New due dates for GSTR 3b filing

New due dates for GSTR 3b filing

As a big relief to the taxpayers, a press release has been issued. Please take note that the notifications are yet to release. According to this press release the due dates for GSRR 3b will be as follows.

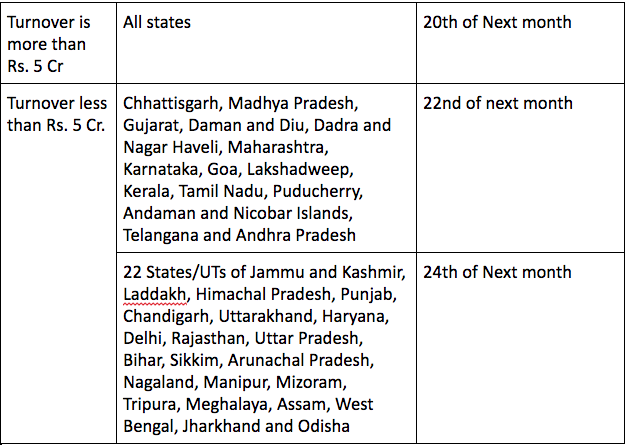

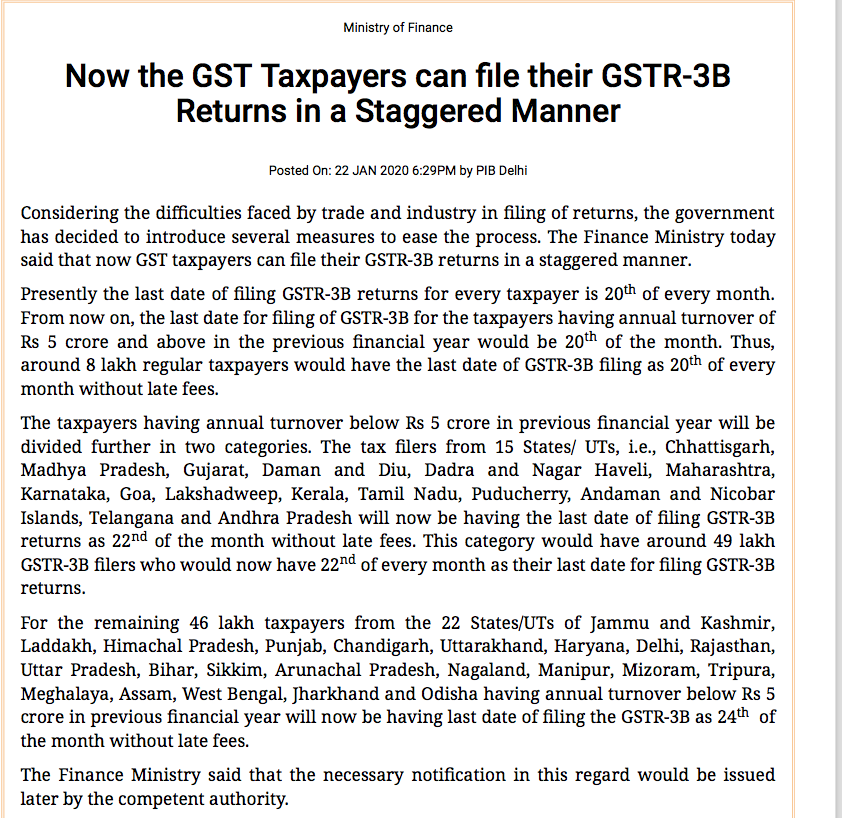

|

Turnover is more than Rs. 5 Cr |

All states |

20th of Next month |

|

Turnover less than Rs. 5 Cr. |

Chhattisgarh, Madhya Pradesh, Gujarat, Daman and Diu, Dadra and Nagar Haveli, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh |

22nd of next month |

|

22 States/UTs of Jammu and Kashmir, Laddakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha |

24th of Next month |

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.