ITC=2A+20% of reflecting in 2A: new rule

CGST rules amended:

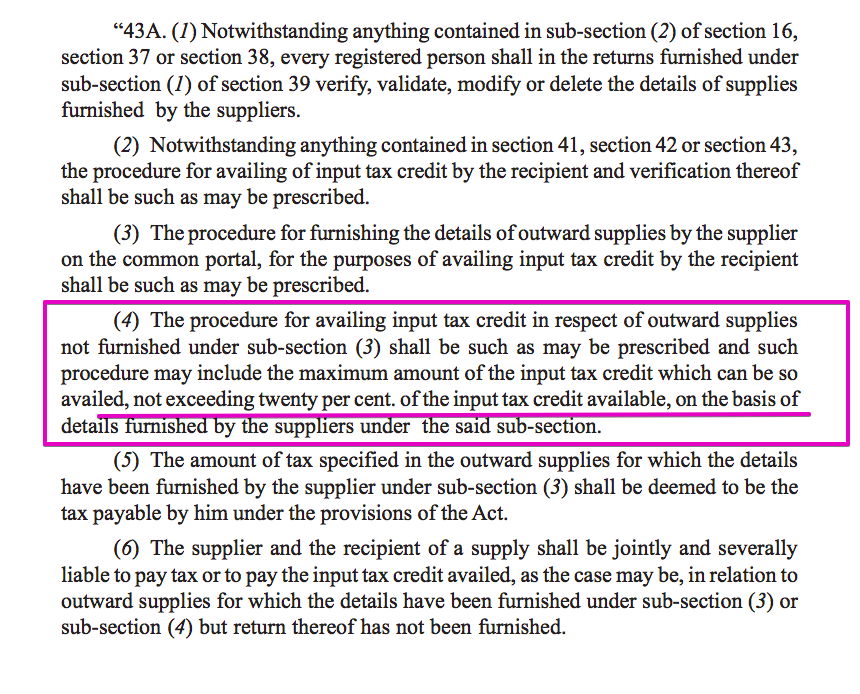

ITC=2A+20% of reflecting in 2A. This is the new rule to claim ITC in GST. The new amendment in CGST rule may make you sad. Now you need to be more compliant. Otherwise, your buyer will lose ITC of invoices. This amendment in CGST rules is not effective yet. The enabling section for this rule is yet to be notified. But it will take just an another notification to notify it. Section 43A of the CGST Act inserted via CGST Amendment Act 2018. This section provide that ITC of non-reflecting can be curtailed to 20% of declared ITC. See what section 43A provides.

As you can see in the highlighted text. The ITC can be curtailed to 20% of what is available on the basis of declared invoices by the supplier. This provision is going to hurt a lot of businesses. Once notified it will be applied instantly. Then you wont be able to claim ITC of invoices unless the supplier upload it.

MaximumITC=2A+20% of reflecting in 2A:

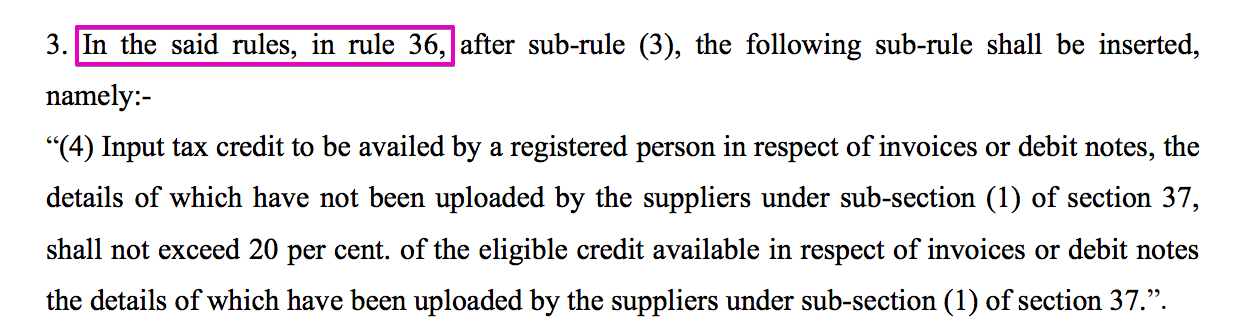

The maximum ITC a taxpayer can claim after this= ITC=2A+20% of reflecting in 2A

The following sub-rule is inserted in CGST rules.

Thus the time has changed drastically. Only compliant vendors can survive in this scenario. A lot of ITC can get stuck due to this. But nevertheless, you will be able to claim it back once it is entered by the vendor.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.