New Tax structure for real estate sector

New Tax structure for real estate sector:

| 1. |

One time option – to pay tax at existing rates on ongoing projects |

3 |

| 2. |

New Tax Rates |

8 |

| 3. |

Conditions for New Tax Rates |

13 |

| 4. |

Calculation of ITC attributable to construction in a project, time of supply of which is on or after 1st April,2019 |

23 |

| 5. |

Capping of % Invoicing and Procurement of input & Input Service on or before 31.03.2019 |

30 |

| 6. |

Transfer of Development Rights/FSI and Long Term Lease |

34 |

| 7. |

Valuation in Case of JDA |

42 |

| 8 |

Other Changes |

45 |

| 9 |

Definitions |

47 |

ONE TIME OPTION TO PAY TAX AT EXITING RATES ON ONGOING PROJECTS:

Conditions to Pay Tax at existing tax rates as specified under tax rate Entry 3(ie)/(if) in tax rate N.No 11/2017-CT(R) newly inserted vide N.No. 3/2019-CT(R) dt. 29.03.19

One Time Option:

• For ongoing projects, option shall be available to pay GST at existing tax rates with ITC

[Entry 3(ie)/(if) of tax rate N.No 11/2017-CT(R)]. Time Limit for Exercising the option:

- Option to be opted on or before 10th May 2019 by submitting a Form [Form given at Annexure IV of N.No. 03/2019-CT(R)].

- If not opted, option to pay tax at new rate shall deemed to have be exercised. Invoices till exercising the option:

• Invoices can be issued during 01st April of 2019 to 10th May of 2019 before exercising the option, but such invoices shall be in accordance with the option to be exercised

- Provided that in case of ongoing project, the registered person shall exercise one time option in the Form at Annexure IV to pay central tax on construction of apartments in a project at the rates as specified for item (ie) or (if), as the case may be, by the 10th of May, 2019;

- Provided also that where the option is not exercised in Form at annexure IV by the 10th of May, 2019, option to pay tax at the rates as applicable to item (i) or (ia) or (ib) or (ic) or (id) above, as the case may be, shall be deemed to have been exercised;

- Provided also that invoices for supply of the service can be issued during the period from 1st April 2019 to 10th May 2019 before exercising the option, but such invoices shall be in accordance with the option to be exercised.;

-

“ongoing project” shall mean a project which meets all the following conditions, namely- (a).

– commencement certificate in respect of the project, where required to be issued by the competent authority, has been issued on or before 31st March, 2019, and

– it is certified by any of the following that construction of the project has started on or before 31st March, 2019:-

(i) an architect registered with the Council of Architecture constituted under the Architects Act, 1972 (20 of 1972); or

(ii) a chartered engineer registered with the Institution of Engineers (India); or

(iii) a licensed surveyor of the respective local body of the city or town or village or development or planning authority.

(b) where commencement certificate in respect of the project, is not required to be issued by the competent authority, it is certified by any of the authorities specified in sub- clause (a) above that construction of the project has started on or before the 31st March, 2019;

(c) completion certificate has not been issued or first occupation of the project has not taken place on or before the 31st March, 2019;

(d) apartments being constructed under the project have been, partly or wholly, booked on or before the 31st March, 2019.”

Explanation.- For the purpose of sub- clause (a) and (b) above , construction of a project shall be considered to have started on or before the 31st March, 2019, if the earthwork for site preparation for the project has been completed and excavation for foundation has started on or before the 31st March, 2019.

[Emphasis Supplied]

Note:

• (xiii) an apartment booked on or before the 31st March, 2019 shall mean an apartment which meets all the following three conditions, namely-

(a) part of supply of construction of which has time of supply on or before the 31st March, 2019 and

(b) at least one instalment has been credited to the bank account of the registered person on or before the 31st March, 2019 and

(c) an allotment letter or sale agreement or any other similar document evidencing booking of the apartment has been issued on or before the 31st March, 2019;

NEW TAX RATES:

Effective 1% [Rate 1.5% after 1/3rd deduction of Land]:

- – Affordable residential housing properties (as decided by GST Council i.e. area 60 sqm. in metros / 90 sqm in non metros and value upto Rs 45 Lakhs)

- – Affordable Houses under existing Central & State Housing Schemes presently taxable at effective concessional rate of 8%.Effective 5% [Rate 7.5% after 1/3rd deduction of Land]:

– Residential housing properties other than those covered in 1% rate.

– Commercial apartments such as shops, offices – In a “Residential Real Estate Project” (RREP) having carpet area of commercial apartment not more than 15% of total carpet area of all apartments.

- Effective 1% [Rate 1.5% after 1/3rd deduction of Land]:– Affordable residential housing properties (as decided by GST Council i.e. area 60 sqm. in metros / 90 sqm in non metros and value upto Rs 45 Lakhs)

-

- Effective 5% [Rate 7.5% after 1/3rd deduction of Land]:– Residentialhousingpropertiesotherthanthosecoveredin1%rate.

– Commercial apartments such as shops, offices – In a “Residential Real Estate Project” (RREP) having carpet area of commercial apartment not more than 15% of total carpet area of all apartments.

Definition of Affordable Residential Apartment:

(xvi) The term “affordable residential apartment” shall mean

- “a residential apartment in a project which commences on or after 1st April, 2019, or in an ongoing project in respect of which the promoter has not exercised option in the prescribed form to pay central tax on construction of apartments at the rates as specified for item (ie) or (if) against serial number 3, as the case may be, having carpet area not exceeding 60 square meter in metropolitan cities or 90 square meter in cities or towns other than metropolitan cities and for which the gross amount charged is not more than forty five lakhs rupees.

- For the purpose of this clause, -(i) Metropolitan cities are Bengaluru, Chennai, Delhi NCR (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata and Mumbai (whole of MMR) with their respective geographical limits prescribed by an order issued by the Central or State Government in this regard;

- (ii) Gross amount shall be the sum total of; –

A. Consideration charged for the services specified at item (i) and (ic) in column (3) against sl. No. 3in the Table;B. Amount charged for the transfer of land or undivided share of land, as the case may be including by way of lease or sub lease; and

C. Any other amount charged by the promoter from the buyer of the apartment including preferential location charges, development charges, parking charges, common facility charges etc.

(b) an apartment being constructed in an ongoing project under any of the schemes specified in sub-item (b), sub-item (c), sub-item (d), sub-item (da) and sub-item (db) of item (iv); sub- item (b), sub-item (c), sub-item (d) and sub-item (da) of item (v); and sub-item (c) of item (vi), against serial number 3 of the Table above, in respect of which the promoter has not exercised option to pay central tax on construction of apartments at the rates as specified for item (ie) or (if) against serial number 3, as the case may be.

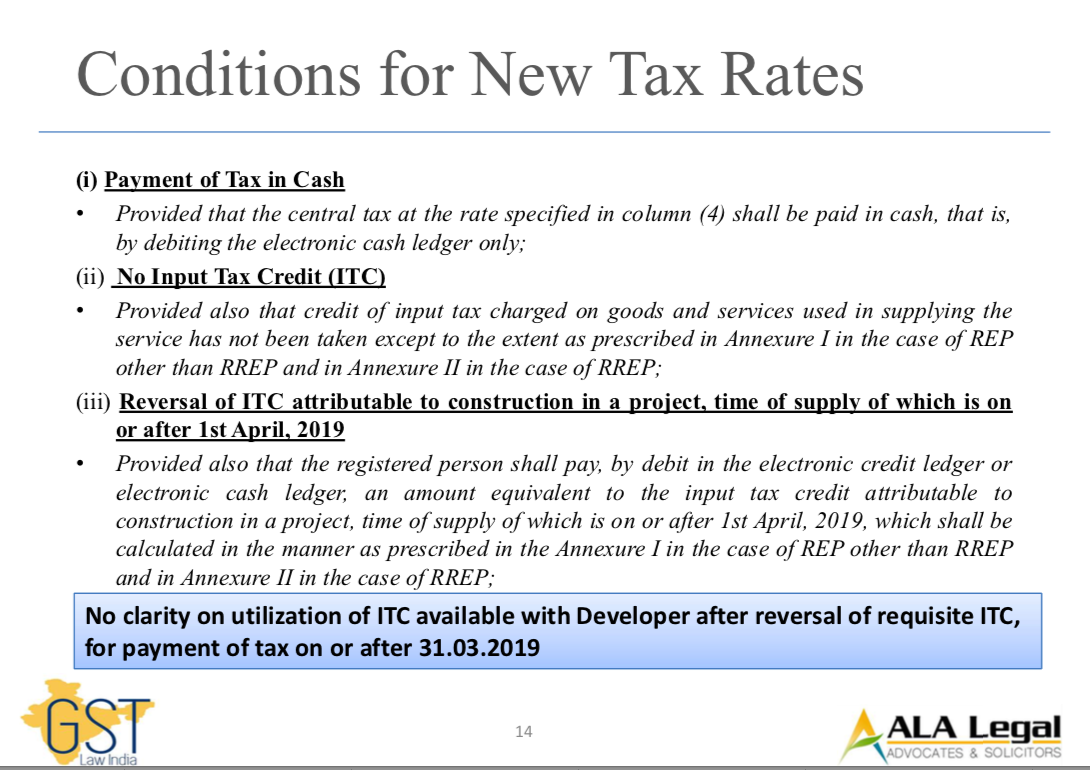

CONDITIONS FOR NEW TAX RATES:

(iv) Conditions in case of Joint Development Agreement (JDA)

- Provided also that where a registered person (landowner- promoter) who transfers development right or FSI (including additional FSI) to a promoter (developer- promoter) against consideration, wholly or partly, in the form of construction of apartments,-(i) the developer- promoter shall pay tax on supply of construction of apartments to the landowner- promoter, and

(ii) such landowner – promoter shall be eligible for credit of taxes charged from him by the developer promoter towards the supply of construction of apartments by developer- promoter to him, provided the landowner-promoter further supplies such apartments to his buyers before issuance of completion certificate or first occupation, whichever is earlier, and pays tax on the same which is not less than the amount of tax charged from him on construction of such apartments by the developer- promoter.

- Explanation:

(i) “developer- promoter” is a promoter who constructs or converts a building into apartments ordevelops a plot for sale,(ii) “landowner- promoter” is a promoter who transfers the land or development rights or FSI to a developer- promoter for construction of apartments and receives constructed apartments against such transferred rights and sells such apartments to his buyers independently.

-

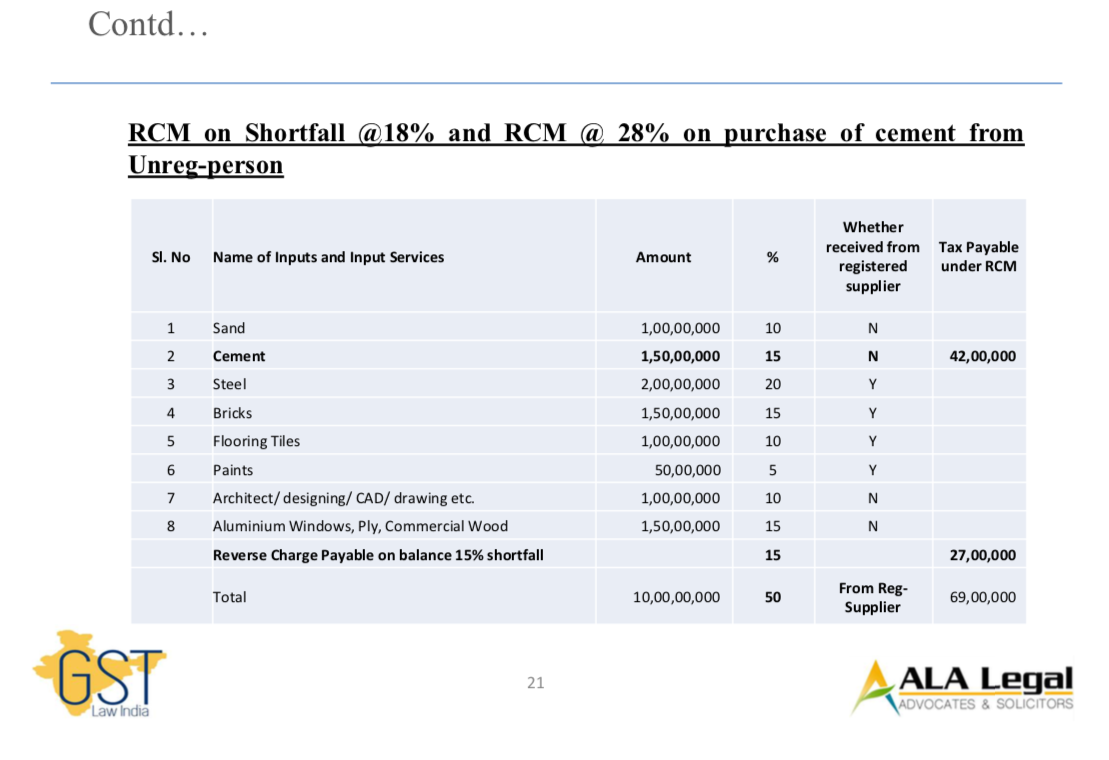

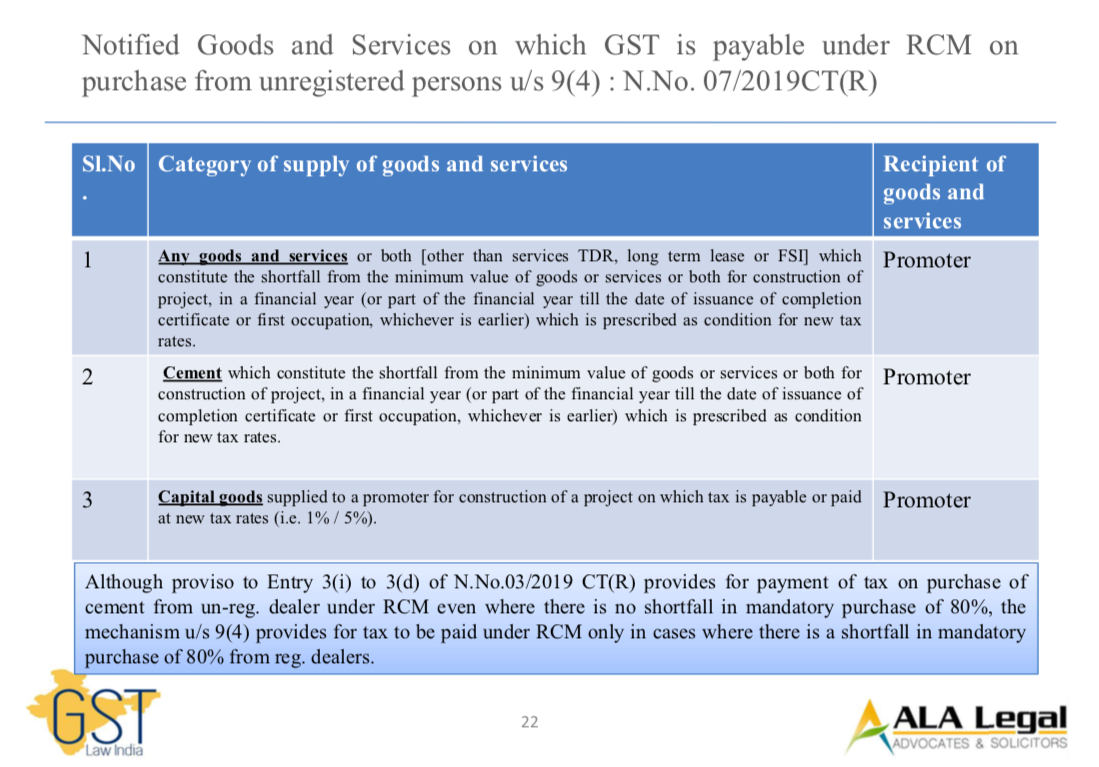

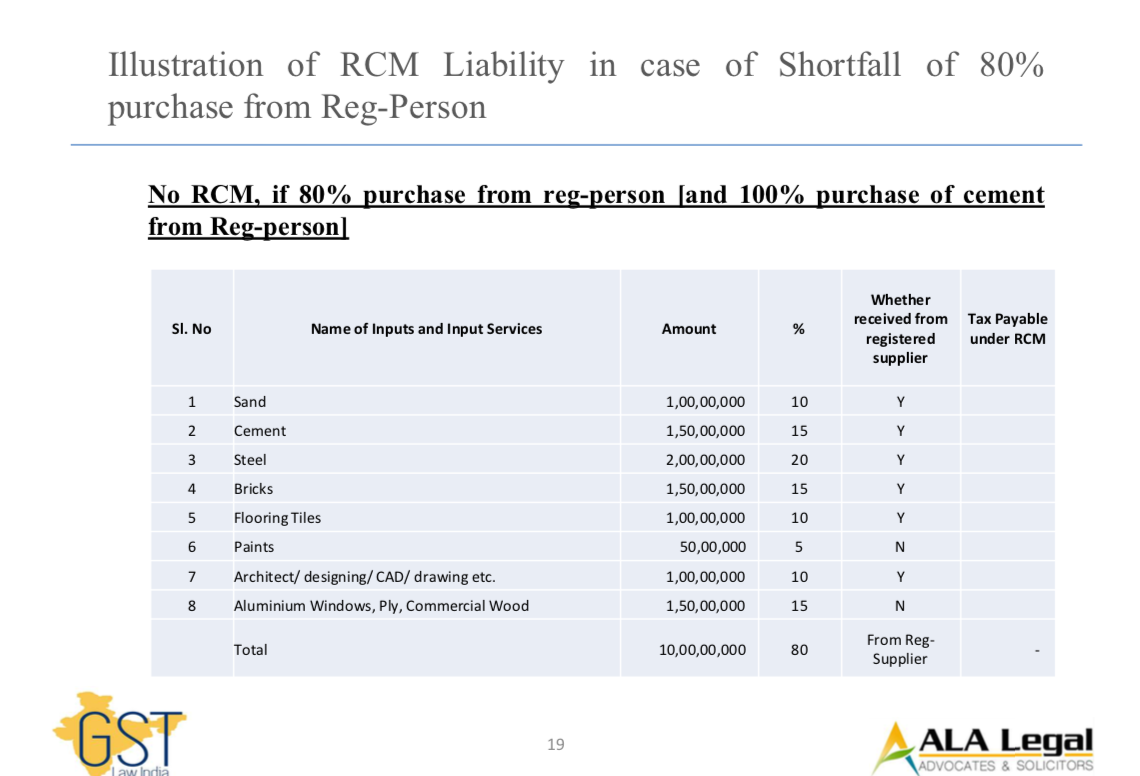

(v) 80% of input (goods other than capital goods) and input services [except TDR, FSI, long term lease (upfront payment , electricity, high speed diesel, motor spirit, natural gas] shall be purchased from registered persons.

- Provided also that eighty percent of value of input and input services, [other than services by way of grant of development rights, long term lease of land (against upfront payment in the form of premium, salami, development charges etc.) or FSI (including additional FSI), electricity, high speed diesel, motor spirit, natural gas], used in supplying the service shall be received from registered supplier only;

- Provided also that inputs and input services on which tax is paid on reverse charge basis shall be deemed to have been purchased from registered person;

(vi) On shortfall of purchases from 80% from registered person – Tax is to be paid under RCM @ of 18%

Provided also that where value of input and input services received from registered suppliers during the financial year (or part of the financial year till the date of issuance of completion certificate or first occupation of the project, whichever is earlier) falls short of the said threshold of 80 per cent., tax shall be paid by the promoter on value of input and input services comprising such shortfall at the rate of eighteen percent on reverse charge basis and all the provisions of the Central Goods and Services Tax Act, 2017 (12 of 2017) shall apply to him as if he is the person liable for paying the tax in relation to the supply of such goods or services or both;

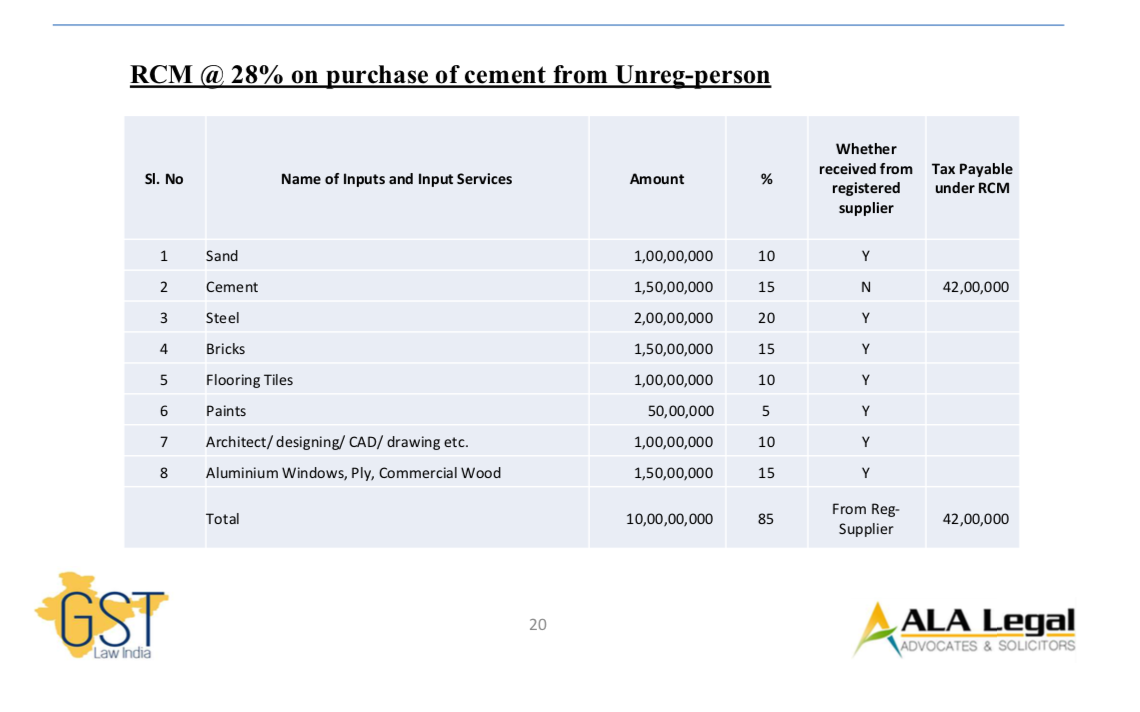

(vii) 100% Cement Purchases from Registered Person. On purchase of Cement from unregistered person – Tax is to be paid under RCM @ of 28%

• Provided also that notwithstanding anything contained herein above, where cement is received from an unregistered person, the promoter shall pay tax on supply of such cement at the applicable rates on reverse charge basis and all the provisions of the Central Goods and Services Tax Act, 2017 (12 of 2017), shall apply to him as if he is the person liable for paying the tax in relation to such supply of cement;

Compliance requirement

- Maintain separate project wise account of inward supply from registered and unregistered supplier.

- Calculation of tax payment on shortfall and Reporting of the same on GSTN portal by 30th June of subsequent FY. Payment of shortfall tax by adding tax liability in the month not later than June of subsequent FY.

- Payment of tax on cement purchase from unreg-person in the month in which cement is received.

- Reporting of ITC not availed as ineligible credit in GSTR-3B [Row No. 4 (D)(2)].Explanation. –

1.The promoter shall maintain project wise account of inward supplies from registered and unregistered supplier and calculate tax payments on the shortfall at the end of the financial year and shall submit the same in the prescribed form electronically on the common portal by end of the quarter following the financial year. The tax liability on the shortfall of inward supplies from unregistered person so determined shall be added to his output tax liability in the month not later than the month of June following the end of the financial year.

2. Notwithstanding anything contained in Explanation 1 above, tax on cement received from unregistered person shall be paid in the month in which cement is received.

3.Input Tax Credit not availed shall be reported every month by reporting the same as ineligible credit in GSTR-3B [Row No. 4 (D)(2)]

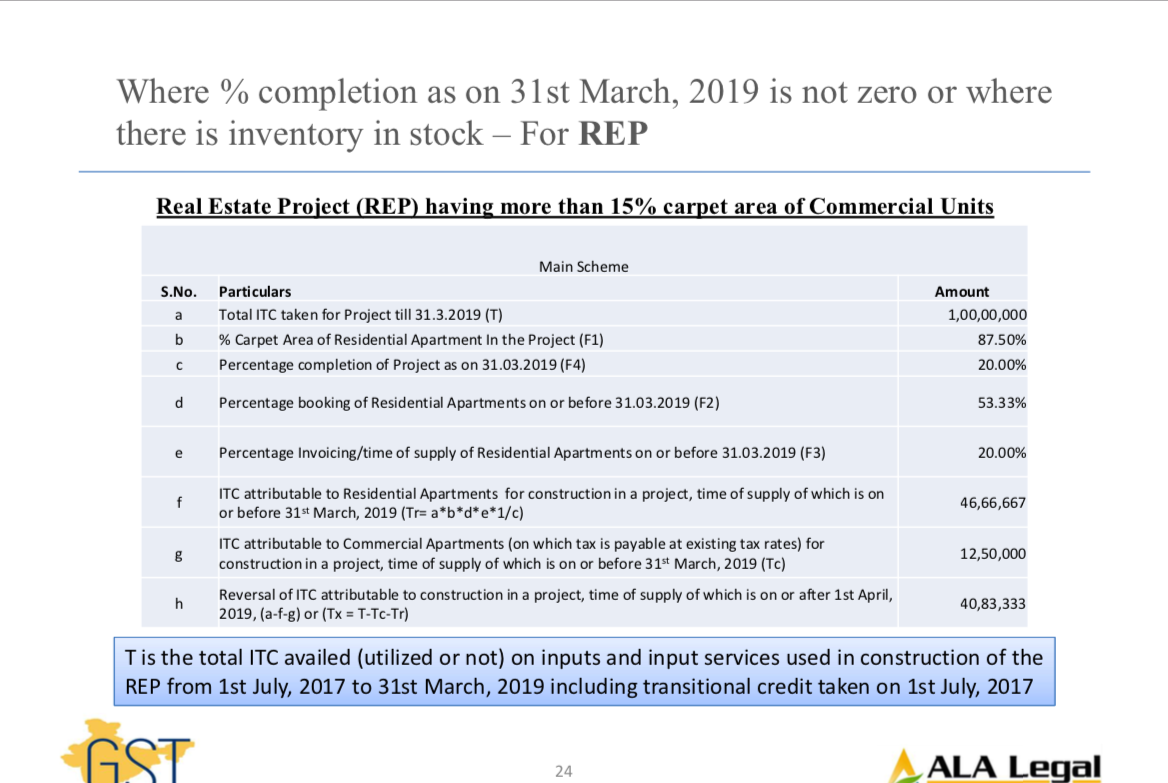

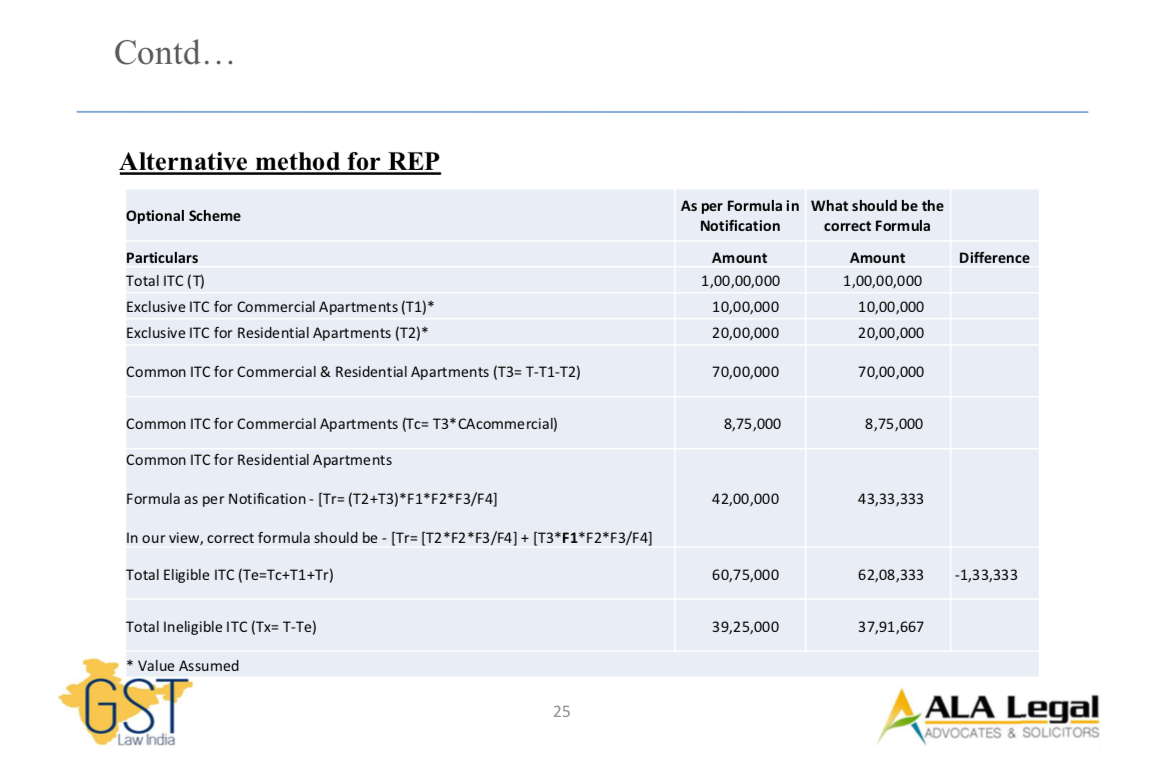

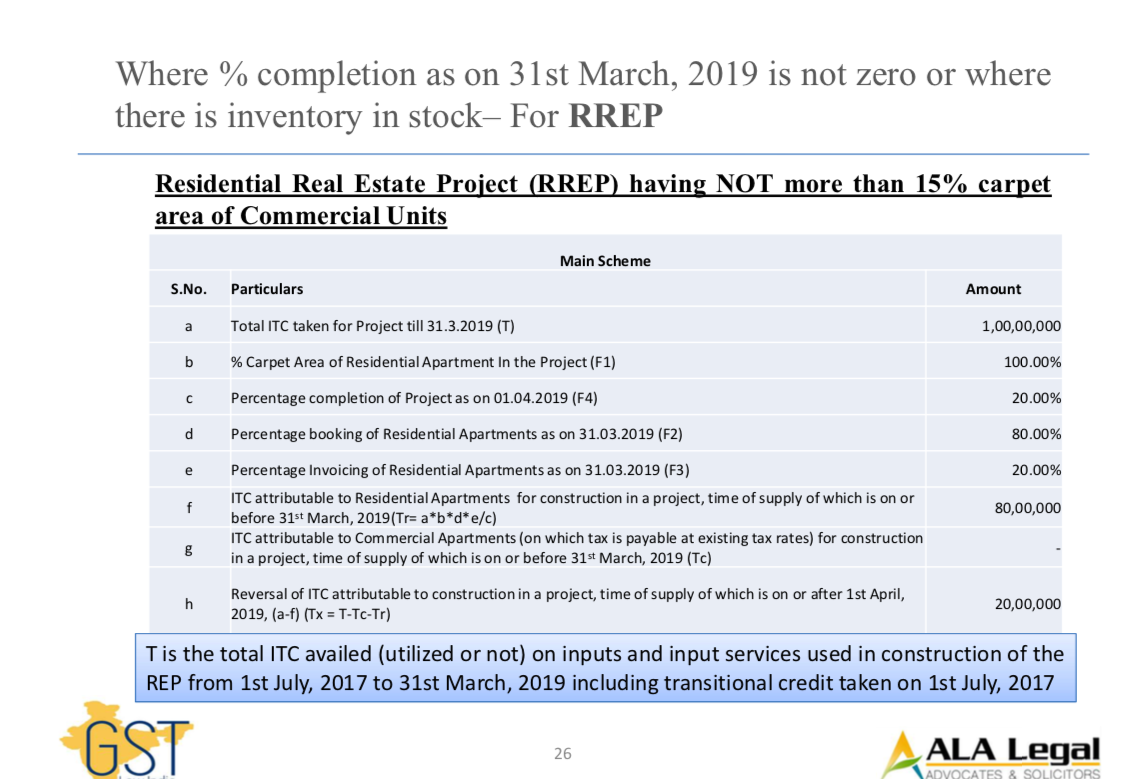

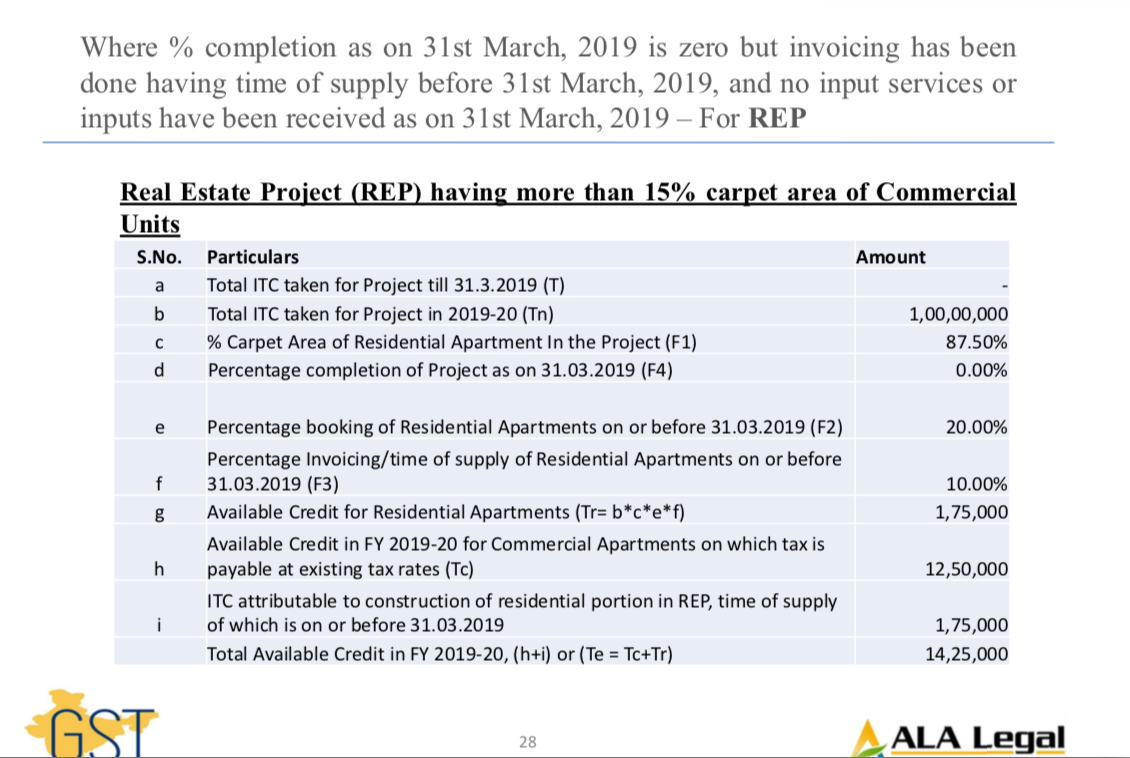

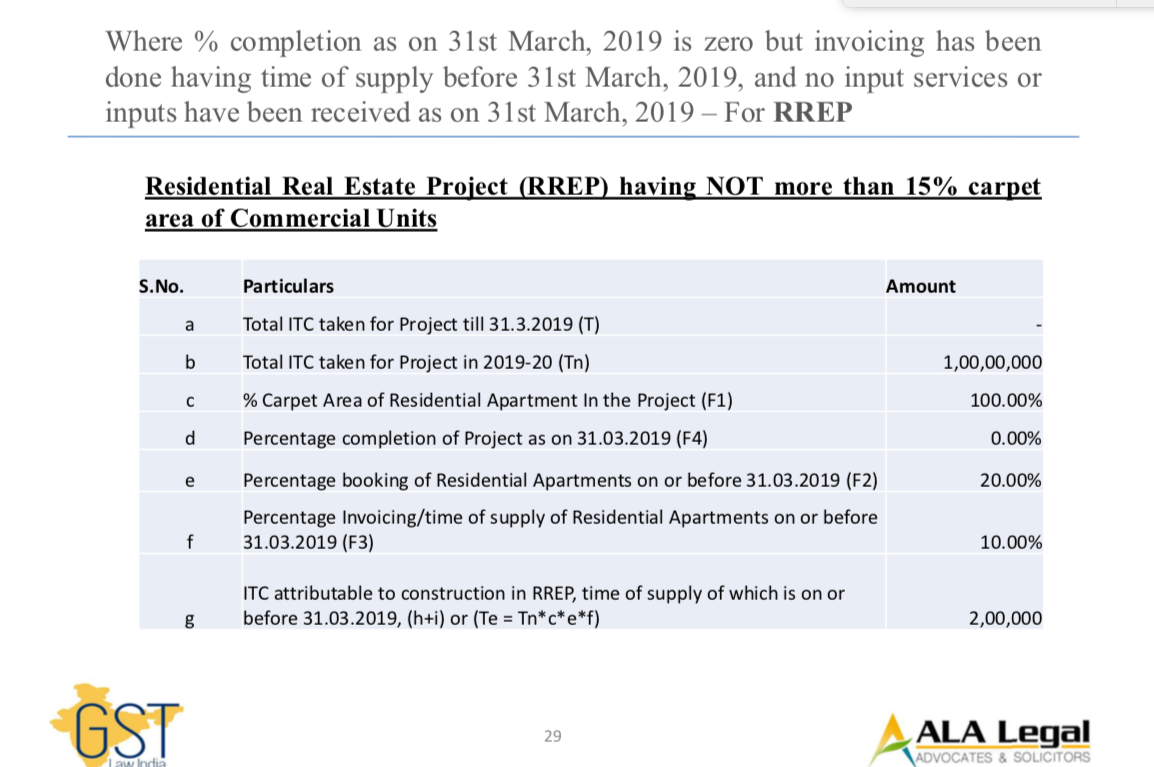

CALCULATION OF ITC ATTRIBUTABLE TO CONSTRUCTION IN A PROJECT, TIME OF SUPPLY OF WHICH IS ON OR AFTER 1ST APRIL,2019

- T is the total ITC availed (utilized or not) on inputs and input services used in construction of the REP from 1st July, 2017 to 31st March, 2019 including transitional credit taken on 1st July, 2017;

- Te is the eligible ITC attributable to (a) construction of commercial portion and (b) construction of residential portion, in the REP which has time of supply on or before 31st March, 2019;

- If eligible credit (Te) is less than total credit availed (T), required to pay by cash/ credit. Application can be moved for payment in installments (not exceeding 24).

- If eligible credit (Te) is more than credit availed (T), differential can be availed on input and input service invoices on which credit otherwise not eligible on or after 01.04.2019.

- ITC computed for commercial apartments (in REP) i.e. on which tax is payable at existing rates (Tc), can be utilized for payment of tax on commercial apartments till the complete accounting of Tx is carried out and submitted.

- Where percentage completion is zero but ITC has been availed on goods and services received for the project on or prior to 31st March, 2019, input tax credit attributable to construction of residential portion which has time of supply on or after 1st April, 2019, shall be calculated and the amount equal to Tx shall be paid or taken credit of, as the case may be, as prescribed above, with the modification that percentage completion for calculation of F4 shall be taken as the percentage completion which, as certified by an architect registered with the Council of Architecture constituted under the Architects Act, 1972 (20 of 1972) or a chartered engineer registered with the Institution of Engineers (India), can be achieved with the input services received and inputs in stock as on 31st March, 2019.

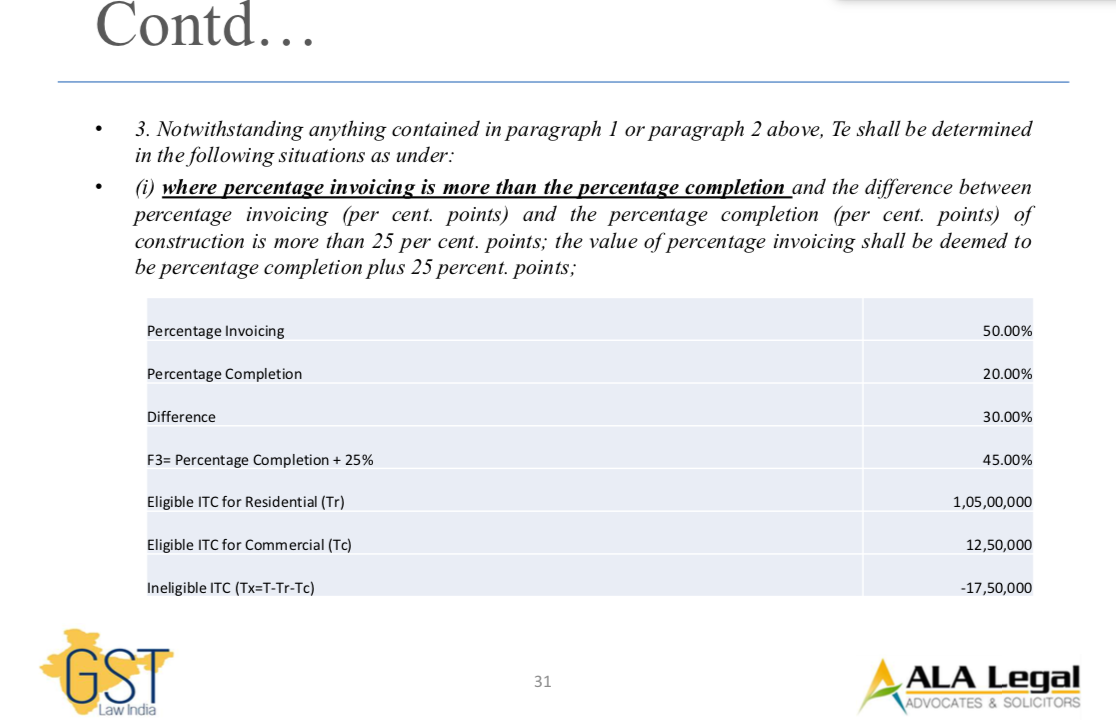

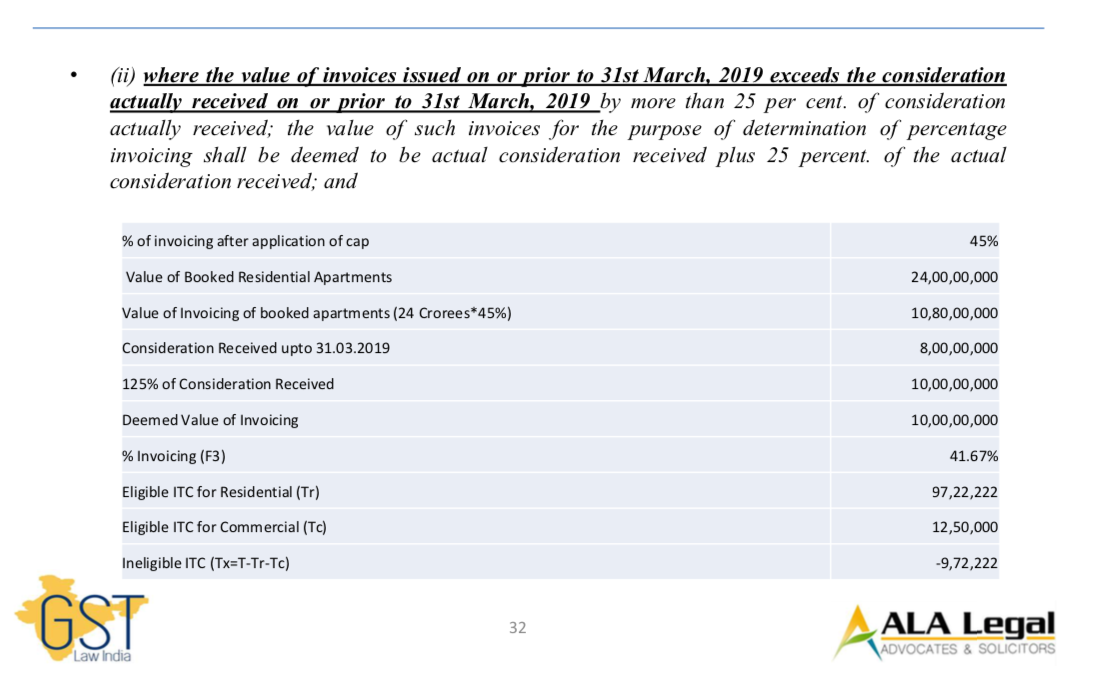

CAPPING OF % INVOICING AND PROCUREMENT OF INPUT & INPUT SERVICE ON OR BEFORE 31.03.2019

• (iii) where, the value of procurement of inputs and input services prior to 1st April, 2019 exceeds the value of actual consumption of the inputs and input services used in the percentage of construction completed as on 31st March, 2019 by more than 25 percent. of value of actual consumption of inputs and input services, the jurisdictional commissioner or any other officer authorized in this regard may fix the Te based on actual per unit consumption of inputs and input services based on the documents duly certified by a chartered accountant or cost accountant submitted by the promoter in this regard, applying the accepted principles of accounting.

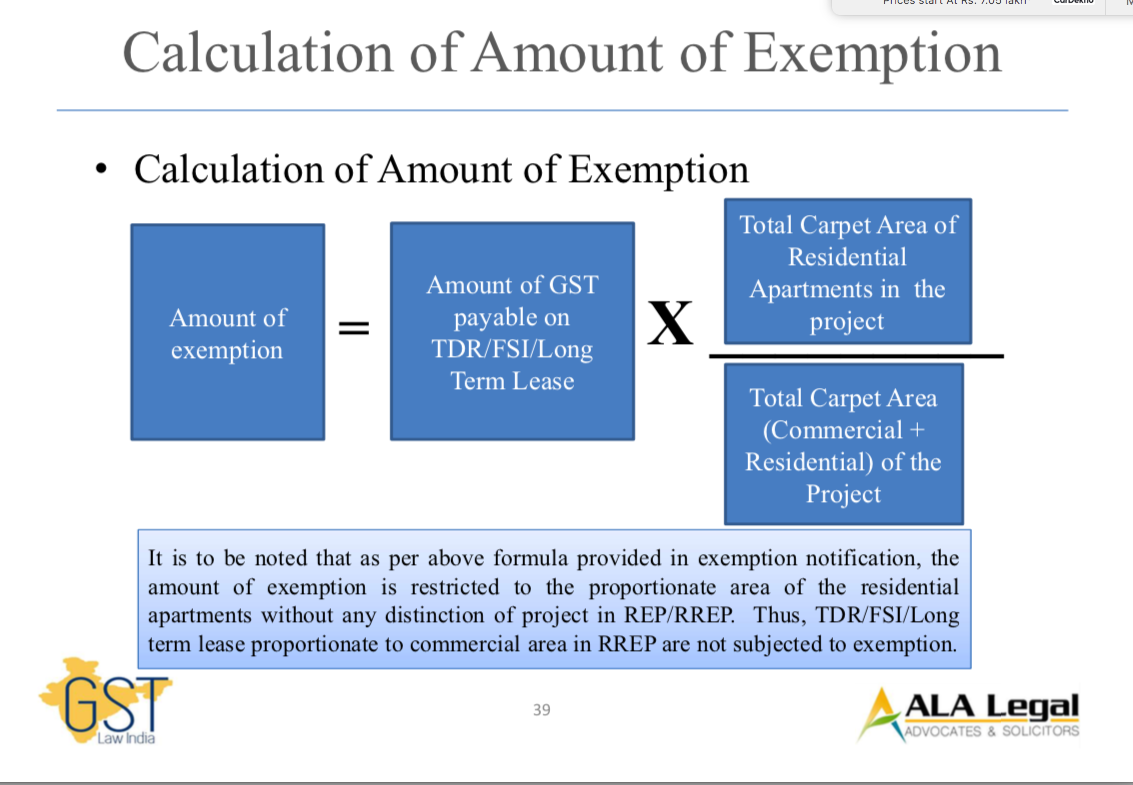

TDR/FSI AND LONG TERM LEASE

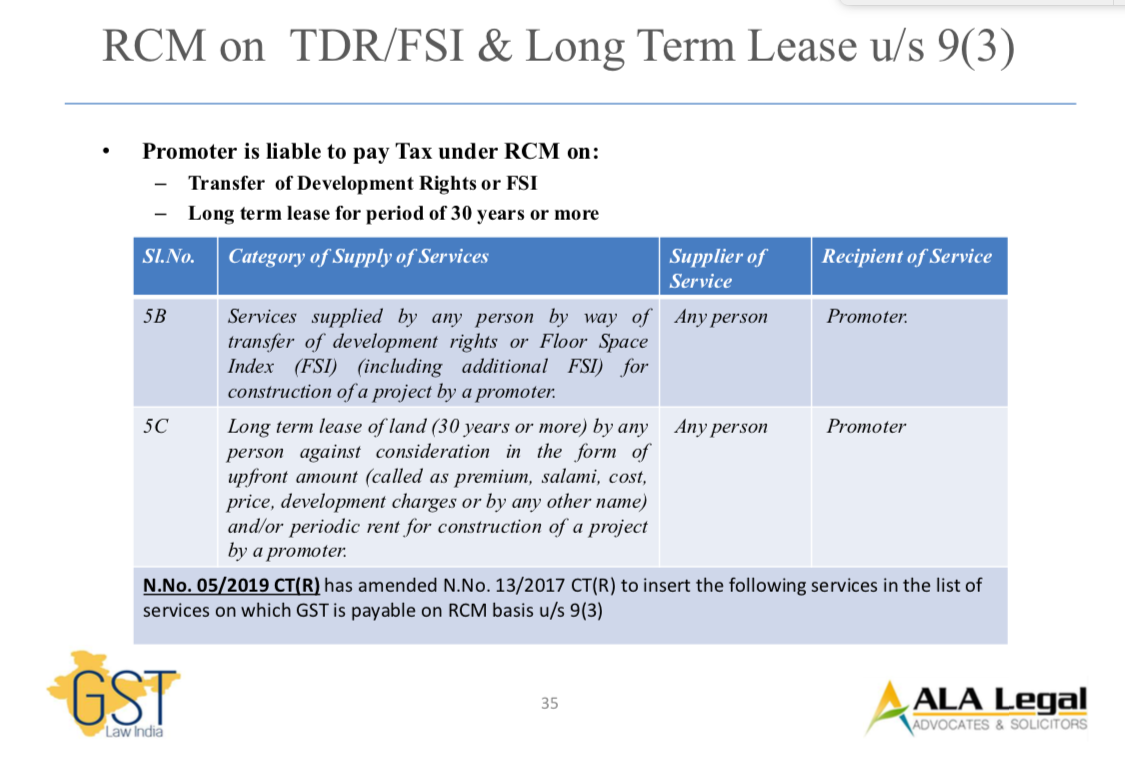

RCM on TDR/FSI & Long Term Lease u/s 9(3)

2. Time of Supply for Promoter in case of JDA & Long Term Lease liable to RCM3. Exemption on TDR/FSI & Upfront amount of Long Term Lease Service for Residential Apartment

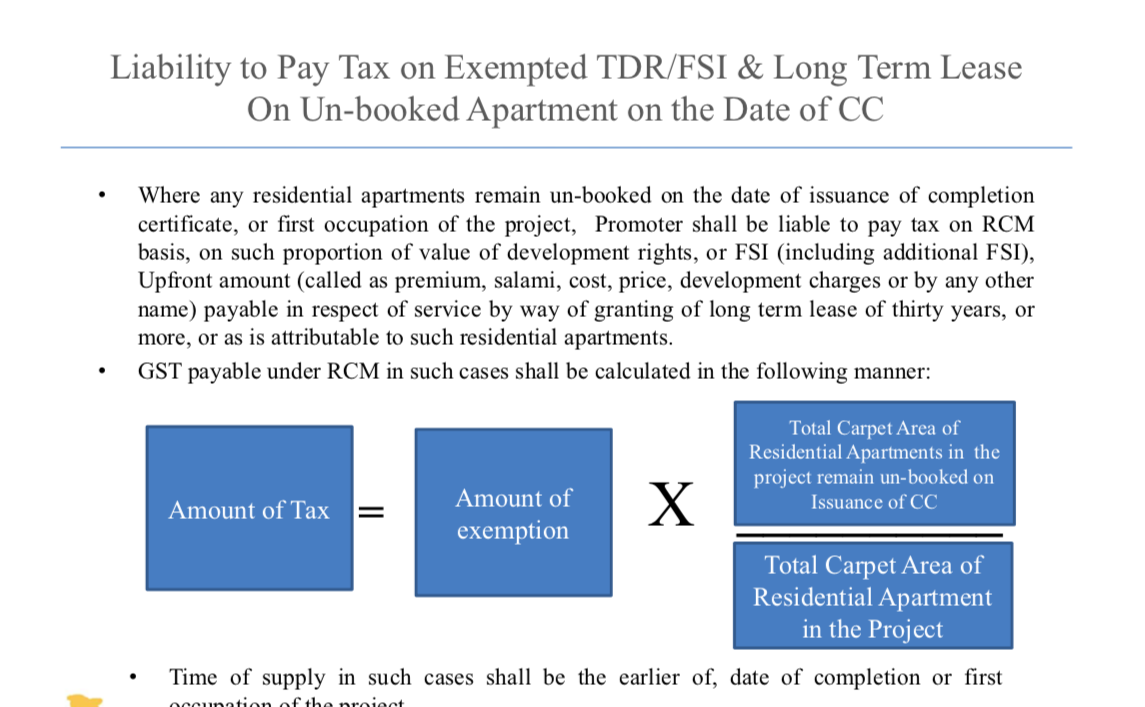

4. Liability to Pay Tax on Exempted TDR/FSI & Long Term Lease on Un-booked Residential Apartment on the date of CC

Time of Supply for Promoter in case of JDA & Long Term Lease liable to RCM

Vide Notification No. 06/2019 CT(R) dated 29.03.2019

• Liability to pay tax in case of following classes of registered persons:a. A promoter who receives TDR/FSI on or before 01.04.2019 for construction of a project against consideration payable or paid by him, wholly or partly, in the form of construction service of commercial or residential apartments in the project or in any other form including in cash;

b. A promoter who receives Long term lease of land on or after 1st April, 2019 for construction of residential apartments in a project against consideration payable or paid by him, in the form of upfront amount (called as premium, salami, cost, price, development charges or by any other name).

Liability to pay tax (time of supply) shall arise on the date of issuance of completion certificate or first occupation, whichever is earlier, for following liability:

For Tax payable as recipient of service

a) the consideration paid by him in the form of construction service of commercial or residential apartments in the project, for supply of development rights or FSI (including additional FSI);

(b) the monetary consideration paid by him, for supply of development rights or FSI (including additional FSI) relatable to construction of residential apartments in project;

(c) the upfront amount (called as premium, salami, cost, price, development charges or by any other name) paid by him for long term lease of land relatable to construction of residential apartments in the project; and

For Tax payable as supplier of service on construction service provided to landowner

(d) the supply of construction service by him against consideration in the form of development rights or FSI(including additional FSI)

N.No. 04/2019 CT(R) has inserted the following services to the list of services exempt from levy of GST under N.No. 12/2017 CT(R) :

- Transfer of TDR/FSI on or after 01.04.2019: Service by way of transfer of development rights (herein refer TDR) or Floor Space Index (FSI) (including additional FSI) on or after 1st April, 2019 for construction of residential apartments by a promoter in a project, intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate.

- Long term lease for thirty or more on or after 01.04.2019 (only upfront amount):Upfront amount (called as premium, salami, cost, price, development charges or by any other name) payable in respect of service by way of granting of long term lease of thirty years, or more, on or after 01.04.2019, for construction of residential apartments by a promoter in a project, intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate.

-

However, tax payable under RCM in such cases shall not exceed :

– 1% of the value in case of affordable residential apartments and

– 5% of the value in case of residential apartments other than affordable residential apartments

remaining un- booked on the date of issuance of completion certificate or first occupation

VALUATION IN CASE OF JDA

1A. Value of supply of service by way of transfer of development rights or FSI by a person to the promoter against consideration in the form of residential or commercial apartments shall be deemed to be equal to the value of similar apartments charged by the promoter from the independent buyers nearest to the date on which such development rights or FSI is transferred to the promoter.

1B. Value of portion of residential or commercial apartments remaining un-booked on the date of issuance of completion certificate or first occupation, as the case may be, shall be deemed to be equal to the value of similar apartments charged by the promoter nearest to the date of issuance of completion certificate or first occupation, as the case may be.

“2A. Where a registered person transfers development right or FSI (including additional FSI) to a promoter against consideration, wholly or partly, in the form of construction of apartments, the value of construction service in respect of such apartments shall be deemed to be equal to the Total Amount charged for similar apartments in the project from the independent buyers, other than the person transferring the development right or FSI (including additional FSI), nearest to the date on which such development right or FSI (including additional FSI) is transferred to the promoter, less the value of transfer of land, if any, as prescribed in paragraph 2 above.”

OTHER CHANGES:

Lower Tax Rate (12%) for Works Contract Service – Received for Construction of Affordable Residential Apartments

Tax rate for Works Contract Service for construction of Affordable Residential Apartments – – inserted vide Entry 3(va) in tax rate N.No 11/2017-CT(R)

- Supply of works contract service supplied by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration

- of affordable residential apartment [i.e. Apartment has area 60 sqm. in metros / 90 sqm in non metros and value upto Rs 45 lakhs]

- in a project which commences on or after 01.04.2019, or in ongoing project where promoter opted to pay tax with new tax rates

- Tax rate @ 12% subject certain specified conditions.

-

DEFINITIONS

- Definition of Real Estate Project (REP): [Sec 2(zn) of The Real Estate (Regulation and Development ) Act, 2016 (RERA)]“Real estate project means the development of a building or a building consisting of apartments, or converting an existing building or a part thereof into apartments, or the development of land into plots or apartments, as the case may be, for the purpose of selling all or some of the said apartments or plots or building, as the case may be, and includes the common areas, the development works, all improvements and structures thereon, and all easement, rights and appurtenances belonging thereto.”

- Definition of Residential Real Estate Project (RREP):(xix) “the term “Residential Real Estate Project (RREP)” shall mean a REP in which the carpet area of the commercial apartments is not more than 15 per cent. of the total carpet area of all the apartments in the REP”

- Definition of Commercial Apartment

“ commercial apartment” shall mean an apartment other than a residential apartment.”Definition of Residential Apartment:

“Residential apartment” shall mean an apartment intended for residential use as declared tothe Real Estate Regulatory Authority or to competent authority”

-

- Definition of Commencement Certificate“”commencement certificate” means the commencement certificate or the building permit or the construction permit, by whatever name called issued by the competent authority to allow or permit the promoter to begin development works on an immovable property, as per the sanctioned plan”

- Definition of External Development Work”external development works” includes roads and road systems landscaping, water supply, seweage and drainage systems, electricity supply transformer, sub-station, solid waste management and disposal or any other work which may have to be executed in the periphery of, or outside, a project for its benefit, as may be provided under the local laws

-

- Definition of Internal Development Work“ “internal development works” means roads, footpaths, water supply, sewers, drains, parks, tree planting, street lighting, provision for community buildings and for treatment and disposal of sewage and sullage water, solid waste management and disposal, water conservation, energy management, fire protection and fire safety requirements, social infrastructure such as educational health and other public amenities or any other work in a project for its benefit, as per sanctioned plans”

- Definition of Internal Development Workthe term “competent authority” as mentioned in definition of “commencement certificate” and “residential apartment” , means the local authority or any authority created or established under any law for the time being in force by the Central Government or State Government or Union Territory Government, which exercises authority over land under its jurisdiction, and has powers to give permission for development of such immovable property

-

Definition of Promoter: [Sec 2(zk) of The Real Estate (Regulation and Development ) Act, 2016 (RERA)]

“promoter means,

(i) a person who constructs or causes to be constructed an independent building or a building consisting of apartments, or converts an existing building or a part thereof into apartments, for the purpose of selling all or some of the apartments to other persons and includes his assignees; or (ii) a person who develops land into a project, whether or not the person also constructs structures on any of the plots, for the purpose of selling to other persons all or some of the plots in the said project, whether with or without structures thereon; or (iii) any development authority or any other public body in respect of allottees of (a) buildings or apartments, as the case may be, constructed by such authority or body on lands owned by them or placed at their disposal by the Government; or (b) plots owned by such authority or body or placed at their disposal by the Government, for the purpose of selling all or some of the apartments or plots; or (iv) an apex State level co-operative housing finance society and a primary co-operative housing society which constructs apartments or buildings for its Members or in respect of the allottees of such apartments or buildings; or

(v) any other person who acts himself as a builder, coloniser, contractor, developer, estate developer or by any other name or claims to be acting as the holder of a power of attorney from the owner of the land on which the building or apartment is constructed or plot is developed for sale; or (vi) such other person who constructs any building or apartment for sale to the general public. Explanation. For the purposes of this clause, where the person who constructs or converts a building into apartments or develops a plot for sale and the person who sells apartments or plots are different person, both of them shall be deemed to be the promoters and shall be jointly liable as such for the functions and responsibilities specified under this Act or the rules and regulations made thereunder.

Definition of Carpet Area: [Sec 2(k) of The Real Estate (Regulation and Development ) Act, 2016 (RERA)]

“carpet area means the net usable floor area of an apartment, excluding the area covered by the external walls, areas under services shafts, exclusive balcony or verandah area and exclusive open terrace area, but includes the area covered by the internal partition walls of the apartment. Explanation. For the purpose of this clause, the expression exclusive balcony or verandah area means the area of the balcony or verandah, as the case may be, which is appurtenant to the net usable floor area of an apartment, meant for the exclusive use of the allottee; and exclusive open terrace area means the area of open terrace which is appurtenant to the net usable floor area of an apartment, meant for the exclusive use of the allottee”.

Definition of Floor Space Index

“the term “floor space index (FSI)” shall mean the ratio of a building’s total floor area (gross floor area) to the size of the piece of land upon which it is built”.

Definition of Project

“project” shall mean a Real Estate Project (REP) or a Residential Real Estate Project (RREP)” .

Definition of Apartment: Sec 2(e) of The Real Estate (Regulation and Development ) Act, 2016 (RERA)]

“apartment whether called block, chamber, dwelling unit, flat, office, showroom, shop, godown, premises, suit, tenement, unit or by any other name, means a separate and self-contained part of any immovable property, including one or more rooms or enclosed spaces, located on one or more floors or any part thereof, in a building or on a plot of land, used or intended to be used for any residential or commercial use such as residence, office, shop, showroom or godown or for carrying on any business, occupation, profession or trade, or for any other type of use ancillary to the purpose specified”

- Provided also that where a registered person (landowner- promoter) who transfers development right or FSI (including additional FSI) to a promoter (developer- promoter) against consideration, wholly or partly, in the form of construction of apartments,-(i) the developer- promoter shall pay tax on supply of construction of apartments to the landowner- promoter, and

- Effective 5% [Rate 7.5% after 1/3rd deduction of Land]:– Residentialhousingpropertiesotherthanthosecoveredin1%rate.

If you already have a premium membership, Sign In.

Adv. Pawan Arora

Adv. Pawan Arora

Adv. Pawan Arora, Partner at Athena Law Associates Experience of Advisory and Litigation of GST, VAT, and Service Tax to more than 25 Reputed Real Estate and Infrastructure Construction Companies. 10 Years of relentless and steady experience of Advisory and Litigation in GST and other Indirect Taxes and handled matters of clients from diverse industries and field of specialization is Indirect Taxes.