Insolvency and Bankruptcy (Application to Adjudicating Authority for Insolvency Resolution Process for Personal Guarantors to Corporate Debtors) Rules, 2019

- Insolvency and Bankruptcy (Application to Adjudicating Authority for Insolvency Resolution Process for Personal Guarantors to Corporate Debtors) Rules, 2019

- 1. Short title and commencement.―

- 2. Application.―

- 3. Definitions. ―

- 4. Relatives.―

- 5. Excluded assets.―

- 6. Application by guarantor.―

- 7. Application by creditor.―

- 8. Confirmation or nomination of insolvency professional.―

- 9. Copy of application.―

- 10. Filing of application and documents.―

- 11. Withdrawal of application. ―

Insolvency and Bankruptcy (Application to Adjudicating Authority for Insolvency Resolution Process for Personal Guarantors to Corporate Debtors) Rules, 2019

MINISTRY OF CORPORATE AFFAIRS

NOTIFICATION

New Delhi, the 15th November, 2019

G.S.R. 854(E).—In exercise of the powers conferred by sub-section (1), clauses (g), (h), (i), (m), (n) and (o) of sub-section (2) of section 239 read with clause (e) of section 2 and sub-section (2), clauses (c) and (e) of sub-section (14) and clause (e) of sub-section (15) of section 79 of the Insolvency and Bankruptcy Code, 2016 (31 of 2016), the Central Government hereby makes the following rules, namely:—

1. Short title and commencement.―

(1) These rules may be called the Insolvency and Bankruptcy (Application to Adjudicating Authority for Insolvency Resolution Process for Personal Guarantors to Corporate Debtors) Rules, 2019. (2) They shall come into force from the 1st day of December, 2019. 18 THE GAZETTE OF INDIA : EXTRAORDINARY [PART II—SEC. 3(i)]

2. Application.―

These rules shall apply to insolvency resolution process for personal guarantors to corporate debtors.

3. Definitions. ―

(1) In these rules, unless the context otherwise requires, –

(a) “Adjudicating Authority” means- (i) for the purpose of section 60, the National Company Law Tribunal constituted under section 408 of the Companies Act, 2013 (18 of 2013); or (ii) in cases other than sub-clause (i), the Debt Recovery Tribunal established under sub-section (1A) of section 3 of the Recovery of Debts and Bankruptcy Act, 1993 (51 of 1993);

(b) “Code” means the Insolvency and Bankruptcy Code, 2016 (31 of 2016);

(c) “electronic form” shall have the meaning assigned to it in clause (r) of section 2 of the Information Technology Act, 2000 (21 of 2000);

(d) “form” means a form appended to these rules;

(e) “guarantor” means a debtor who is a personal guarantor to a corporate debtor and in respect of whom guarantee has been invoked by the creditor and remains unpaid in full or part;

(f) “section” means section of the Code;

(g) “serve” means sending any communication by any means, including registered post, speed post, courier or electronic form, which is capable of producing or generating an acknowledgement of receipt of such communication: Provided that where a document cannot be served in any of the modes, it shall be affixed at the outer door or some other conspicuous part of the house or building in which the addressee ordinarily resides or carries on business or personally works for gain; (2) Words and expressions used and not defined in these rules but defined in the Code shall have the meanings respectively assigned to them in the Code.

4. Relatives.―

For the purposes of clause (ii) of Explanation to sub-section (2) of section 79, the manner of relationship shall mean the manner as provided in the Explanation to clause (24A) of section 5.

5. Excluded assets.―

For the purposes of sub-section (14) of section 79,―

(a) the value of unencumbered personal ornaments under clause (c) of the said sub-section shall not exceed one lakh rupees;

(b) the value of unencumbered single dwelling unit owned by the debtor under clause (e) of the said sub-section shall not exceed,- (i) in the case of dwelling unit in an urban area, twenty lakh rupees; (ii) in the case of dwelling unit in rural area, ten lakh rupees.

Explanation.— For the purposes of this rule,- (a) “rural area” shall have the same meaning as assigned to it in clause (o) of section 2 of the National Rural Employment Guarantee Act, 2005 (42 of 2005); (b) “urban area” means any area other than rural area.

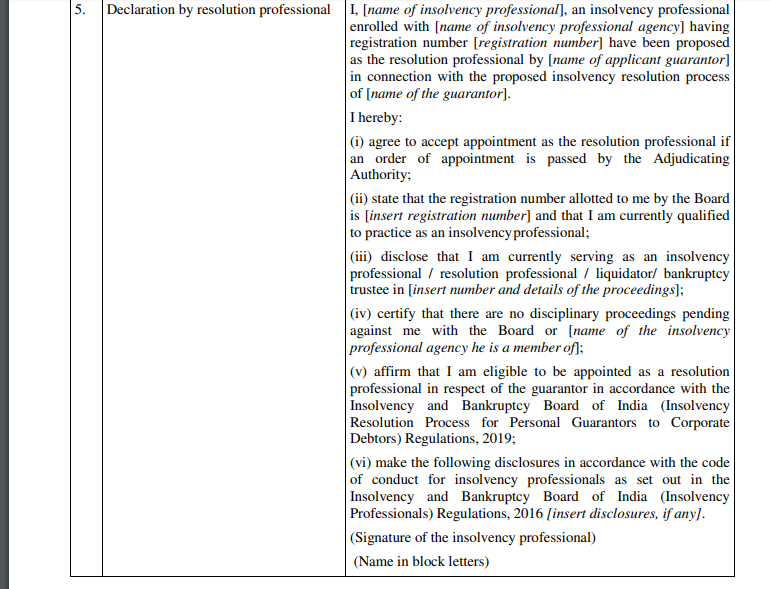

6. Application by guarantor.―

(1) The application under sub-section (1) of section 94 shall be submitted in Form A, along with an application fee of two thousand rupees. (2) The guarantor shall serve forthwith a copy of the application referred to in sub-rule (1) to every financial creditor and the corporate debtor for whom the guarantor is a personal guarantor.

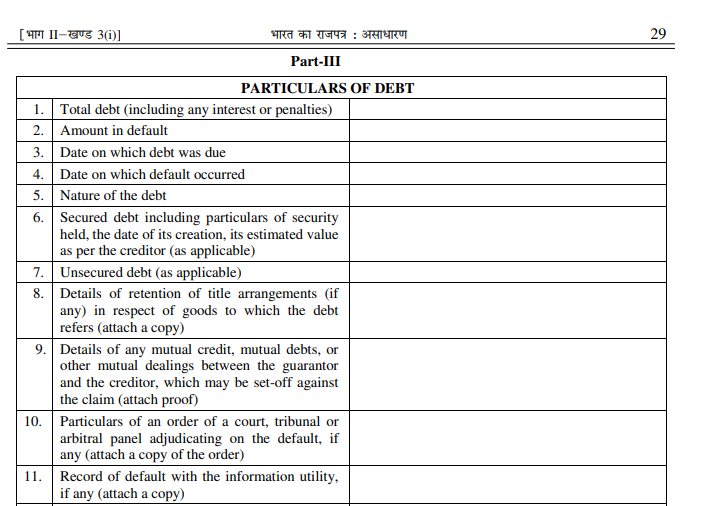

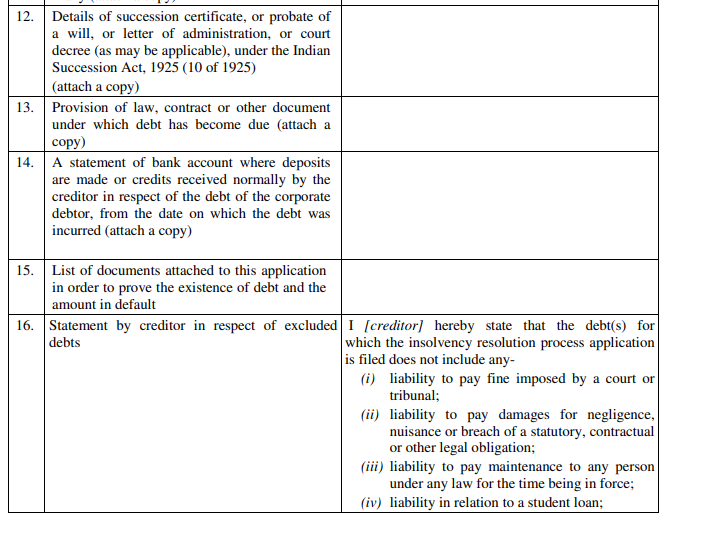

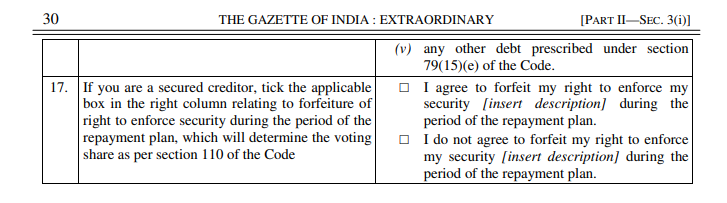

7. Application by creditor.―

(1) A demand notice under clause (b) of sub-section (4) of section 95 shall be served on the guarantor demanding payment of the amount of default, in Form B.

(2) The application under sub-section (1) of section 95 shall be submitted in Form C, along with a fee of two thousand rupees.

(3) The creditor shall serve forthwith a copy of the application referred to in sub-rule (2) to the guarantor and the corporate debtor for whom the guarantor is a personal guarantor.

(4) In case of a joint application, the creditors may nominate one amongst themselves to act on behalf of all the creditors.

8. Confirmation or nomination of insolvency professional.―

(1) For the purposes of sub-section (2) of section 97 and sub-section (5) of section 98, the Board may share the database of the insolvency professionals, including information about disciplinary proceedings against them, with the Adjudicating Authority from time to time. (2) For the purposes of sub-section (4) of section 97 and sub-section (3) of section 98, the Board may share a panel of insolvency professionals, who may be appointed as resolution professionals, with the Adjudicating Authority.

9. Copy of application.―

The applicant shall provide a copy of the application filed under subsection (1) of section 94 or sub-section (1) of section 95, as the case may be, if not provided earlier, to the resolution professional within three days of his appointment under sub-section (5) of section 97, and to the Board for its record.

10. Filing of application and documents.―

(1) Till such time, rules of procedure for conduct of proceedings under the Code are notified, the applications under rules 6 and 7 shall be filed and dealt with by the Adjudicating Authority in accordance with ― (a) rules 20, 21, 22, 23, 24 and 26 of Part III of the National Company Law Tribunal Rules, 2016 made under section 469 of the Companies Act, 2013 (18 of 2013); or (b) rule 3 of the Debt Recovery Tribunal (Procedure) Rules, 1993 made under section 36 of the Recovery of Debts and Bankruptcy Act, 1993 (51 of 1993) and regulations 3, 4, 5 and 11 of the Debt Recovery Tribunal Regulations, 2015 made under section 22 of the Recovery of Debts and Bankruptcy Act, 1993, as the case may be.

(2) The application and accompanying documents shall be filed in electronic form, as and when such facility is made available and as directed by the Adjudicating Authority: Provided that till such facility is made available, the applicant may submit accompanying documents, and wherever they are bulky, in electronic form, in scanned, legible portable document format in a data storage device such as compact disc or a USB flash drive acceptable to the Adjudicating Authority.

11. Withdrawal of application. ―

(1) The Adjudicating Authority may permit withdrawal of the application submitted under rule 6 or rule 7, as the case may be,- (a) before its admission, on a request made by the applicant; (b) after its admission, on the request made by the applicant, if ninety per cent. of the creditors agree to such withdrawal. (2) An application for withdrawal under clause (b) of sub-rule (1) shall be in Form D.

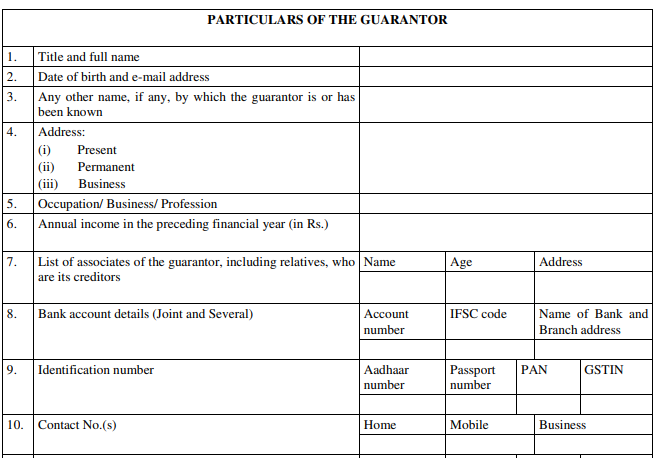

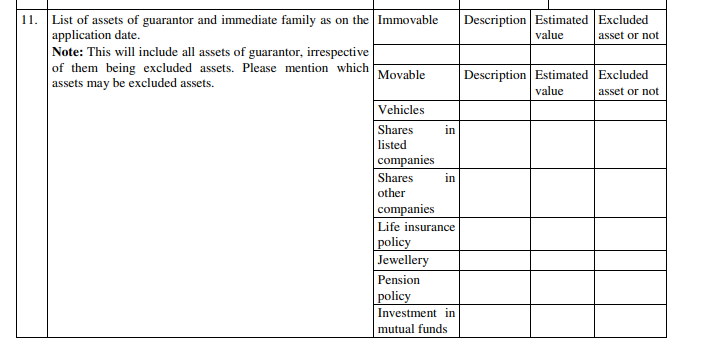

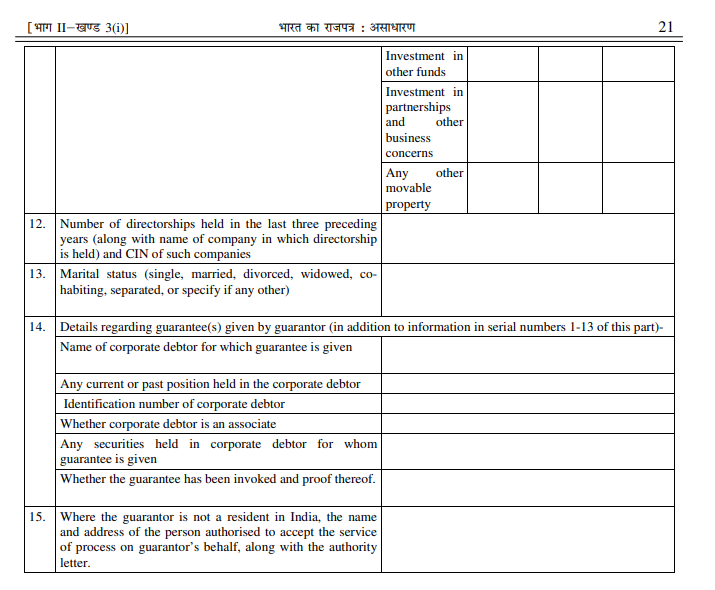

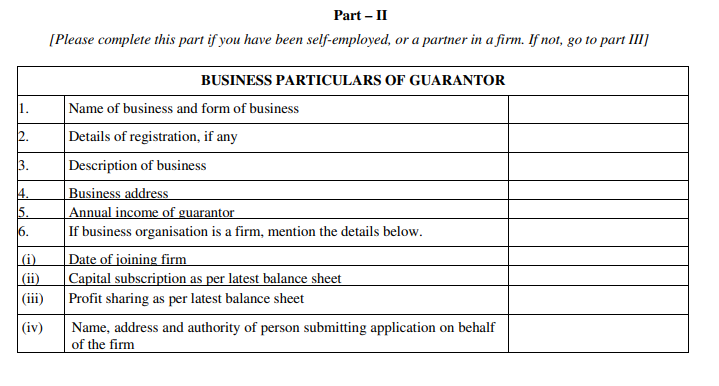

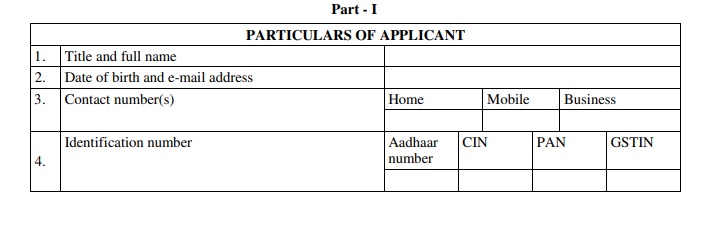

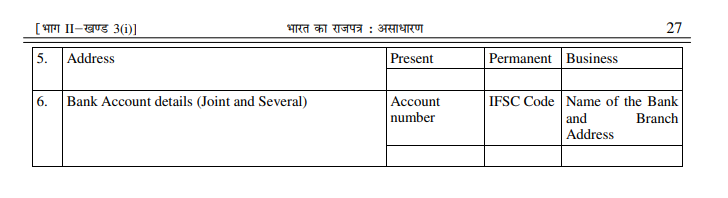

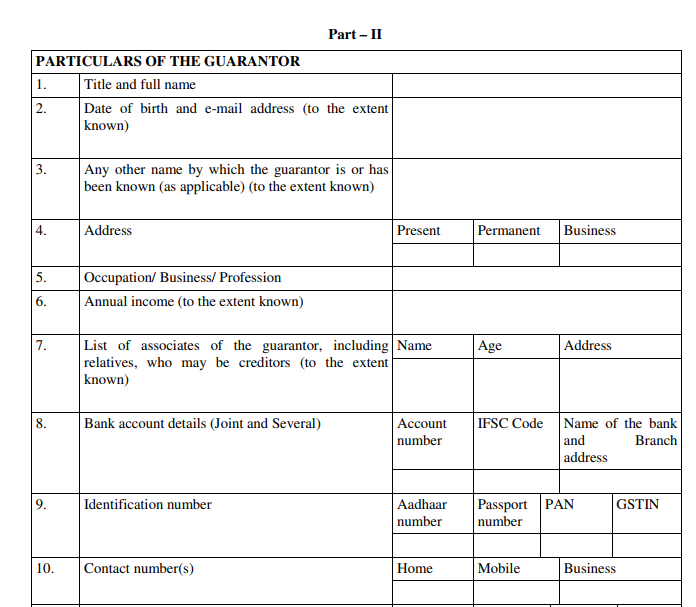

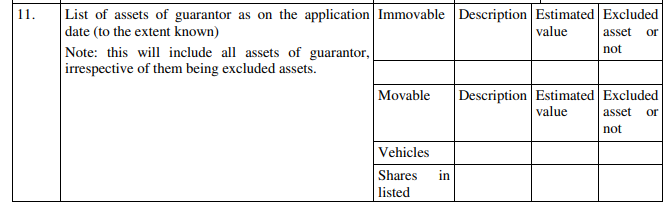

FORM A [See rule 6(1)] APPLICATION BY GUARANTOR TO INITIATE INSOLVENCY RESOLUTION PROCESS [Under rule 6 of the Insolvency and Bankruptcy (Application to Adjudicating Authority for Insolvency Resolution Process for Personal Guarantors to Corporate Debtors) Rules, 2019] [Date] To The Adjudicating Authority [Address]

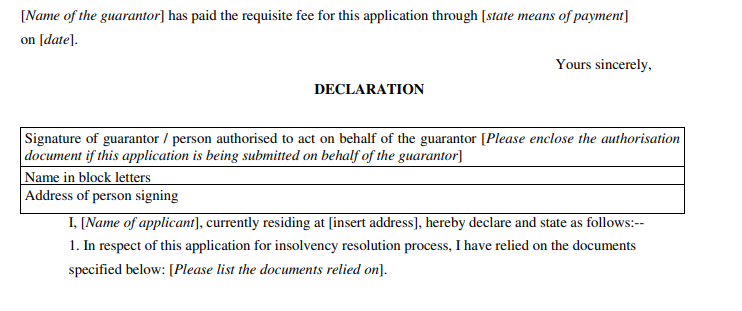

20 THE GAZETTE OF INDIA : EXTRAORDINARY [PART II—SEC. 3(i)] From [Name and address of the guarantor] In the matter of [name of the guarantor] Subject: Application to initiate insolvency resolution process in respect of [name of the guarantor]. Madam/Sir, I/We hereby submit this application to initiate an insolvency resolution process in respect of [name of guarantor]. The details for the purpose of this application are set out below

24 THE GAZETTE OF INDIA : EXTRAORDINARY [PART II—SEC. 3(i)]

2. The contents of the said application along with the said documents are true, valid and genuine to the best of my knowledge, information and belief and nothing material facts have been concealed therefrom. Date: Place: (Signature of the applicant) VERIFICATION I, [name of applicant], do hereby verify that the contents of this application are true and correct to my knowledge and belief. Nothing is false and no material has been concealed therefrom. Verified at ______ on this ______ day of ______ 201__ ________ (Signature of the Applicant)

ATTACHMENTS: List of documents to be appended to the application: 1. All documents mentioned in serial number 14 of Part III of this form. 2. Copy of the income tax returns with detailed computation of the income of the guarantor, or the firm, as the case may be, for the previous three years. 3. Copy of the personal guarantee contract. 4. Copies of entries in a bankers’ book in accordance with the Bankers Books Evidence Act, 1891 (18 of 1891) 5. The latest and complete copy of the financial contract reflecting all amendments and waivers to date. 6. Copies of relevant ownership and title documents for all assets. 7. Copy of the authorisation, wherever required under this form. 8. Proof that the application fee has been paid. 9. Documentary evidence of all information sought in each entry for each Part of the form. 10. A statement of affairs of the guarantor made up to a date not earlier than seven days from the date of the application including the following information and supporting documents, namely:- (i) guarantor’s assets (inclusive of assets which may be excluded assets) and liabilities for the previous three years; (ii) secured and unsecured debts (inclusive of excluded debts mentioned in serial number 15 of Part III of the form) with names of the creditors, and all requisite details for the previous three years; (iii) particulars of debt owed by guarantor to associates of the corporate debtor for the previous three years; (iv) guarantees given in relation to any of the debts of the corporate debtor, and if any of the guarantors is an associate of the corporate debtor; (v) financial statements with all annexures and schedules for the business owned by the guarantor, or of the firm in which the guarantor is a partner, as the case may be, for the previous three years, if applicable; (vi) wealth tax statements, if any, filed by the guarantor, for the previous five years; (vii) income statement of the guarantor, for the previous three years; (viii) payment of indirect taxes including GST for the previous three years.

¹Hkkx IIµ[k.M 3(i)] Hkkjr dk jkti=k % vlk/kj.k 25

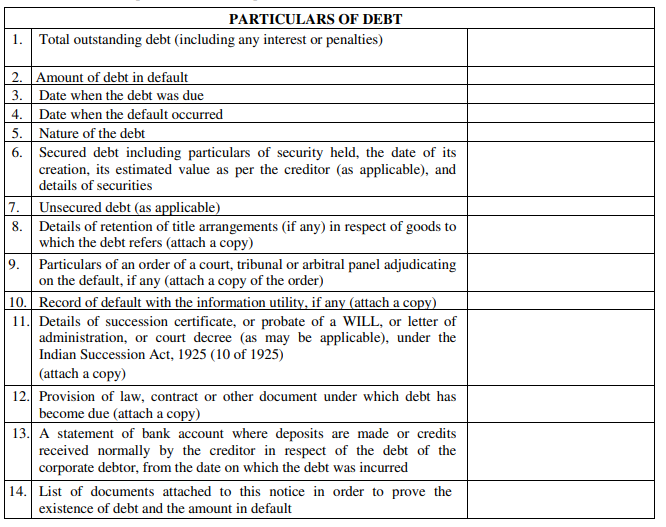

FORM B [See rule 7(1)] FORM OF DEMAND NOTICE [Under rule 7(1) of the Insolvency and Bankruptcy (Application to Adjudicating Authority for Insolvency Resolution Process of Personal Guarantors to Corporate Debtors) Rules, 2019] [Date] To [Name and address of the guarantor] From [Name and address of the creditor] Subject: Demand notice in respect of unpaid debt in default due from [corporate debtor] under the Code. Madam/Sir, 1. This letter is a demand notice of unpaid debt in default due from [name of corporate debtor]. 2. Please find particulars of the unpaid debt in default below:

3. If you believe that the debt has been repaid before the receipt of this notice, please demonstrate such repayment by sending to us, within fourteen days of receipt of this notice, the following:– (a) an attested copy of the record of electronic transfer of the unpaid amount from the bank account of the guarantor; or

26 THE GAZETTE OF INDIA : EXTRAORDINARY [PART II—SEC. 3(i)]

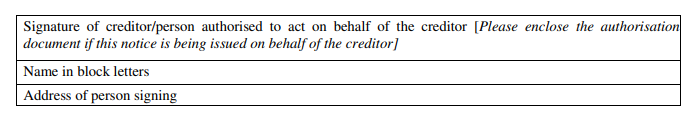

(b) evidence of encashment of cheque for the unpaid amount issued by the guarantor; or (c) an attested copy of any record that [name of the creditor] has received the payment. 4. The undersigned request you to unconditionally pay the unpaid debt in default in full within fourteen days from the receipt of this letter failing which insolvency resolution process, under the Code, shall be initiated against you

Yours sincerely,

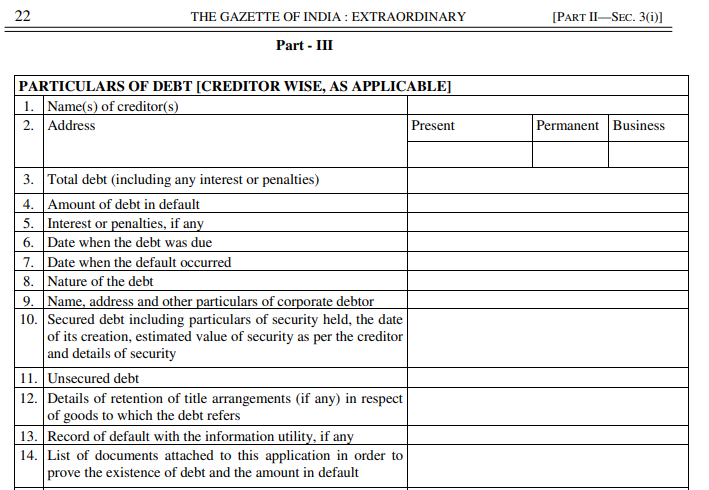

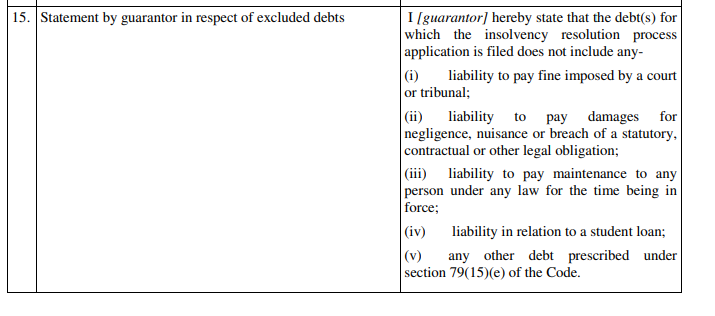

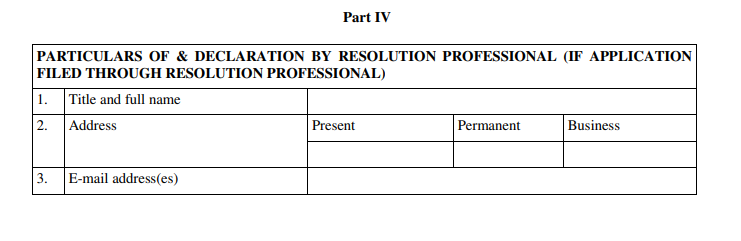

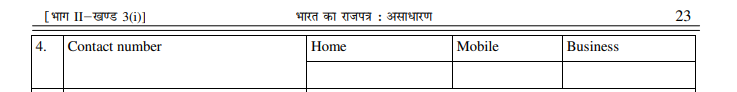

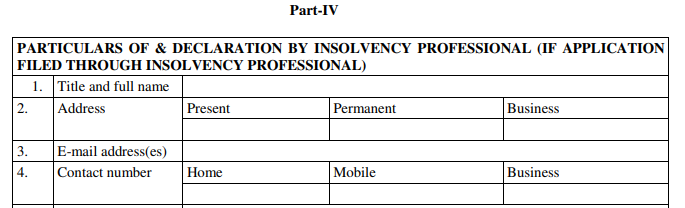

Instructions 1. Please serve a copy of this notice on the guarantor, fourteen days in advance of filing an application under section 95 of the Code. 2. Please attach a copy of such served notice with the application made by the creditor to the Adjudicating Authority. FORM C [See rule 7(2)] APPLICATION BY CREDITOR TO INITIATE INSOLVENCY RESOLUTION PROCESS [Under rule 7(2) of the Insolvency and Bankruptcy (Application to Adjudicating Authority for Insolvency Resolution Process for Personal Guarantors to Corporate Debtors) Rules, 2019] [Date] To The Adjudicating Authority [Address] From [Name and address of the creditor] In the matter of [name of the guarantor] Subject: Application to initiate insolvency resolution process in respect of [name of the guarantor] under the Code. Madam/Sir, [Name of the creditor], hereby submits this application to initiate an insolvency resolution process in the case of [name of guarantor]. The details for the purpose of this application are set out below:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.