Update on Instructions for filling ITR-4 SUGAM

Update on Instructions for filling ITR-4 SUGAM

On the 1st September 2018, the e-filing site has updated on Instructions for filling ITR-4 SUGAM. Following are the instructions issued:

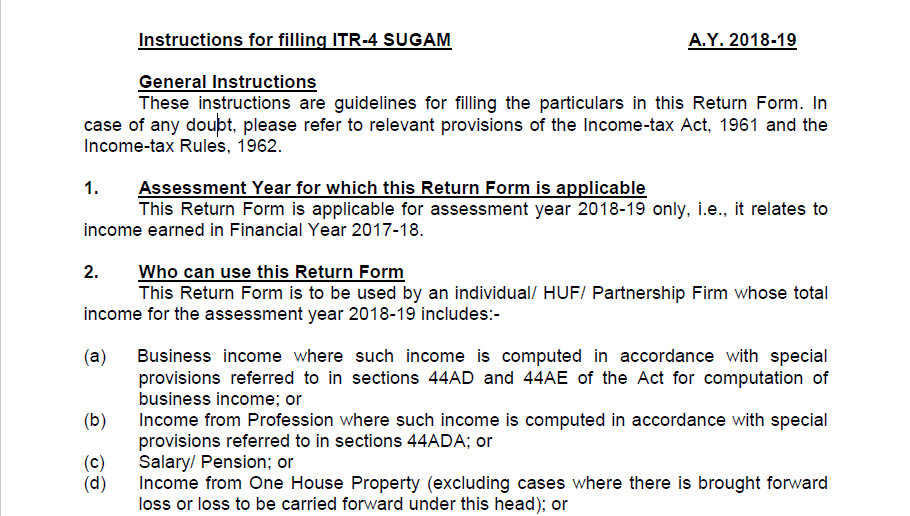

General Instructions

These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962.

1. Assessment Year for which this Return Form is applicable

This Return Form is applicable for the assessment year 2018-19 only, i.e., it relates to income earned in Financial Year 2017-18.

2. Who can use this Return Form

This Return Form is to be used by an individual/ HUF/ Partnership Firm whose total income for the assessment year 2018-19 includes:-

(a) Business income where such income is computed in accordance with special provisions referred to in sections 44AD and 44AE of the Act for computation of business income; or

(b) Income from Profession where such income is computed in accordance with special provisions referred to in sections 44ADA; or

(c) Salary/ Pension; or

(d) Income from One House Property (excluding cases where there is brought forward loss or loss to be carried forward under this head); or

(e) Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses).

Note 1: The income computed shall be presumed to have been computed after giving full effect to every loss, allowance, depreciation or deduction under the Income-tax Act.

Note 2: Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used only if the income being clubbed falls into the above income categories.

Download the Full instruction on Instructions for filling ITR-4 SUGAM by clicking the below image:

3. Who cannot use this Return Form

SUGAM cannot be used in the following cases:-

(a) Income from more than one house property or where there is brought forward loss or loss to be carried forward under this head; or

(b) Income from Winnings from lottery or income from Racehorses; or

(c) Income under the head ―Capital Gains‖, e.g. Short-term capital gains or long-term capital gains from the sale of house, plot, shares etc.; or

(d) Income taxable under section 115BBDA; or

(e) Income of nature referred to in section 115BBE; or

(f) Agricultural income in excess of ₹5,000; or

(g) Income from Speculative Business and other special incomes; or

(h) Income from an agency business or income in the nature of commission or brokerage; or

(i) The person claiming relief of foreign tax paid under section 90, 90A or 91; or

(j) Any resident having any asset (including financial interest in any entity) located outside India or signing authority in any account located outside India; or

(k) Any resident having income from any source outside India.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.