Reconciliation of GST audit report with annual return

Reconciliation of GST audit report with annual return:

Reconciliation of GST audit report with annual return is important to understand. A set of data will move from GST annual return to GST audit report. There it will be compared with the figures from financials. Every unreconciled amount will be explained in GSTR 9C. In case there is any tax liability, it will also be calculated. If the data in GST annual return is filled wrongly it will cause error in GSTR 9c too. Once filed , GSTR 9C wont be able to get edited. Data will freeze. There will be no wayout if we will come to understand the errors at the time of filing GSTR9C.

We have drafted this article so that users can understand the relationship of data of GSTR 9 with GSTR9C.Basically entire GST deals with following four figures:

- Turnover

- ITC

- Taxes paid

- Refund claimed

GSTR 9 and GSTR 9C also covers all these figures and try to match the actual reported/paid with the idle.

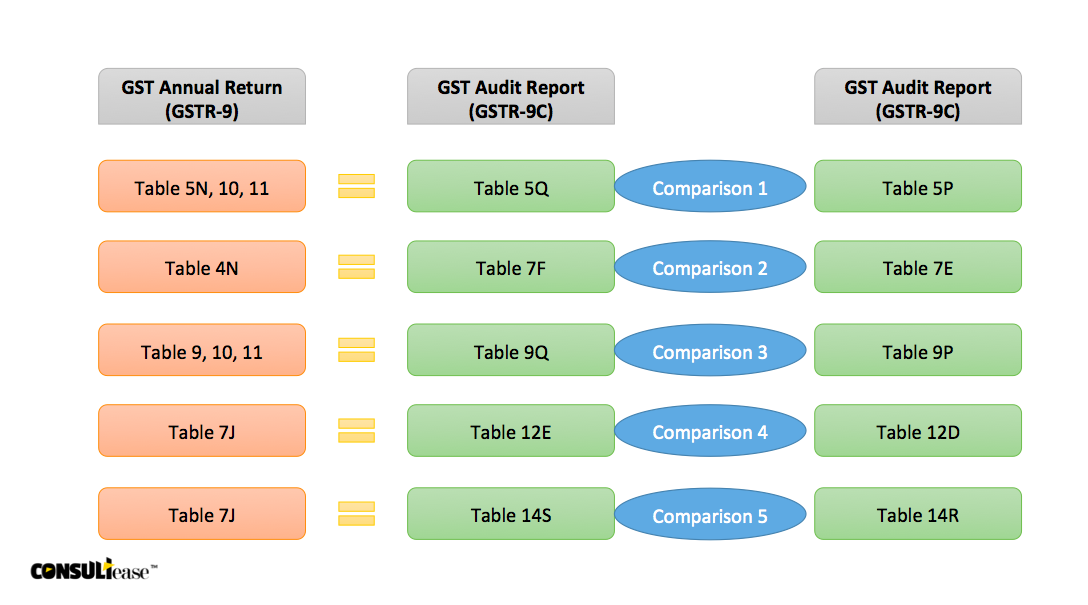

Following data from GSTR 9 travel to GSTR 9C

Comparison 1: Table 5P of GSTR 9C:

Table 5P indicates the gross turnover including advances but excluding reverse charge inward supplies. This amount is compared with tale 5Q. It is compiled from 5N ,10 and 11 of GSTR 9. Table 5N of GSTR 9 is gross turnover with advance but without RCM inward.

5N of GSTR 9= 5M+4N-4G

5M= Supplies on which tax is not payable

4N= Supplies (including advances and inward supplies) on which tax is payable.

4G= inward supplies on which tax was liable to be paid by recipient.

Comparison 2: Table 7F of GSTR 9C with table & 7E

Table 7E indicates the turnover on which tax was payable. It is compared with 7F of GSTR 9. Which is compiled from table 4N of GSTR 9. It coves the supplies liable for tax. It is noteworthy here that it includes the inward supplies on which tax was payable in reverse charge.

Comparison 3: Table 9P with 9Q:

This is the comparison of taxes paid as declared in annual return with as per financials. The table provides for reconciliation of tax paid as per reconciliation statement and amount of tax paid as declared in Annual Return (GSTR 9). Under the head labelled ―RC‖, supplies where tax was paid on reverse charge basis by the recipient (i.e. the person for whom reconciliation statement has been prepared ) shall be declared. It is in turn compared with the actual figure in GSTR 9.

Comparison 4: Table 12D with 12 E:

This is details of input tax credit as per financials. It is compared with the actual figure of input tax credit claimed via GSTR 3b. Data of ITC taken via GSTR 3b is compiled in table 7J of GSTR 9.

Comparison 5: Table 14R with 14S:

This is comparison of expansewise break up of Input tax credit. It is again compared with table 7J of GSTR3b.

Contact author at info@consultease.com

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.