GST deptt started advisory for reversal of ITC of 2018-19

Advisory for reversal of ITC of 2018-19

As you know there are various restrictions on availing and utilization of input tax credit. Section 16(4) of the CGST Act restricts the ailment of ITC after the due date ff filing of return of September. At present, the return to be filed u/s 39 of the CGST Act is GSTR 3b. This is the return to claim ITC also. The taxpayers who have filed there March 2019 or earlier returns after the due date of September 2019. If they have also claimed any ITC in return. It is time-barred. Now deptt has started to issue advisory to such taxpayers. In an advisory, they are advised to reverse such ITC. In case of default, they will be liable for further action.

Related Topic:

Contractual Obligation To Pay To Vendors After 180 Days – A Controversy On ITC Reversal

Section 16(4) puts a time limit for ITC of PY. The text of the section is as follows.

“Section 16(4) A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the due date of furnishing of the return under section 39 for the month of September following the end of financial year to which such invoice or invoice relating to such debit note pertains or furnishing of the relevant annual return, whichever is earlier.”

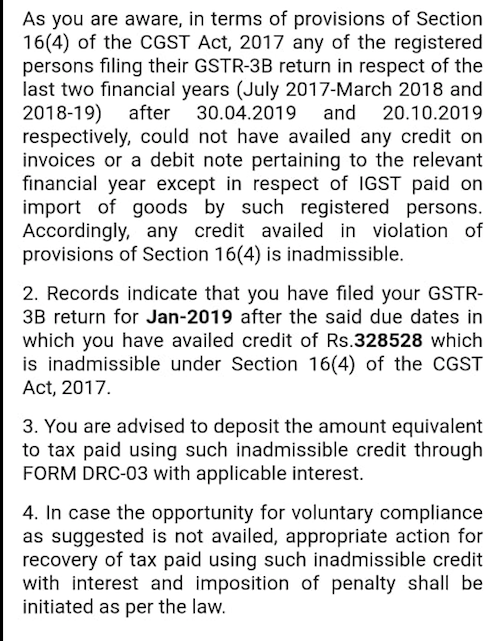

A copy of such advisory is attached.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.