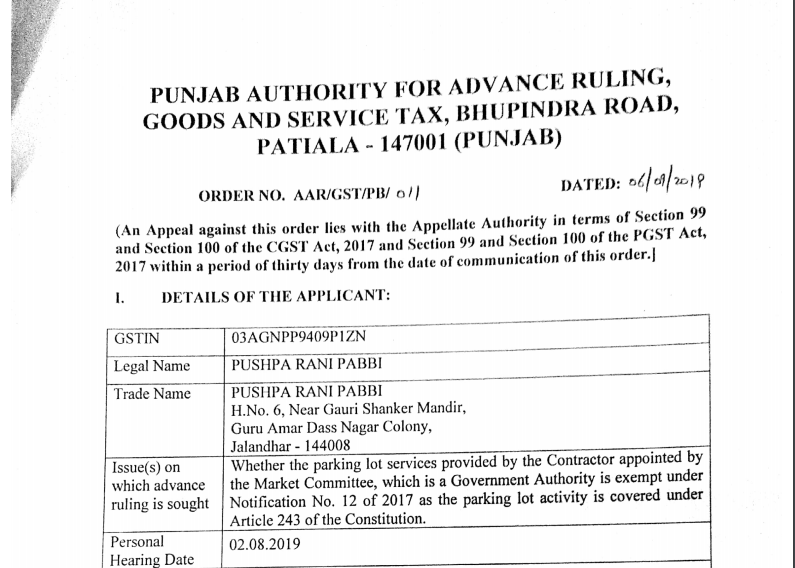

PUSHPA RANI PABBI

Facts of the case:

Pushpa Rani Pabbi(applicant) is a registered Proprietorship concern registered under the CGST Act,2017 and Punjab SGST Act, 2017 with GSTIN No. 03AGNPP9409PIZN. The applicant has been appointed as a contractor for providing parking lot services at the place of the market committee at Jalandhar. The applicant is of the view that the market committee is a Government Authority as per definition of the Government Authority provided in the clause(zf) of the notes appended to the Notification No. 12/2017 as it is established by the State Government and the services provided by the Government Authority by way of any activity in relation to any function entrusted to a municipality under Article 243W of the Constitution is NIL rated service notified under Notification No. 12/2017- Central Tax (Rate) dated 28.06.2017 (as amended).

Download the copy:

Pronouncement of AAR:

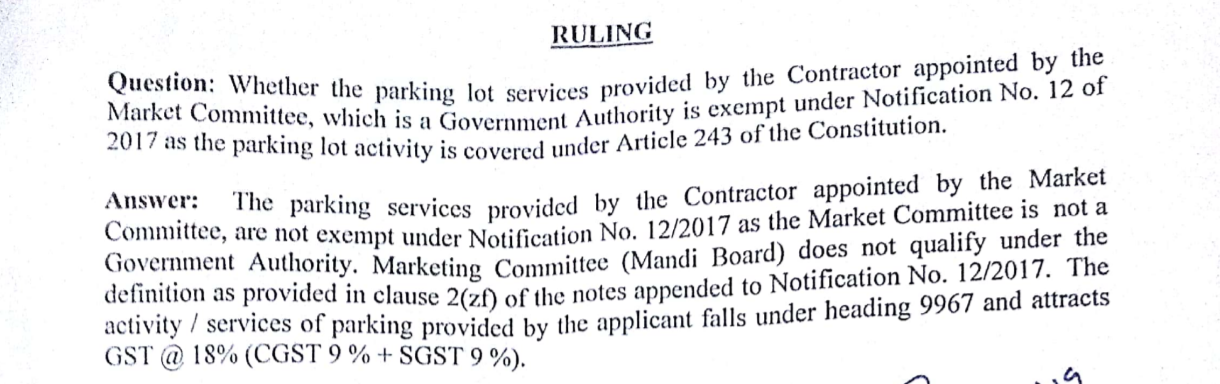

In the present case, although the Punjab State Agricultural Marketing Board was established on 26th May 1961 under Punjab Agricultural Produce Markets Act, 1961, its functions cannot be considered as sovereign functions and accordingly parking fees collected by them through the applicant does not acquire the nature of statutory fee so as to be outside the scope of any tax. Thus, the parking fees collected by the applicant are not in the nature of statutory fees.

In view of the above, it is held that the parking lot services provided by the contractor appointed by the Market Committee, are not exempted under Notification No. 12/2017 as the Market Committee is not a Government Authority as per the definition provided in clause 2(zf) of the notes appended to Notification No. 12/2017.

Now as regards the classification of Parking Services provided by the applicant, a reference to the Annexure about Scheme of Classification of Service as appended to the Notification No. 11/2017- Central Tax (Rate).

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.