GST to do list for March 2019

GST to do list for March 2019:

Here we have compiled a GST to do list for March 2019 covering important tasks we need to do in March. It includes various tasks having the deadline of March on GST portal.

Table of content:

- Check your 2A and 3B matching available on GSTN

- Claim any ITC left in GSTR 3b of March

- Make correction in GSTR 1

- Apply for LUT for FY 2019-20

- Option for ITC of 50% under section 17(4) by banks

- Opt for Composition

- Avail B option of valuation for Forex Dealers under the rule

- File ITC 04

- File TDS return

Check your 2A and 3B matching available on GSTN:

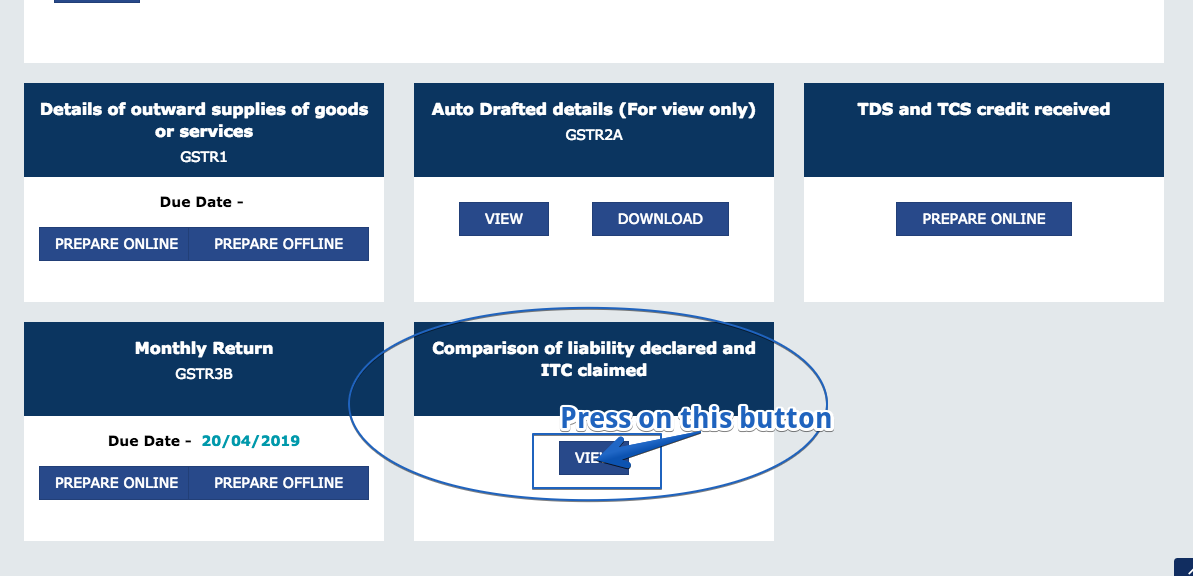

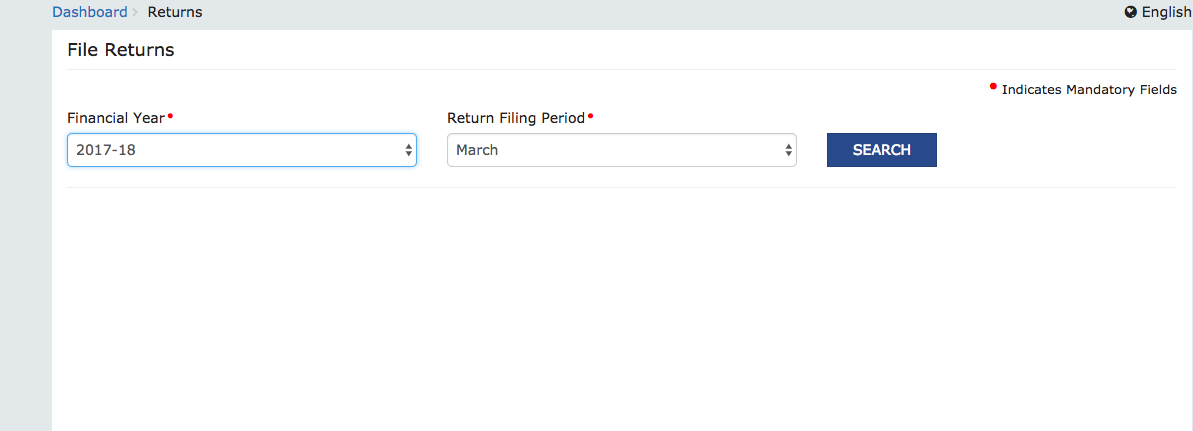

This functionality is available on GST portal now. You can access it from your dashboard.

GST to do list for March 2019

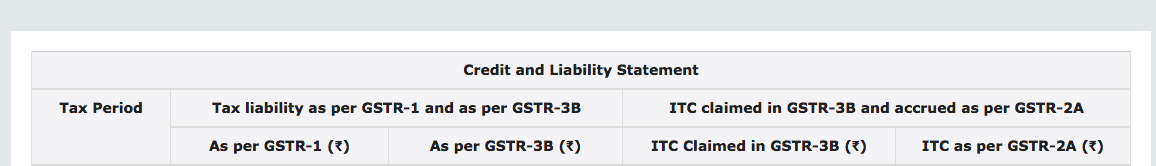

Then click on the matching option available on dashboard.

Then you will see the data of GSTR 3B and GSTR 1. Data for 2A and 3b is also auto populated. Any difference between the two is also reflected. You can check this data and can make the corrections in relevant returns as this is last opportunity to do that. Notices are also issued in some cases where the mismatch was huge.

Claim any ITC left in GSTR 3b of March:

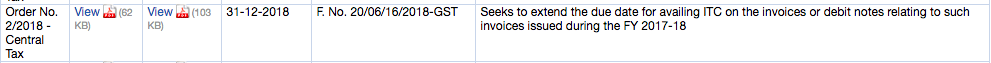

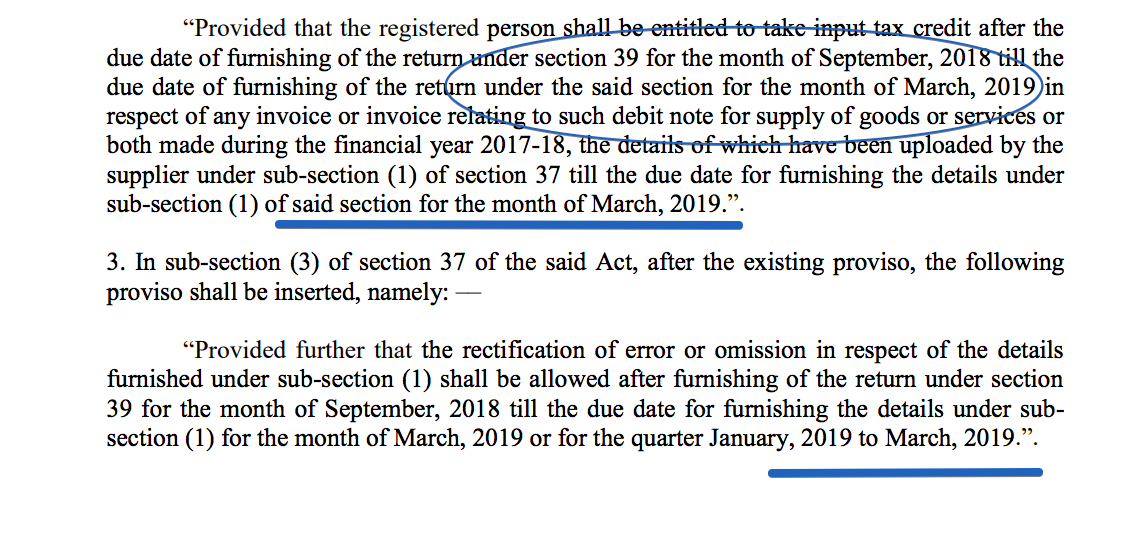

Have you skipped any ITC for the FY 2017-18? This is last time to claim this ITC. Although the last date to claim it was October. CBIC extended this date. Now you can take it till the filing of GST return of March 2019. A removal of difficulty order was released to this regard. This is last chance to claim those credits.

This is the relevant order.

Eligibility to take ITC

Caution: But remember only the ITC of invoices uploaded by supplier will be available under this option.

Make correction in GSTR 1:

See image above. The due date for correction in GSTR 1 is also extended to due date of filing of return of March. It is last chance to make corrections. Otherwise your buyer may lose the ITC.

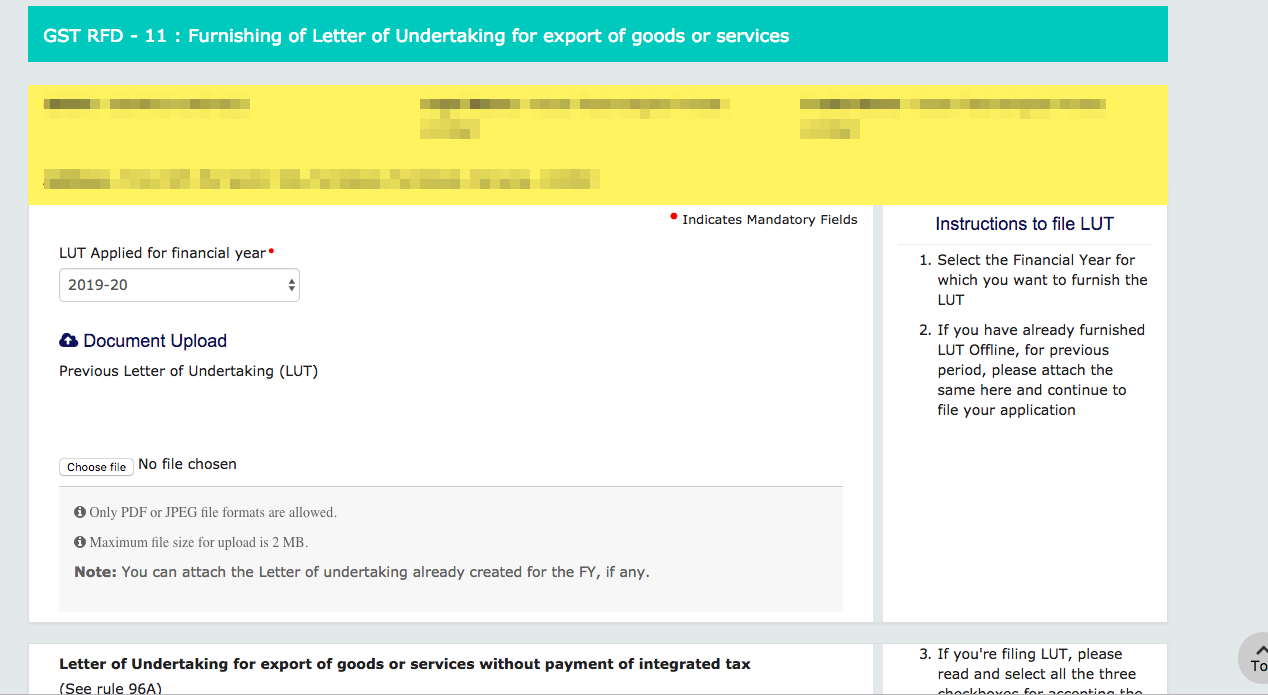

Apply for LUT for FY 2019-20:

The option to apply for LUT for FY 2019-20 is also available on portal. This option is available in user services tab. From there you can select file LUT.

LUT of last year is required to apply afresh. You need to upload it. In case you don’t have last year’s LUT you will have to apply for it in Department manually.

Option for ITC of 50% under section 17(4) by banks:

Section 17(4) provide for an option to claim 50% ITC each month. This option is also required to be excercised at the start of year for full year. This cant be changed during the year.

Opt for Composition:

Taxpayers in normal levy can shift to composition. In this case requirements of section 18 of CGST Act should be observed. The ITC in balance will lapse. Taxpayer is required to pay ITC on closing stock. This functionality is also live on portal now.

Avail B option of valuation for Forex Dealers under rule

Rule 32(2) (b) provide for an option for valuation of currency trade. That option is required to be selected at the start of year.

File ITC 04:

ITC 04 last date is also 31st March. This return is required to be filed by a person sending the goods for job work.

File TDS return:

TDS return is also required to be filed by this time. IT is filed by the person required to deduct TDS.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.