Transfer of goods to Govt Depots will come under purview of Schedule I Tata coffee AAR

In an application filed before AAR under GST, Kerala by TATA Coffee Ltd reported in 2020 (32) G.S.T.L 120. Applicant during the course of the plantation of coffee cuts down the excessive trees grown as shade to coffee. Such trees are transported to Government Auction Deports as per provision of Forest Act. Depots auction the same to general public. Government Depots raise invoice in their name. Invoice does not contain the name of the applicant. Depots remits the consideration after deducting 10% of sale value as supervision charges. Held Govt Depot is acting as agent of Applicant. Transfer of goods to Govt Deports will come under purview of Schedule I and hence deemed supply. Applicant shall issue Tax Invoice and discharge GST on removal of goods from applicant premises on value determined as per Rule 29. Applicant shall discharge the tax on supervision charges under reverse charge.

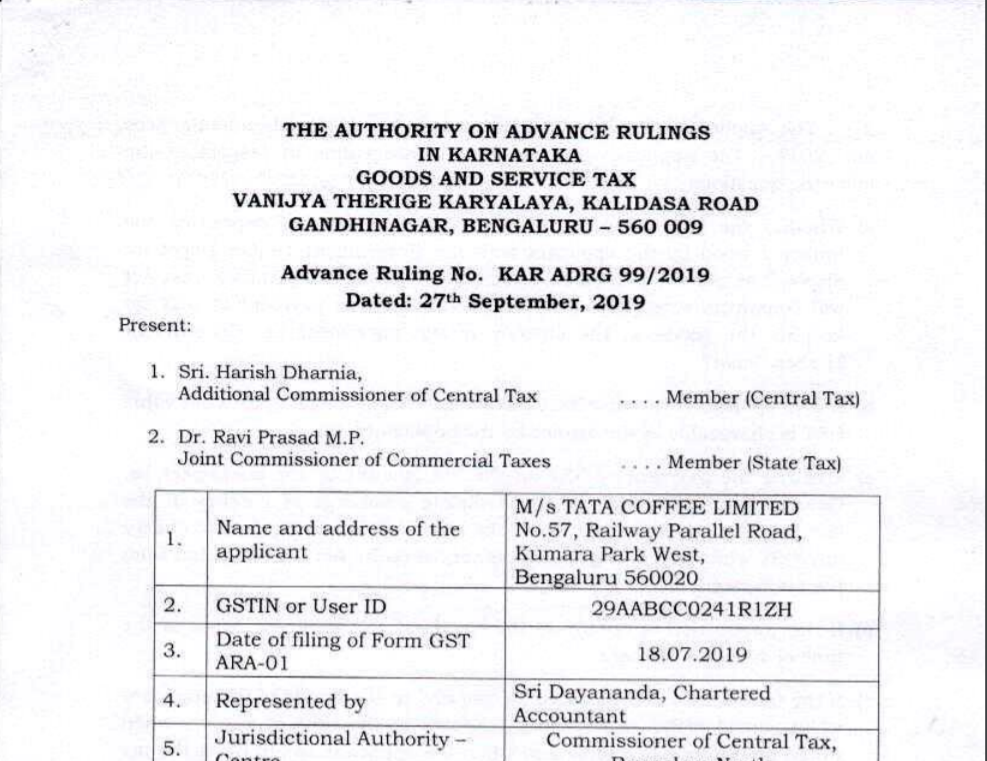

AAR99TataCoffeeLimited

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal