Who can be eligible to use/file ITR 2

Who can be eligible to use/file ITR 2

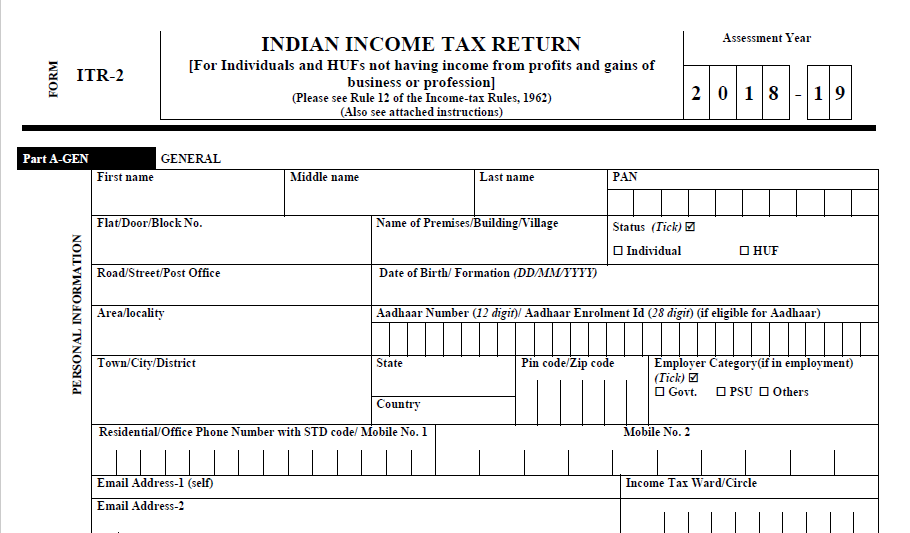

For A.Y 2018-19, Form ITR 2 can be used by an individual and Hindu Undivided Family. Who is not eligible to file ITR-1 Sahaj and not having income from “profit and gains of business or profession”. Also not having income from “Profits and gains of business or profession” in the nature of interest, salary, bonus, commission or remuneration. By whatever name called, due to, or received by him from a partnership firm.

Further, in the case where the income of another person like spouse, minor child, etc., is to be clubbed with the income of the taxpayer. This Return Form can be used if income to be clubbed falls in any of the above categories.

Download the Form for filing ITR-2 by clicking the below image:

Who cannot file the ITR 2

For A.Y 2018-19, Form ITR 2 cannot be used by an individual and HUF. Whose total income for the year includes income from profit and gains from business or profession. Also having income in the nature of interest, salary, bonus, commission or remuneration, by whatever name called, due to, or received by him from partnership firm

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.