e-book on VAT in Bahrain by CA Pritam Mahure

e-book on VAT in Bahrain by CA Pritam Mahure

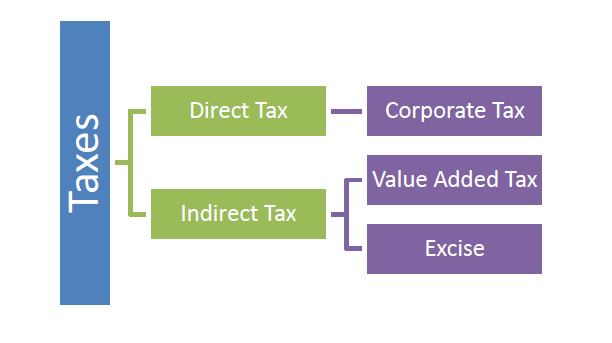

Taxes are typically the key source of revenues for Governments across the world. Taxes can be ‘direct’ taxes or ‘indirect’ taxes.

Direct taxes are taxes which are levied and collected directly from the person, company, firm etc. Taxes such as Corporate Tax is an example of Direct Tax.

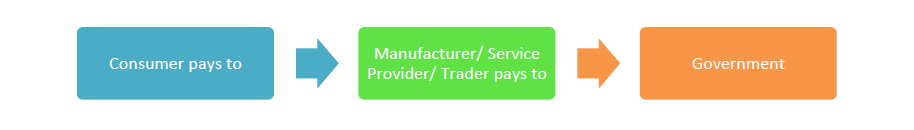

Indirect taxes are levied and collected from consumers through manufacturers, traders or service providers. Herein, the Government collects the taxes through manufacturers, service providers, traders than the person who bears it ultimately (i.e. consumer), and thus it is called as ‘Indirect Tax’.

In the legal sense, the responsibility to pay an indirect tax rests with the manufacturer/ seller/ service providers though, finally, the tax is collected from the consumer.

The following picture depicts how money is collected by Government indirectly:

Pictorial depiction of Direct Tax and Indirect Tax:

Primer on VAT

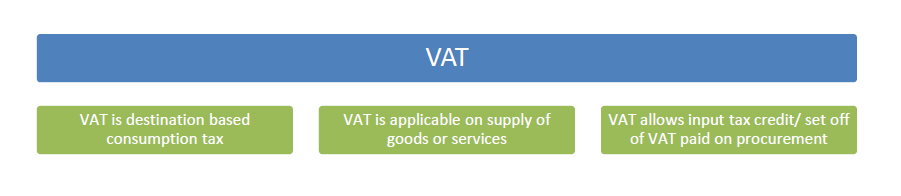

VAT is the abbreviation for Value Added Tax. In few countries, VAT is also known as Goods and Service Tax (GST).

Value Added Tax is levied on activities such as ‘supply’ of goods and services. VAT is a consumption-based tax wherein the basic principle is to tax the value addition at each business stage. To achieve this, tax paid on purchases is allowed as a set off/ credit against liability on output/income.

Each time goods/ services exchange hands, typically, they are subjected to the VAT.

VAT is levied on all transaction of goods and services. Thus, in principle, VAT should not differentiate between ‘goods’ and ‘services’ (though VAT law may prescribe a separate place of supply/ time of supply provisions for goods and services).

Internationally, VAT was first introduced in France and now more than 160 countries have introduced VAT. Most of the countries, depending on their own socio-economic formation, have introduced Single VAT (like UAE or KSA) or Dual VAT (like India).

Key aspects of VAT:

Download the Full e-book on VAT in Bahrain by CA Pritam Mahure by clicking the below Image:

If you already have a premium membership, Sign In.