No GST on salary for notice period

Introduction:

GST on salary for the notice period. The recent decision of CESTAT , Allahabad will be a relief in this case. This may not touch the MSME sector but for corporates, it is a big issue. It is a general practice to pay notice pay salaries to employees. In companies where there is a big turnaround in a number of employees, this amount is quite big.

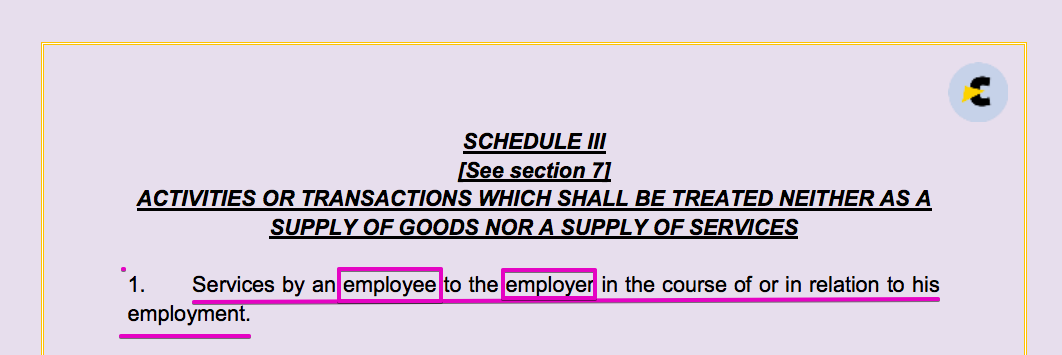

Taxability of salary in GST:

Schedule III of the CGST Act covers this as one of the items. It lists the item out of the preview of GST being no supply. It covers any service from the employee to the employer in the course of his employment. So this is quite clear that there will not be a levy of GST on remuneration given to employees. But the condition is that it should be in the course of employment. See the entry in schedule III below.

What was the controversy:

Demand was raised by the department for notice period deductions. It is a deduction from the salary given to employees where they don’t serve the minimum notice period. It is a recovery from the salary already given to employees. Whether it should be liable for GST. It is important to decide whether there is a supply from employer to employee. Also, it is important to understand that any supply from an employer to an employee is not a no supply in GST. It is not covered in schedule III. It is a taxable supply liable for GST.

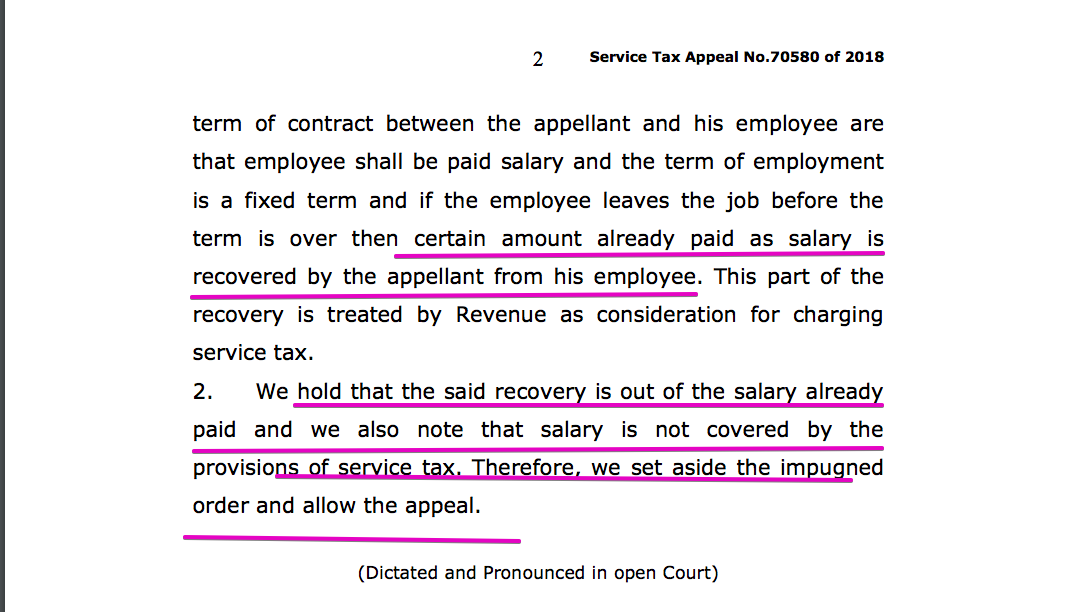

observation in Judgment of M/s HCL Learning Limited

In case of M/s HCL Learning Limited, it is observed that it is not a fresh supply. The payment made by an employee for not serving the notice period is a recovery from the past salary. The observation, in this case, was as follows:

“We hold that the said recovery is out of the salary already paid and we also note that salary is not covered by the provisions of service tax. Therefore, we set aside the impugned order and allow the appeal.”

Read the full judgement of HCT Tech:

You can download and read the full judgement of HCL tech here.

Send your queries at info@consultease.com, shaifaly.ca@gmail.com

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.