Composition levy updated after finance bill 2019

Who is eligible for composition levy after all amendments?

Now there are two types of composition levy in GST. Section 10 of CGST Act covers it. New amendments are proposed in this section. It includes the composition scheme for services providers also.

- Composition levy for Trader, manufacturers, and restaurants. We call it restaurant in lose language actually it is para 6b of schedule II.

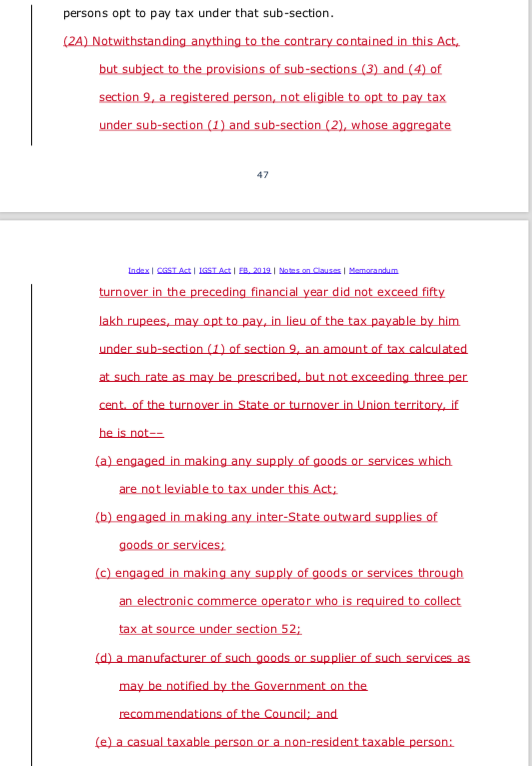

- Composition levy for services providers who are otherwise not eligible for normal composition. This provision is introduced by notification no. 2/2019 of CGST Act. In finance bill 2019 it is proposed to be inserted into CGST Act in section 10.

Clause 2A is inserted in section 10.

What is the applicable tax on composition Dealers?

Again the answer is not going to be that simple. There are various tax rates and even base amount to calculate the tax in composition levy.

- For manufacturers and para 6b of schedule II i.e restaurants, it is 1% and 5% respectively on total turnover including the exempted turnover.

- For traders, it is 1% on taxable turnover. Please refer text of notification no. 1/2018. It provided relief but only to traders.

- The tax rate for services composition levy is 6% including the exempted supply.

In all of these case, there will be no tax for interest income.

In all of the above cases, the input tax credit is not available. Reverse charge is applicable in all of these cases. In the case of service providers, you need to analyze the benefit of taking it. You need to apply for it at the time of registration. Composition dealers are not eligible to collect the tax.

Which return a composition taxpayer is required to file?

- CMP 08 quarterly. Tax payment is also quarterly. It is not live on GSTIN portal. Taxpayers are waiting for it as the last date to file is near.

- GSTR 4 annually. Consolidated figures are included in this return.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.